Notifications

car insurance accident insurance auto

car insurance accident insurance auto

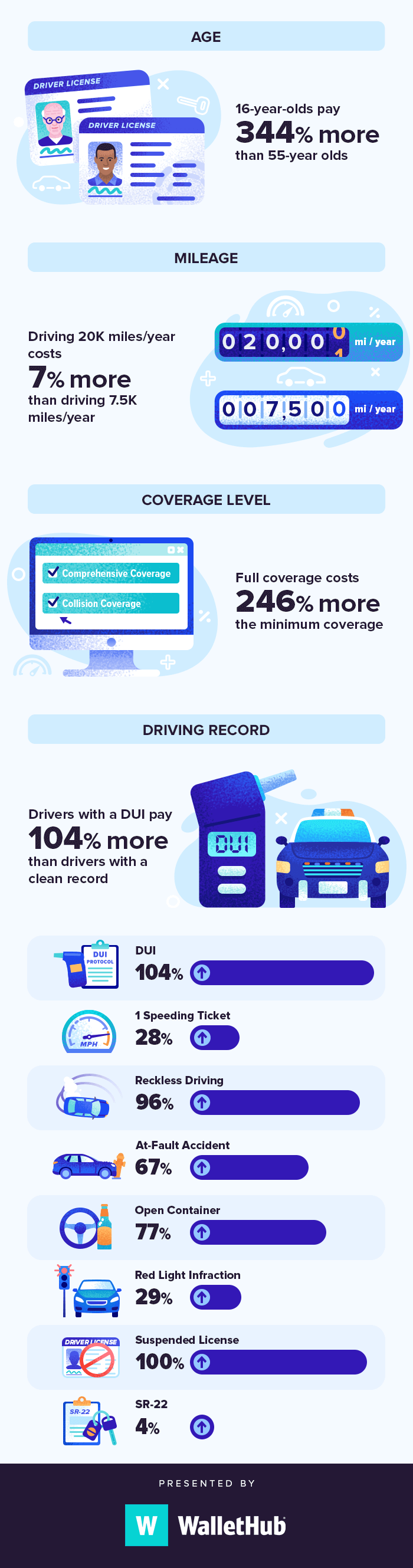

What you pay will depend on your own vehicle driver profile your age, driving document, type of cars and truck you drive, where you live and also each insurance provider will determine your rate in a different way based on those factors - perks. So doing a auto insurance policy contrast is the finest means to save cash, as rates vary considerably among carriers.

That suggests, if you are seeking the same coverage on a financed vehicle vs. perks. an owned vehicle, the insurance coverage costs should not vary as long as all other variables are the same like automobile make, model as well as worth, insurance coverages and chauffeur account. Since automobile insurance policy covers the actual cash value of the automobile, not what you owe to a lender on an auto loan, space insurance coverage can be a smart option.

Example, Let's claim you get a funding to buy a cars and truck for $22,000 and also complete it in an accident. Your extensive or crash insurance will pay out up to the actual money worth, which is commonly lower than the funding amount.

low-cost auto insurance low-cost auto insurance credit score auto insurance

low-cost auto insurance low-cost auto insurance credit score auto insurance

This kind of insurance coverage is costly and does not supply any type of insurance coverage for you, just the lender. Can I drop complete protection car insurance policy as soon as my vehicle loan is repaid? Yes. You can drop complete insurance coverage as soon as your auto is repaid, however it does not necessarily mean you should.

car affordable auto insurance cheap credit

car affordable auto insurance cheap credit

All of that said, there are a couple states where you can obtain away with not having complete protection, as well as you can constantly think about some theoretical where you might make an argument that you do not need full insurance coverage. Talk to any kind of responsible person on the earth, and also most of them will tell you to obtain complete coverage on a financed car, whether it's utilized or brand brand-new.

If it would certainly be tough to make repayments on a cars and truck that you no more can drive, then you need to obtain full insurance coverage, as well as once again, your lending institution may need that you're guaranteed before you drive your auto off the great deal. Do various financial institutions have different policies on auto insurance coverage for funded cars and trucks? Typically, no.

After all, until you settle your vehicle, it's not truly your cars and truck. It comes from the lending institution that will be left installed and also dry if those automobile payments aren't made. Your chances of voluntarily making settlements on a completed car that you can no more drive go way down for the lending institution and also so most, if not all, banks are mosting likely to firmly insist that your financed car is totally insured prior to you drive it off the automobile great deal.

Actually, each state manages all insurance coverage in a different way. there are no nationwide criteria for automobile insurance policy or any type of kind of insurance, like house owners insurance policy, for that matter. In reality, you can practically escape not having any kind of car insurance in Virginia as well as New Hampshire - insurance. That said, Virginia and also New Hampshire do not specifically motivate their citizens to drive around without insurance. car.

You'll pay it when you pay your car registration fee. You don't have to buy automobile insurance coverage, yet if you do not, you have to confirm that you can afford to pay for the damages you do to someone's cars and truck in an accident and if you can't show that, you might not be allowed to drive.

by Valerie Hawkins Opportunities are, if you possess a cars and truck, and also you're a righteous resident, you have car insurance coverage. And although vehicle insurance is just one of the most typical sorts of insurance out there there are a whole lot of sickening, complex terms that support it. But don't allow insurance policy mumbo-jumbo obtain you bewildered.

vehicle insurance liability suvs affordable auto insurance

vehicle insurance liability suvs affordable auto insurance

Occasionally, when you have more questions than responses on confusing insurance coverage terms, it may seem simpler to do nothing at all. Whether you're shielding the points you like or preparing for tomorrow, do not get overloaded, obtain started. car insurance.

A finance or lease provider might need collision as well as thorough coverages, and perhaps gap coverage. When shopping for insurance coverage, you require the called for protections.

This ensures your insurance provider covers expenses linked with any type of damages you've created to others' automobiles or property and also for which you're responsible. Both physical injury and home damage obligation insurance coverage have restrictions. A limitation is the optimal buck amount the insurance provider will pay when you have an insurance claim.

You choose the amount of your limitations when you purchase the policy and also can expect to pay more in costs for higher limits.Collision This is an optional coverage that applies if you are accountable for an accident as well as your automobile is damaged. It assists cover the expense of your vehicle's repair work or substitute - cheap car. It covers the price to repair or change your vehicle if it's harmed in an incident apart from a collision with another car. Instances include damages triggered by serious weather (such as a hailstorm or flooding), damage suffered by a tree branch falling onto your car, or damages endured in an accident with a deer or various other animal. Both coverages have deductibles. The deductible is your share of (cars).

the expenses to fix or replace your lorry if you have a claim. Deductibles normally vary from $500 to$1000, and you choose this quantity when you purchase the plan. Note that while crash and also thorough are not called for by state law, they might be needed by your financing or lease company. Your settlement(the quantity of money you can expect to receive from the insurance provider) would be based upon the car's depreciated value. This may be a lot less than the quantity of money you owe your financial institution for the loan or a lease. Having gap protection suggests your insurance company will aid pay for that distinction. What does complete coverage vehicle insurance not pay for? Every insurance plan has exemptions. These are circumstances for which the policy will certainly not offer compensation, regardless of what protections you have actually selected. Exclusions are noted in the policy's agreement, which you must get when the plan goes right into effect. You might additionally be able to view your contract at the firm's website or via its app. Exactly how a lot does complete insurance coverage car insurance policy cost? Your premium check here the amount of cash you pay for your automobile insurance coverage will always be impacted by your protection, limit, as well as insurance deductible selections.

You will certainly be asked to address several inquiries concerning on your own, where you live, your preferred level of coverage, and also your automobile or home. For Your Security, Once you have actually selected the insurance policy protections you require and an insurance policy agent or business, there are actions you can take to make specific you obtain your cash's worth (prices). It is prohibited for unlicensed insurance providers to offer insurance coverage as well as, if you purchase from an unlicensed insurance firm, you have no guarantee that the insurance coverage you pay for will ever before be recognized.

Below we detail 5 kinds of coverages as well as offer a few scenarios where you would benefit from having a non-required insurance coverage added to your policy along with some ideas to save some cash depending on your lorry as well as budget. If you can afford it, nevertheless, it is generally an excellent suggestion to have liability insurance that is over your state's minimum responsibility protection demand, as it will certainly give extra protection in the occasion you are found at mistake for a mishap, as you are responsible for any type of claims that exceed your protection's top limitation. Anti-theft as well as tracking tools on cars and trucks can make this coverage a little more budget friendly, however lugging this type of insurance coverage can be expensive, and may not be essential, particularly if your cars and truck is conveniently exchangeable.