Notifications

insure trucks car insurance car insurance

insure trucks car insurance car insurance

Below are the major kinds of protection that your plan may include: The minimum protection for physical injury varies by state as well as might be as low as$10,000 per person or$ 20,000 per accident (risks). If you injure a person with your car, you can be filed a claim against for a great deal of money. The amount of Responsibility insurance coverage you lug need to be high adequate to protect your assets in case of a crash. Many experts suggest a limit of at the very least $100,000/ $300,000, yet that might not be sufficient.

If you have a million-dollar home, you might lose it in a lawsuit if your insurance policy coverage is insufficient - cheaper. You can obtain additional insurance coverage with an Individual Umbrella or Individual Excess Responsibility policy. The greater the value of your assets, the extra you stand to shed, so you need to buy liability insurance policy appropriate to the value of your properties. You don't need to figure out just how much to acquire that relies on the automobile (s) you guarantee. You do need to choose whether to buy it and how big an insurance deductible to take. The greater the insurance deductible, the lower your premium will certainly be. Deductibles typically vary from$250 to$1,000. If the car is only worth$1,000.

and the deductible is$500, it might not make good sense to acquire crash protection. Accident insurance is not usually needed by state law. Covers the price of various problems to your vehicle not brought on by a crash, such as fire and also burglary. As with Accident insurance coverage, you need to pick an insurance deductible. Comprehensive protection is normally offered along with Collision, as well as both are frequently referred to with each other as Physical Damage protection. If the cars and truck is leased or funded, the renting business or lender might require you to have Physical Damages protection, also though the state legislation may not require it. Covers the cost of treatment for you and

your guests in case of an accident. As a result, if you choose a$2,000 Medical Expense Limitation, each passenger will certainly have up to $2,000 protection for medical cases resulting from an accident in your lorry. If you are entailed in a crash and also the various other vehicle driver is at mistake however has inadequate or no insurance policy, this covers the gap in between your costs and the various other driver's protection, up to the limitations of your - cheaper car insurance.

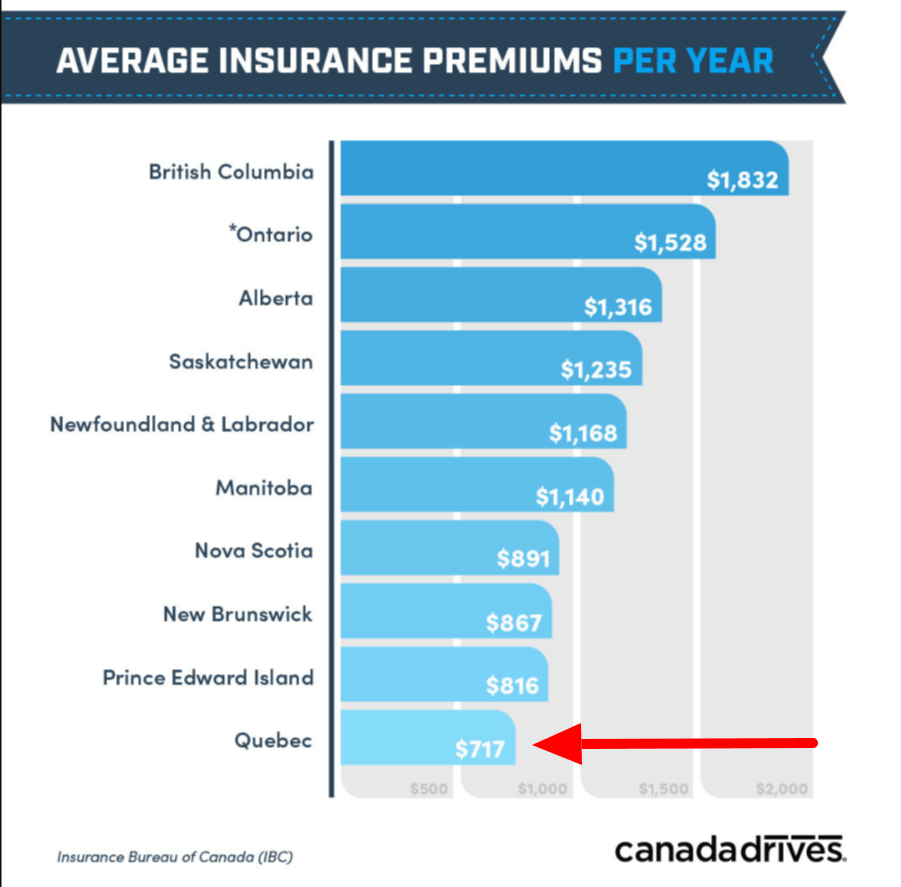

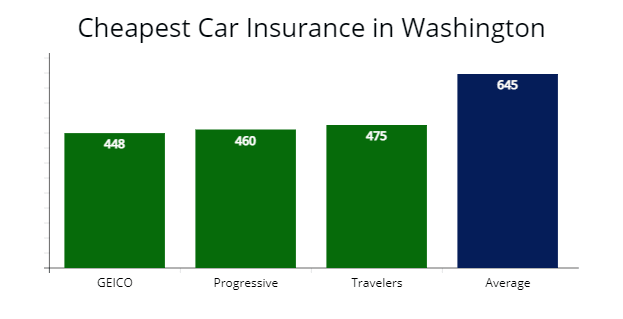

protection. The limitations required and also optional limits that may be readily available are established by state regulation. This coverage, called for by legislation in some states, covers your medical expenses and also those of your passengers, no matter that was accountable for the accident. The limits needed as well as optional restrictions that might be available are established by state regulation. In this post, we'll check out how ordinary automobile insurance policy prices by age and also state can change. We'll likewise have a look at which of the very best auto insurance policy firms use good discount rates on vehicle insurance policy by age as well as compare them side-by-side. Whenever you look for automobile insurance coverage, we recommend getting quotes from several suppliers so you can compare insurance coverage as well as prices. Why do average automobile insurance policy rates by age vary so a lot? Essentially, it's everything about threat. According to the Centers for Illness Control and also Avoidance (CDC ), people in between the ages of 15 and also 19 represented 6. 5 percent of the population in 2017 yet stood for 8 percent of the complete cost of automobile accident injuries. The rate data comes from the AAA Foundation for Web Traffic Safety, as well as it represents any type of accident that was reported to the authorities . The average premium data originates from the Zebra's State of Auto Insurance policy report. The rates are for policies with 50/100/50 obligation protection limitations as well as a$500 deductible for comprehensive as well as accident insurance coverage. According to the National Highway Web Traffic Safety Administration, 85-year-old males are 40 percent most likely to enter a mishap than 75-year-old men. Taking a look at the table over, you can see that there is a straight relationship in between the crash price for an age which age's typical insurance policy costs. Maintain in mind, you could locate much better rates via another firm that doesn't have a details pupil or elderly price cut. * The Hartford is just available to participants of the American Association of Retired Persons(AARP). Insurance holders can add younger motorists to their policy and also get price cuts. Typical Automobile Insurance Fees As Well As Cheapest Provider In Each State Because car insurance coverage rates vary a lot from state to state, the company that offers the least expensive auto insurance coverage in one state might not provide the cheapest protection in your state. You'll likewise see the ordinary expense of insurance policy in that state to help you compare. The table additionally consists of prices for Washington, D.C. These rate estimates use to 35-year-old chauffeurs with great driving records as well as debt. As you can see, ordinary auto insurance coverage costs vary extensively by state. cars. Idahoans pay the least for automobile insurance policy, while vehicle drivers in Michigan pay out the big bucks for protection. If you live in midtown Des Moines, your costs will possibly be more than the state average. On the various other hand, if you reside in upstate New York, your car insurance plan will likely cost less than the state average. Within states, car insurance premiums can vary commonly city by city. The state isn't one of the most pricey general. Minimum Coverage Needs A lot of states have economic obligation legislations that call for motorists to carry minimum auto insurance coverage. You can only do away with insurance coverage in 2 states Virginia and New Hampshire however you are still economically in charge of the damages that you create. No-fault states include: What Various other Aspects Impact Cars And Truck Insurance Fees? Your age as well as your home state aren't the only points that affect your rates. Insurance companies make use of a variety of elements to identify the price of your premiums. Below are several of one of the most vital ones: If you have a tidy driving document, you'll discover much better rates than if you've had any type of current crashes or website traffic offenses like speeding tickets.

The price of crash protection is based on the value of Look at this website your car, and it usually includes a deductible of $250 to $1,000 (suvs). So if your auto would set you back $20,000 to change, you 'd pay the initial $250 to $1,000, depending upon the insurance deductible you picked when you purchased your policy, and also the insurance provider would be accountable for as much as $19,000 to $19,750 afterwards.

accident cars cheaper car insurance dui

accident cars cheaper car insurance dui

Between the cost of your yearly premiums and also the insurance deductible you 'd need to pay out of pocket after a crash, you might be paying a great deal for extremely little coverage - car insurance. Even insurance provider will inform you that dropping crash protection makes sense when your vehicle is worth less than a couple of thousand bucks.

As with thorough insurance coverage, states don't require you to have accident protection, but if you have a car loan or lease, your lender might need it. And also once again, when you have actually paid off your finance or returned your leased vehicle, you can drop the protection.

You'll likewise want to consider exactly how much your car is worth compared to the expense of covering it every year. Uninsured/Underinsured Driver Insurance coverage Even if state legislations need chauffeurs to have liability insurance coverage, that does not indicate every vehicle driver does. As of 2019, an approximated 12. 6% of driversor about one in eightwere without insurance.

That is where this sort of protection is available in. It can cover you as well as relative if you're hurt or your auto is damaged by an uninsured, underinsured, or hit-and-run chauffeur. Some states need drivers to carry uninsured vehicle driver coverage (). Some additionally call for underinsured vehicle driver protection (UIM). Maryland, as an example, requires chauffeurs to carry uninsured/underinsured vehicle driver bodily injury obligation insurance of at the very least $30,000 per person and $60,000 per crash.

If your state calls for uninsured/underinsured vehicle driver insurance coverage, you can buy greater than the called for amount if you wish to. You can likewise buy