Notifications

cheap car cheap automobile credit

cheap car cheap automobile credit

In these states, fault is not appropriate in establishing who need to spend for physical injury liability after an accident (credit score). Injury problems are covered by your own insurer, despite that is at mistake for an accident. No-fault states still need drivers to buy residential property damages obligation, and many also require that you carry physical injury obligation coverage.

cars credit accident affordable auto insurance

cars credit accident affordable auto insurance

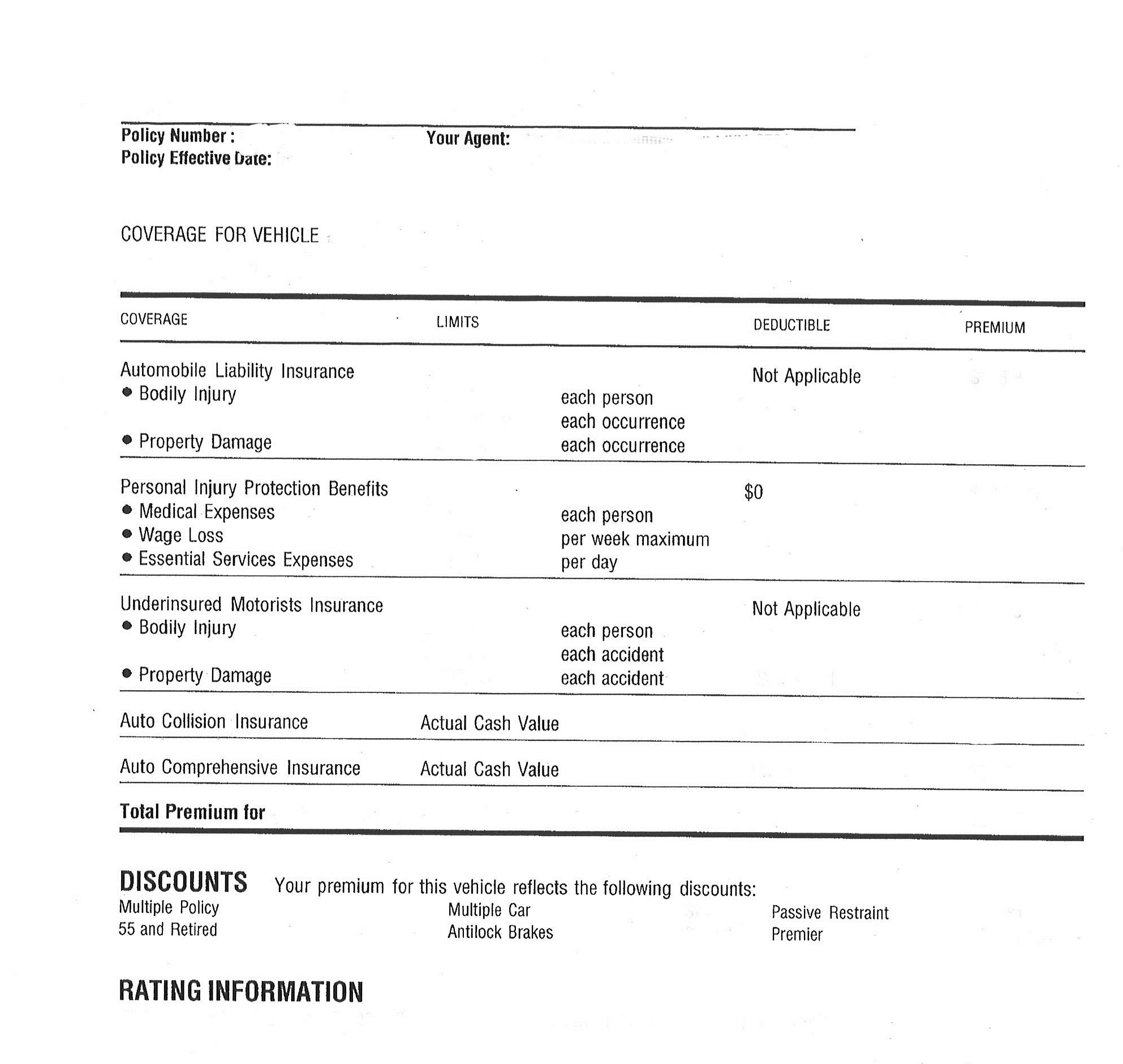

This option is made when you acquisition or restore your automobile insurance plan. What obligation cars and truck insurance policy does not cover Responsibility vehicle insurance policy does not cover damages to your very own vehicle and person after a crash. If you want your insurance company to cover these damages, you will certainly need collision and also clinical insurance coverage. vehicle insurance.

Obligation protection will not spend for residential property problems as well as clinical costs for the various other driver if you are not to blame.

Vehicle liability insurance policy protection assists cover the prices of the other chauffeur's residential property as well as physical injuries if you're discovered to blame in an accident. The car obligation insurance coverage meaning might appear straightforward enough, however right here's a reality example: you go to a four-way stop a couple of blocks from your residence. car.

The following thing you understand; you've struck one more vehicle driver's car in the center of the intersection. Your insurance provider will collaborate with the other vehicle driver's insurance provider to establish that is at mistake (if you stay in a no-fault state). If you have obligation insurance coverage, your insurance coverage company will cover costs for the vehicle driver's broken auto, minus your insurance deductible, and as much as your protected limitation (cars).

In some scenarios, it may even cover shed earnings and/or lawful costs if the victim files a lawsuit. Building damages liability security relates to damages to home arising from a covered mishap in which you're at mistake. It might cover the various other celebration's automobile repair service or replacement costs, along with other property that might have been damaged in the mishap, such as fences, structures, phone poles as well as other sorts of residential property.

You can go with a bigger quantity than the minimum required by your state, relying on your demands. cheaper auto insurance. Think of liability insurance coverage as the standard for vehicle insurance coverage. Accident protection and also thorough protection not to point out various other optional protections like clinical payments coverage as well as personal injury security can not be acquired till you have ample responsibility insurance policy.

What does automobile responsibility insurance coverage cover? Obligation insurance covers you if you are found at-fault for a vehicle crash. Let's claim you make a left turn without examining your unseen area, and you do not see an oncoming vehicle, which creates you to face their lorry. Not just is the various other car damaged, the chauffeur claims they have neck pain.

The brief solution: Yes, when you acquire car insurance, your policy has to consist of a particular amount of liability protection (there's a particular quantity needed in all 50 states). Just how much responsibility coverage is required and what is advised?

Nevertheless, you might locate that the state's minimum might not be sufficient to secure you economically. Consider this. In 2016, the typical obligation case for physical injury was $16,110, according to the Insurance Details Institute. Yet, in 7 states, the minimal physical injury per individual is evaluated $15,000. That implies you could be out there driving with an excellent opportunity that minimum protection won't look after all the costs.

Let's state you had an auto mishap on the freeway and also you were located at mistake. The chauffeur was harmed and also taken to the hospital with injuries. Let's claim your car insurance coverage had bodily injury insurance coverage at $25,000 each and also $50,000 per crash. If the vehicle driver's healthcare facility costs concerned $30,000, the initial $25,000 would certainly be covered, as well as you would likely have to come up with the continuing to be $5,000.

One option is to acquire greater limits on your liability insurance. This will enhance what you pay for premiums. Below's something else to consider concerning the nature of auto accidents.

Or perhaps it was simply unintended, such as striking a patch of ice and moving into someone else's automobile. Either method, when you are deemed the reason of any mishap, you can be found responsible for various other individuals's clinical expenses along with damage to their auto or other home.

Nonetheless, many various other aspects can influence the total prices of your automobile insurance coverage. Here are a couple of: Doing things like paying your bills on schedule may have an impact on what you pay for cars and truck insurance. Credit history is one sign of exactly how likely you are to sue.

Once again, the insurance policy business is evaluating the danger to guarantee you, and those that have a record of negligent or dangerous habits behind the wheel are much more most likely to sue. If you live and also drive in a hectic urban area, you're considered most likely to sue than, claim, a person that lives as well as operates in a much more backwoods - suvs.

The more miles you drive in your auto every year enhances the probability of a mishap. The individual with an hour-long commute may pay higher costs than someone who, say, works from home.

When it comes to automobile insurance policy, the age-old concern is, Exactly how much vehicle insurance coverage do I require? You require coverage that really covers you, the kind that safeguards you from budget-busting auto wreckages.

You're either covered or you're not. One of the big reasons it's difficult to obtain the ideal insurance coverage is because, allow's encounter it, car insurance coverage is confusing. That's why we're mosting likely to reveal you exactly what you need. For beginners, most vehicle drivers must contend least 3 kinds of cars and truck insurance coverage: obligation, extensive and crash.

Why You Required Car Insurance Driving around without car insurance coverage is not only foolish with a funding D, it's also illegal. Yet one in eight Americans drives without some sort of car insurance coverage in place.1 Don't do this. There are severe effects if you're captured on the roadway without cars and truck insurance coverage.

We suggest having at the very least $500,000 worth of overall coverage that consists of both kinds of liability coverageproperty damage liability as well as physical read more injury responsibility. That method, if a crash's your fault, you're covered for costs connected to fixing the various other driver's cars and truck (building damages) and any costs connected to their shed wages or medical costs (physical injury).

cheapest car vehicle insurance cheapest auto insurance insurers

cheapest car vehicle insurance cheapest auto insurance insurers

Right here's what we claim: If you can not change your automobile with cash, you need to get accident (cheap car insurance). The only time you might not need accident is if your cars and truck is paid off as well as, again, you might change it from your savings.

Presently, there are 22 states where you're either needed by law to have PIP or have the choice to purchase it as an add-on insurance coverage - vans.5 If you stay in a state that requires you to carry PIP, you need to maximize the protection if you ever require it.

Also though they would certainly be reducing you a pretty big check, it still wouldn't be enough to pay off your financing. That's because brand-new cars lose greater than 20% in value in the first year.7 Yikes! Void insurance policy loads this "space" by covering the remainder of what you still owe on your lending - insure.

If you believe you'll need this back-up plan in position, it's not a bad suggestion to include this to your policy. Pay-Per-Mile Insurance coverage If your vehicle often tends to rest in the garage accumulating dust, you might have an interest in pay-per-mile protection - cheaper car insurance. With this insurance coverage, a general practitioner device is mounted in your automobile so you're billed per mile, instead of an annual estimate.