Notifications

Having a teenager motorist can get pricey, quickly. Perhaps among those young drivers is your teen! Parents and guardians need to make the effort to talk to teen drivers about the severity of driving safely. Teenagers must understand that driving is a privilege and if treated lightly it can result in increased premiums and costly repair work costs, and at worst reckless habits behind the wheel might result in their death or the deaths of others.

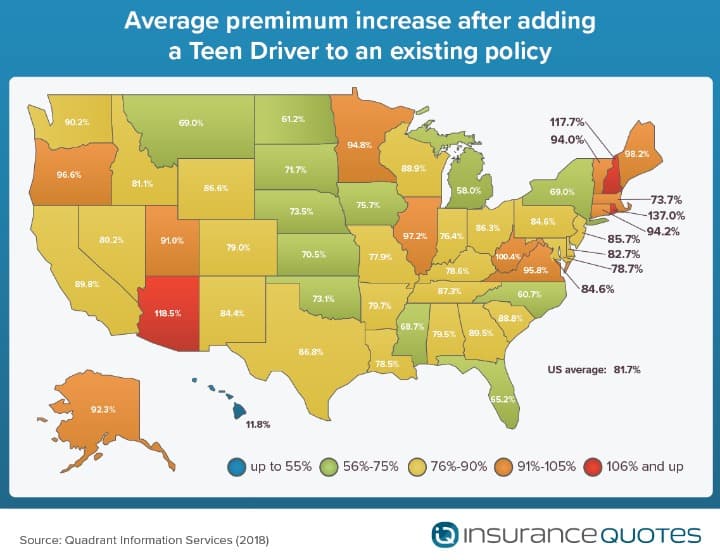

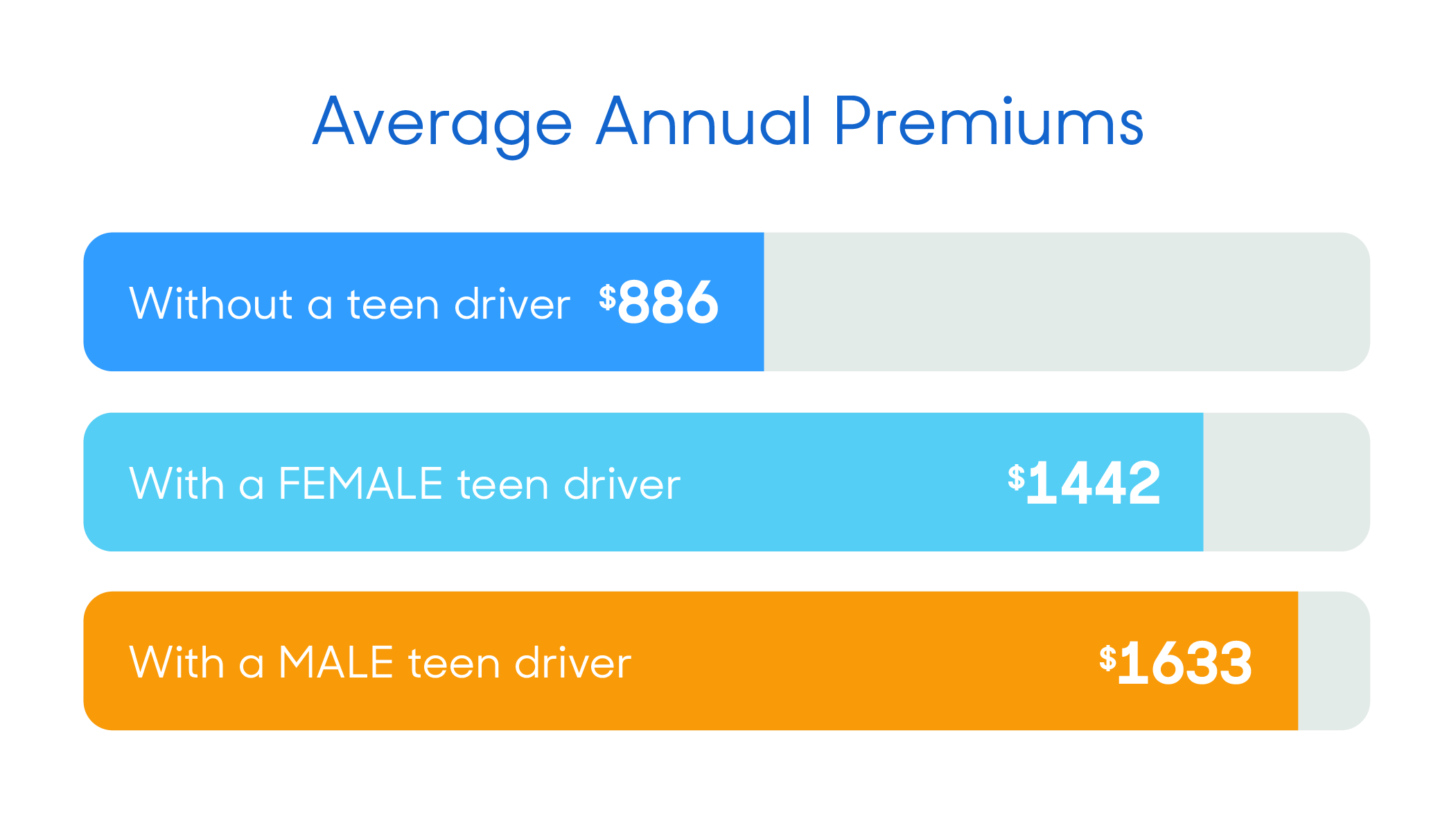

com used a family profile of owning a 2019 Honda Accord driven by a 40-year old man purchasing full protection. They added a 16-year old teen to the policy. This is what they saw take place to the rates: The average household's car insurance costs rose 152%. A teenage kid was more pricey.

According to the post, the reason behind the boost was because "teens crash at a much greater rate than older drivers. Insurance companies have to prepare for that expected sustained expense of insuring the chauffeur.

Normally, cars and truck insurer will not interact what discounts they use to teen drivers unless you ask. Do your research study and know what is available to you. To get you began, here are a few of the finest discount rates for teenager drivers that will assist you get car insurance that you can afford.

Trainee Away Discount Rate: If your teen is away for school and not driving, ask your provider about an "away" discount. This can save you around 5%-10%. Raise Your Deductible: This just implies you raise the amount that you are responsible for covering in case of an accident and is an easy method to lower car insurance coverage premiums.

Great driving routines are key to keeping insurance premiums low and inexpensive. Be sure to talk to your teen about safe driving practices and be sure you model those safe driving routines to them.

South Carolina ranks in the leading 5 in the country for deaths per 100 million automobile miles took a trip. 982 people died in traffic accidents on our state roads in 2017.

Klaus Vedfelt, Getty Images Car insurance for young, unskilled motorists isn't low-cost, and for excellent reason. Teenage chauffeurs in between the ages of 16 and 19 are most likely to be associated with accidents than any other age, as mentioned by Webb Insurance coverage. For parents with teens who are rapidly approaching the driving age, learning how to save on teenage cars and truck insurance coverage is a need.

If your teen makes the dean's list or is on the honor roll, share that information with your insurance service provider, as it might assist with lower rates too. Till your teen reaches age 25, getting good grades might lead to a discount rate that ranges anywhere from 5 to 15 percent, depending on the provider.

Certain cars, such as sports cars, already pose a greater threat for insurer. Putting a teenager behind the wheel of a vehicle the business considers high-risk is going to increase the amount you pay each month for insurance coverage. Numerous insurance coverage service providers think about these automobiles to be the best alternatives for teens: Volkswagen Jetta, Toyota Camry, Ford Taurus, Subaru Forester, While it's not mandatory that your teen drive one of the automobiles on this list, a four-door sedan will assist you conserve the most money on teenage car insurance coverage.

According to Cash Talks News, insurance providers can utilize telematics gadgets to track your driving routines. Talk with your insurance company to learn if they have a gadget they can set up in your car that tracks things like your braking habits, driving speed, the distance you take a trip typically, and how often you drive.

Naturally, they will gather this information your teenager, too. Shopping Around, Even if you have a great insurance service provider, before you include your teenager to your policy, you might wish to look around. Every insurance provider offers different rates and discounts, so get quotes from other cars and truck insurance service providers to see how they compare.

Plus, getting quotes does not mean you have to make a commitment to any of the providers you ask with. The majority of insurance coverage companies have discounts you can take advantage of, which is crucial when you're including a teenager to your policy.

While this might appear easy, you'll have to examine your own driving practices. Before you can teach another person to be an excellent chauffeur, you should set an example by being one yourself. When driving, make certain you remain within the speed limit, utilize your turn signal, and concern a total stop at stop signs.

Having a clean driving record without mishaps or moving violations is one of the finest methods to get a low rate on your vehicle insurance coverage. If your teen can drive without having mishaps or other violations on their driving record, they'll wind up with a much lower rate while they're on your policy.

On the same note, if your teenager goes on a trip or isn't driving for a specific duration, let your insurance provider understand, as they might provide you a discount. It's also important to keep in mind that if your teen drives an insured car for less than 25 percent of the time the lorry is on the roadway, you can get a more affordable rate.

Teenagers are more most likely to be included in mishaps and have proven to be higher risks for insurer. Take a look at how to minimize teenage automobile insurance coverage before they take this huge step toward their self-reliance. This material is produced and maintained by a 3rd party, and imported onto this page to assist users supply their email addresses.

When it concerns teen chauffeurs and car insurance coverage, things get complicated-- and costly-- quickly. A moms and dad including a male teen to a policy can anticipate car insurance coverage rate to balloon to more than $3,000 for full protection. It's even greater if the teenager has his own policy.