Notifications

If you transfer to Florida from another state, ask your insurance coverage representative if your company writes in Florida (most do) and to transfer your insurance coverage to Florida. You can look up insurer certified to do organization in Florida at the business directory site on the Florida Office of Insurance Guideline - laws.

The registration charge is $225. To register your car: If you just stay in Florida during the winter season, you still need to keep a legitimate car insurance coverage active. The state calls for any kind of car with a Sunlight State permit plate and registration to be covered by a Florida insurance plan.

Some vehicle insurance coverage companies in Florida offer you with seasonal protection be sure to ask your insurance policy carrier concerning it. If you have a Florida motorist's Certificate as well as you're 55 or older, you may complete a six-hour car crash prevention program. You can take the training course online. As long as the finished program is acknowledged by the Florida Department of Highway Safety And Security as well as Motor Autos, you'll be eligible to receive a discount rate on your car insurance policy, great for 3 years.

m. and also 11 p. m. When you're 17, you can drive between 5 a. m. and also 1 a. m. When you turn 18, all constraints are removed.

Automobile Insurance Quotes in Florida Are you searching for cost effective auto insurance coverage in Florida? Perhaps you have actually been a citizen of the Sunshine State for some time and are just trying to find a far better or even more inexpensive car plan. Every motorist in Florida needs auto insurance protection. See why numerous insurance holders count on GEICO to supply phenomenal car insurance from responsibility security to thorough protection.

We make it easy for you to obtain a free Florida cars and truck insurance policy quote online. Required Vehicle Insurance Insurance Coverage in Florida Drivers need to make certain they have the vehicle insurance policy coverages called for by the state of Florida to lawfully run a car: These are the minimal Florida car insurance protection requirements, however you must select the protection you require.

requires all chauffeurs to bring Injury Security (PIP). This coverage assists pay the insured's medical costs in the event of an accident, despite fault. Individuals frequently think drivers can not be legally gone after for injuries they trigger in a mishap due to the fact that Florida is a No-Fault state, yet that isn't right.

For the very first 90 days with a learner's license, a teen might just drive during daylight hrs. A qualified chauffeur over the age of 21 must constantly go along with the teen chauffeur. > What Is The Cheapest Vehicle Insurance Coverage in Florida for 2022?

Auto Insurance Coverage in Florida Whether you just relocated to the Sunlight State or are purchasing brand-new vehicle insurance in Florida, you can rely on The Hartford to be there when you require us most. With the AARP Auto Insurance Coverage Program from The Hartford,1 you can have peace of mind as you drive.

If you're aiming to get a quote from an insurer or need information about buying car insurance coverage in Florida, you've pertained to the best area - car. Car Insurance Coverage Quotes for Florida Drivers Obtaining an auto insurance coverage quote in Florida from The Hartford is so simple that you can do it in minutes.

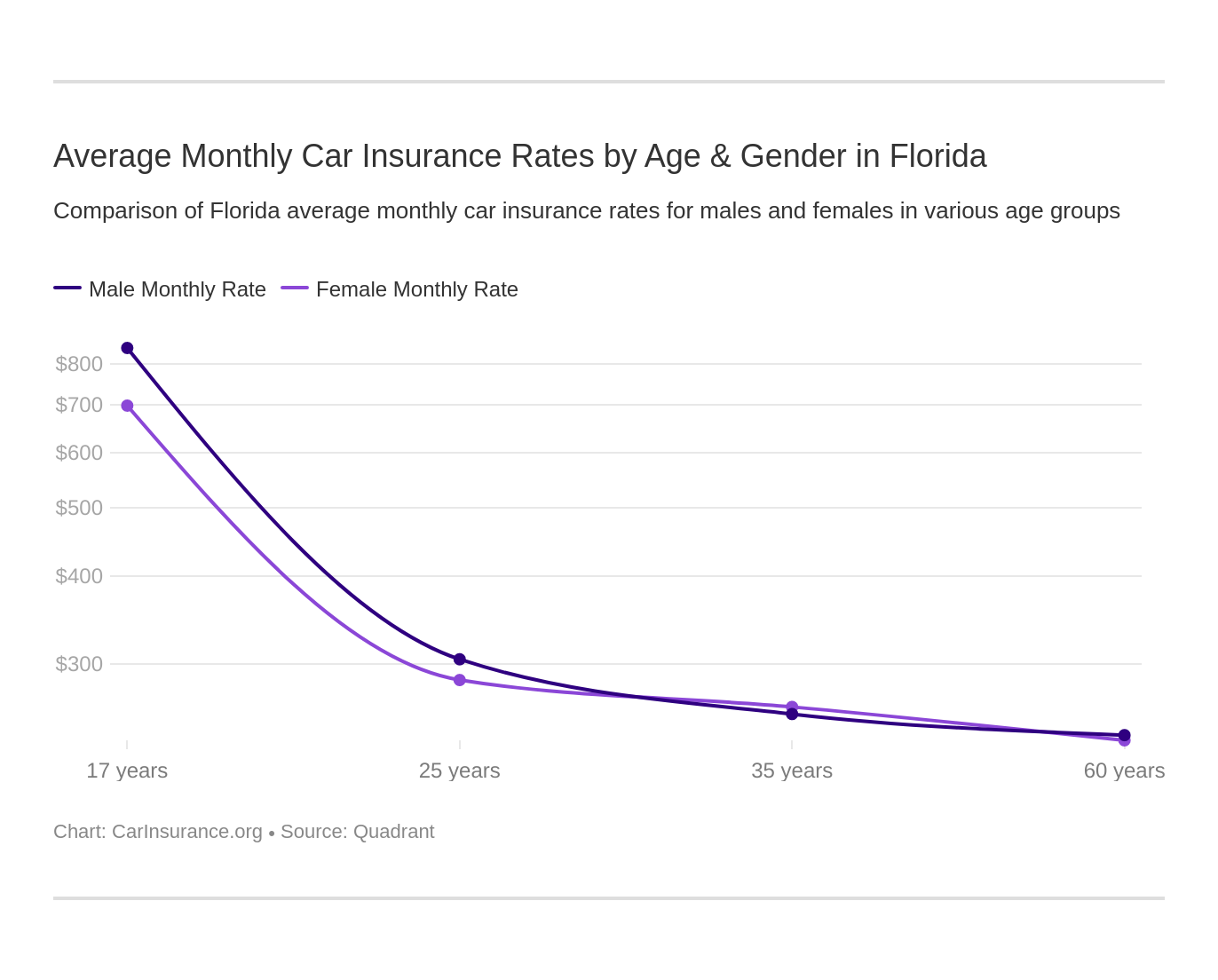

What is the Typical Cars And Truck Insurance Coverage Expense Each Month in Florida? According to the Insurance Policy Information Institute, the 2018 typical annual cost for car insurance in Florida was $1,426, balancing to be around $120 monthly - cheap. Auto insurance rates in Florida will certainly differ relying on things like your credit rating, automobile crash background and also the amount of insurance coverage needed.

Florida Auto Insurance Policy Regulations As a Florida resident, you are required by law to have vehicle insurance coverage. If you do not have cars and truck insurance in Florida, you can be fined. There are a number of secure driving laws indicated to protect you on Florida's roadways. Below are just a couple of:3 Florida Safety Belt Laws It is obligatory to wear a seat belt while driving in Florida. dui.

Florida Distracted Driving Legislations Distracted driving is anything that takes your eyes off the road or your hands off the wheel, like texting while driving, which is prohibited for all motorists in Florida. Florida Teen Driver Laws Florida has actually executed graduated licensing legislations to make sure that teens acquire the experience they require to be safe behind the wheel - insure.

The Financial Obligation Legislation Based on your driving document, you could be required to lug full liability car insurance policy in Florida - cheapest car insurance. For example, full coverage can be called for if you have actually created an auto mishap where somebody had a covered injury or if you have actually obtained excessive factors on your license.

Florida is the fourth most pricey state in America to buy cars and truck insurance policy, according to the Insurance coverage Info Institute. Car insurance policy prices vary for drivers as well as are produced by insurance firms in Florida.

If you have an at-fault vehicle accident, your insurance policy price might be higher. What Is the Minimum Automobile Insurance Protection in Florida?

Just How Much Is Florida Automobile Insurance Coverage? The typical price of automobile insurance policy in Florida is about $118 per month.

![]()

Any type of automobile with a current Florida enrollment need to: be insured with PIP as well as PDL insurance coverage at the time of vehicle registration. have an Automobiles registered as taxis must carry bodily injury obligation (BIL) coverage of $125,000 per person, $250,000 per occurrence as well as $50,000 for (PDL) insurance coverage. have continuous protection also if the car is not being driven or is unusable.

You have to get the enrollment certification and also permit plate within 10 days after starting work or registration - cheapest auto insurance. You need to likewise have a Florida certificate of title for your automobile unless an out-of-state lien holder/lessor holds the title and also will not launch it to Florida. Relocating Out of State Do not terminate your Florida insurance coverage until you have actually registered your automobile(s) in the various other state or have given up all legitimate plates/registrations to a Florida.

Charges You must preserve necessary insurance coverage throughout the registration duration or your driving advantage as well as certificate plate might be put on hold for up to 3 years. There are no arrangements for a momentary or hardship chauffeur license for insurance-related suspensions. Failing to keep needed insurance policy coverage in Florida may lead to the suspension of your motorist license/registration and also a demand to pay a reinstatement charge of approximately $500.

takes place when an at-fault event is sued in a civil court for problems created in an automobile accident and has not completely satisfied property damages and/or bodily injury requirements. (PIP) covers you regardless of whether you are at-fault in an accident, approximately the limits of your plan. (PDL) pays for the damage to various other people's property (credit).

Complete ordinary yearly expenditure actions what Florida vehicle drivers actually invested on auto insurance policy in 2018. These averages might not be what you see in your location. Lots of people recognize that the county they stay in matters, but costs can even change between postal code. Miami is just one of one of the most costly locations to live, while rural areas and also middle-class residential areas have a tendency to be the least expensive.

State Farm provides the most affordable full coverage insurance coverage for chauffeurs in Florida with a crash on their record at an annual price quote of A speeding ticket is among several website traffic offenses that will certainly create your costs to leap. In Florida, the average price quote for chauffeurs with a speeding ticket is for a complete protection plan.

Sure, all of us desire to conserve cash, however the cost can not be the only aspect. Besides, you can choose the cheapest cars and truck insurance policy in Florida, however will your claims be paid quickly? That's why we review automobile insurance policy coverage by numerous variables, taking a look at points like average expense, financial strength, J.D (vans).

Pros Cons Budget friendly rates and countless discount rates Just available for military and also their households Good choice for army members Superior monetary strength score and also A+ score from the Better Service Bureau (BBB) To get more information about the automobile insurance