Notifications

If you're a new chauffeur, you don't have a recognized driving record that shows insurance companies you're less of a threat. On the flip side, a history of vehicle accidents and tickets can cause your rates to increase. If you're a young driver or you have actually just recently remained in an accident or gotten a ticket, you're most likely questioning when your rates will go down.

As a result, your driving history has a direct effect on the cost you'll pay to bring insurance. If you have a clean driving record, you'll likely be thought about a safe chauffeur and gain from lower rates. If you've been involved in mishaps or ticketed for major traffic violations, there's a great chance you'll pay more.

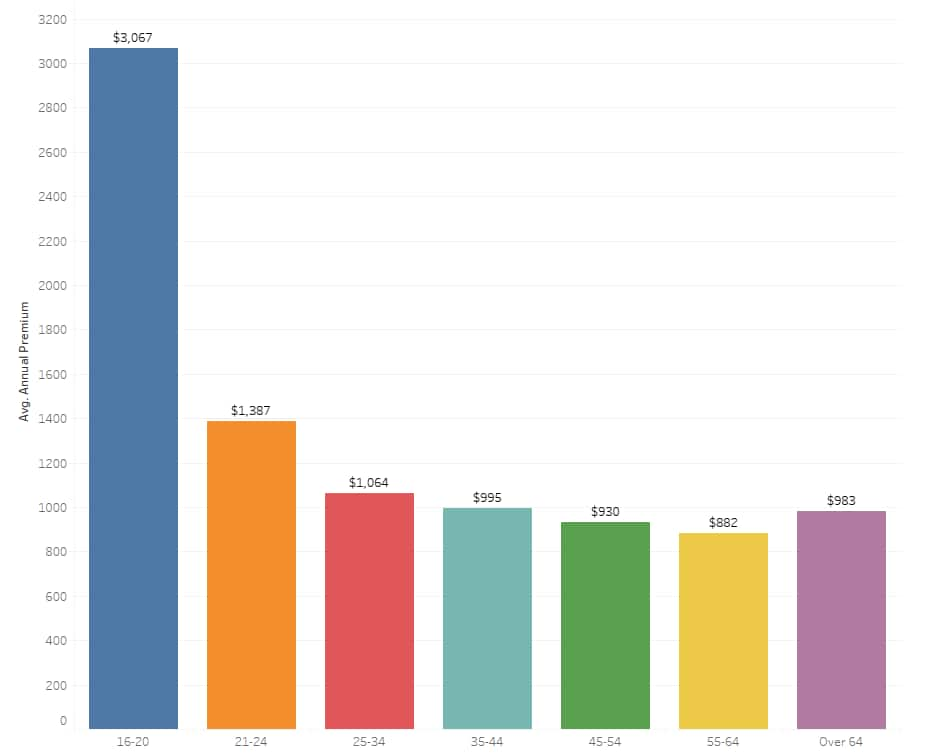

Insurance providers typically charge more for youths below the age of 25.: Statistically speaking, much more males than females pass away each year in automobile mishaps more than double according to the National Highway Traffic Safety Administration. Guy tend to drive more miles and engage more frequently in risky driving, such as driving while intoxicated, speeding, and not utilizing safety belt.

This is due to the fact that more knowledgeable drivers are less likely to have mishap claims than unskilled chauffeurs, which generally indicates older motorists are less costly to insure than younger chauffeurs. From the viewpoint of cars and truck insurer, 25 is the age at which you're considered an experienced motorist. This is presuming you've had your license for rather a couple of years, that is.

A nonrenewal is when your insurance coverage business chooses not to restore your policy when it ends. In basic, these increases tend to remain on your premium for three years following your claim. If, however, you had a solid driving record prior to an at-fault mishap, you might not see a boost at all.

Although a DUI will likely result in your insurer deciding to not restore your policy, a speeding ticket might simply result in a higher premium. It actually depends upon how your state and insurer treat the specific moving violation. A speeding ticket will normally come off your record within three years.

Does car insurance coverage go down if you improve your credit history? Your insurance rating is similar to your credit history in that it's determined utilizing the info in your credit report. Insurance business look at info from your credit report, such as your payment history, credit usage, new applications for credit, and impressive financial obligation, and they use a weighted rating to each factor.

For numerous teens, the expense of purchasing cars and truck insurance coverage by themselves may be more than their summertime tasks can deal with. That's why many moms and dads put teens on the family insurance coverage, where the expense is much less than if a teenager purchased his/her own insurance coverage. Eventually, however, teenagers become adults and their insurance coverage danger level declines.

Is this the time to encourage children to take over responsibility and move off their moms and dads' vehicle insurance coverage? It depends. There are several alternatives open to the family - for the child to buy his or her own vehicle insurance, for parents to continue to insure kids and pay the premiums, or for parents to continue to guarantee kids and have them cover the expense.

You might be questioning; The length of time can a kid remain on their moms and dads' car insurance? The truth is, moms and dads can keep children on the household auto insurance plan for as long as they want, however it might not constantly make financial sense. In this regard, there are necessary factors to think about.

Knowing the ideal age to do it is the challenge. Different vehicle insurance rates for teenage girls and kids Teenagers on a family's car insurance coverage policy will be ranked greater and differently, based upon their gender, than older adults. "If 2 parents have boy-and-girl fraternal twins, each getting their driver's license at the exact same time, the girl will initially receive a better rate than the boy, based on analytical data showing a lower risk of accidents involving teenage women," says Kevin Lynch, assistant teacher of insurance at The American College of Financial Services in Bryn Mawr, Pennsylvania.

Kids might not have standard adult rates until they reach age 25 if they have a clean driving record. Regardless of gender, teaching your teenagers safe driving is of the utmost importance, both for insurance rates and their security.

" My son moved to Texas after college, where cars and truck insurance coverage is a lot more affordable than it remains in New york city," says Hartwig. "He had a task and might manage his own insurance now." Reconsider your automobile insurance coverage after graduation Many moms and dads normally opt to maintain teenagers on the household's automobile insurance plan till they finish from college, presuming they discover work and live far from home.

If the kid can pay for paying for his or her own auto insurance coverage, this is the time for the family to sit down and talk about it. "A representative has the threat and insurance coverage competence to help with a talk on the different types of insurance protections that exist in the market and the importance in shopping for insurance coverage, comparing and contrasting the terms, conditions and costs of various policies," he states.

Wondering just how much the expense of vehicle insurance will be for that stunning brand-new car you've been dreaming about? You're not alone. And landing on that specific number can be hard for a number of factors since insurance coverage rates can differ by vehicle type and the age of the automobile.

But other elements like your personal monetary history and your household's driving records can all influence the cost of your premium as well. To much better comprehend what elements remain in play, let's take a look at what goes into computing the expense of automobile insurance and dig deep into the factors that sway your insurance coverage costs.

They'll likewise ask you about your favored protection limitations, which can adjust the cost of your vehicle insurance policy.

Usually, this will suggest you'll be changing your policy, whether you're including your brand-new spouse or removing your ex. You may be able to conserve cash on automobile insurance with a good credit rating.