Notifications

If you're a new driver, you do not have a recognized driving record that shows insurance providers you're less of a risk. On the other side, a history of automobile accidents and tickets can trigger your rates to increase. If you're a young motorist or you've recently remained in a mishap or gotten a ticket, you're most likely questioning when your rates will go down.

As an outcome, your driving history has a direct influence on the cost you'll pay to bring insurance. If you have a tidy driving record, you'll likely be thought about a safe chauffeur and take advantage of lower rates. If you have actually been involved in accidents or ticketed for severe traffic offenses, there's a likelihood you'll pay more.

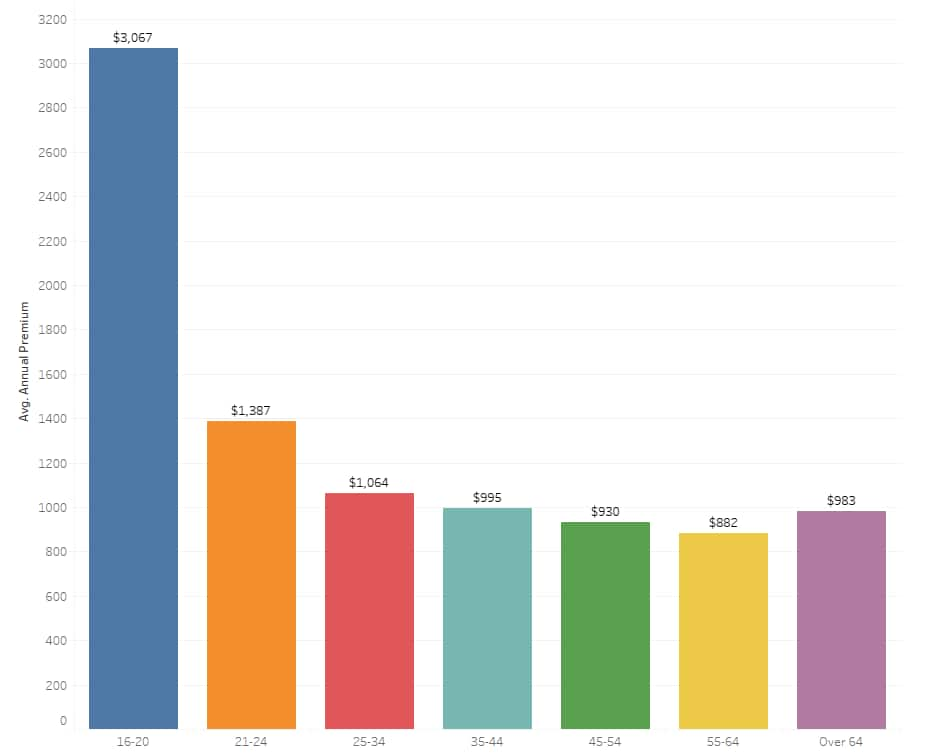

Insurance companies usually charge more for youths below the age of 25.: Statistically speaking, numerous more guys than females die each year in car accidents more than double according to the National Highway Traffic Security Administration. Guy tend to drive more miles and engage more regularly in dangerous driving, such as driving while intoxicated, speeding, and not using seat belts.

This is since more knowledgeable motorists are less most likely to have mishap claims than inexperienced chauffeurs, which usually implies older motorists are less costly to insure than more youthful motorists. From the point of view of automobile insurer, 25 is the age at which you're thought about an experienced chauffeur. This is assuming you've had your license for several years, that is.

A nonrenewal is when your insurer picks not to renew your policy when it ends. In general, these boosts tend to remain on your premium for 3 years following your claim. If, nevertheless, you had a strong driving record prior to an at-fault accident, you may not see an increase at all.

For example, although a DUI will likely lead to your insurance provider deciding to not renew your policy, a speeding ticket might just lead to a higher premium. It truly depends on how your state and insurance company deal with the particular moving violation. A speeding ticket will generally come off your record within 3 years.

Does vehicle insurance go down if you improve your credit rating? Your insurance rating is comparable to your credit rating because it's determined utilizing the info in your credit report. Insurance coverage business look at information from your credit report, such as your payment history, credit use, brand-new applications for credit, and exceptional debt, and they apply a weighted score to each aspect.

For lots of teenagers, the expense of buying vehicle insurance coverage by themselves might be more than their summer season tasks can handle. That's why numerous parents put teens on the family insurance coverage, where the cost is much less than if a teenager purchased his or her own insurance plan. At some time, nevertheless, teenagers become adults and their insurance coverage danger level decreases.

Is this the time to advise kids to take over responsibility and move off their moms and dads' vehicle insurance coverage policy?, for moms and dads to continue to guarantee children and pay the premiums, or for moms and dads to continue to insure kids and have them cover the cost.

You might be wondering; The length of time can a child remain on their moms and dads' car insurance? The reality is, parents can keep children on the family car insurance coverage for as long as they desire, but it may not constantly make financial sense. In this regard, there are crucial elements to think about.

Knowing the best age to do it is the challenge. Different car insurance coverage rates for teenage girls and boys Teens on a family's vehicle insurance plan will be ranked greater and in a different way, based upon their gender, than older grownups. "If two parents have boy-and-girl fraternal twins, each getting their driver's license at the same time, the woman will initially get a much better rate than the kid, based on analytical information showing a lower risk of accidents involving teenage girls," states Kevin Lynch, assistant teacher of insurance at The American College of Financial Solutions in Bryn Mawr, Pennsylvania.

Kids may not have standard adult rates until they reach age 25 if they have a tidy driving record. Regardless of gender, teaching your teens safe driving is of the utmost value, both for insurance rates and their safety.

" My boy transferred to Texas after college, where vehicle insurance is a lot less expensive than it is in New York," says Hartwig. "He had a job and might afford his own insurance now." Reconsider your vehicle insurance coverage policy after graduation Many parents usually decide to retain teens on the family's automobile insurance plan up until they finish from college, assuming they find work and live far from house.

If the child can afford paying for his or her own car insurance, this is the time for the family to sit down and talk about it. Ask an insurance agent Hartwig even more recommends including an insurance coverage agent in the conversation. "An agent has the threat and insurance coverage know-how to help with a talk on the various kinds of insurance protections that exist in the market and the significance in searching for insurance, comparing and contrasting the terms, conditions and costs of various policies," he states.

Wondering just how much the expense of automobile insurance will be for that stunning brand-new cars and truck you've been dreaming about? You're not alone. And landing on that specific number can be challenging for a number of reasons due to the fact that insurance rates can vary by car type and the age of the automobile.

Other elements like your personal monetary history and your family's driving records can all influence the expense of your premium. To better comprehend what elements are in play, let's have a look at what enters into calculating the cost of car insurance coverage and dig deep into the elements that sway your insurance costs.

Many car insurance provider will have their insurance coverage agents gather information about your car when developing a quote. They'll likewise ask you about your preferred protection limitations, which can change the cost of your car insurance coverage. Agents will take a look at state-mandated protection requirements to be sure you're getting the defense you need to drive lawfully.

Usually, this will mean you'll be changing your policy, whether you're including your new spouse or removing your ex. You might be able to save cash on vehicle insurance coverage with a great credit score.