Notifications

Paying factors will certainly cost you more than simply initially paying a greater rates of interest on the finance if you intend to sell the building within just the next few years. Banks usually have more stringent certifying needs, might charge more charges as a result of included compliance demands, and might take longer to reach closing. However you might likewise be eligible for connection price cuts if you take advantage of their various other banking solutions. For instance, bank consumers might obtain a price cut on closing expenses or a reduction in their rates of interest if they established mortgage autopay linked to their examining account with the same financial institution. Due to the fact that your credit rating has a huge influence on your interest rate, customers with great credit rating will generally pay a lot less for their mortgage than those with reduced ratings.

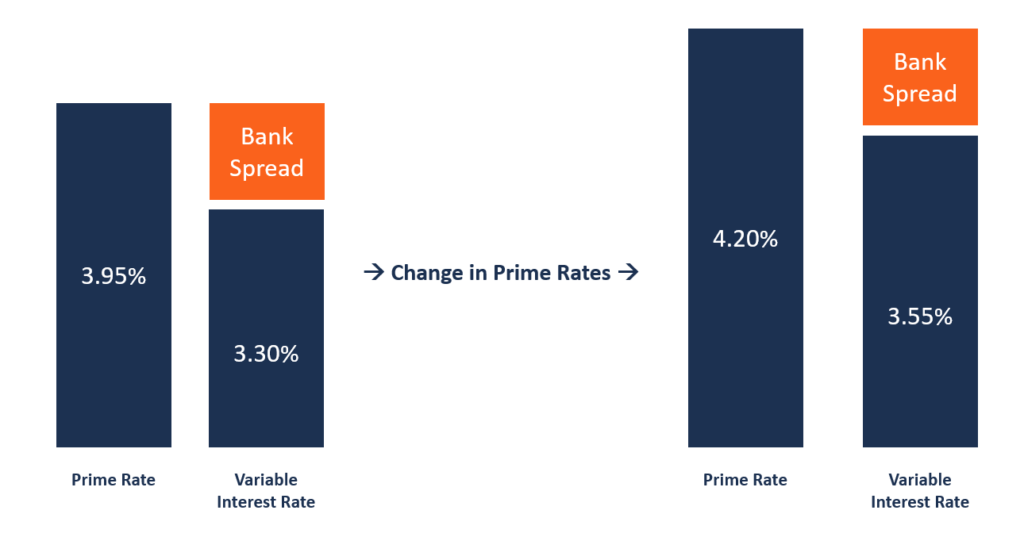

Unlike the stability of fixed-rate financings, adjustable-rate mortgages have rising and fall rates of interest that can increase or down with market problems. Lots of ARM items have a fixed rate of interest for a couple of years prior to the funding adjustments to a variable rates of interest for the remainder of the term. For instance, you might see a 7-year/6-month ARM, which implies that your rate will certainly stay the very same for the initial seven years and also will adjust every 6 months after that first duration. If you take into consideration an ARM, it's essential to review the small print to recognize how much your price can boost and just how much you can end up paying after the introductory period runs out. USDA fundings-- USDA car loans aid modest- to low-income consumers get houses in backwoods.

If you're pondering homeownership and asking yourself how to get started, you have actually pertained to the appropriate place. Right here, we'll cover all the home mortgage essentials, consisting of funding kinds, mortgage language, the house getting process as well as even more. That said, generating the needed funds to do this isn't constantly very easy, so expanding the cost of shutting over the entire financing term could be the best choice for some.

It needs nothing down and rates are generally less than for FHA. Another home loan that enables you to fund 100% of the residence's expense is the VA home loan. This funding is offered to candidates typically with a minimum of 2 years of previous armed forces experience, or 90 days if still offering. To qualify, you need to have enough income to sustain your house repayment, but not excessive income. As specified below, there are numerous alternatives, like the USDA home loan and also VA financing. Even FHA can be a zero-down loan if you get present funds to cover the 3.5% down payment.

New as well as repeat house buyers are eligible for 100% funding via across the country government-sponsored programs. Is a financing that enables you to obtain cash from the equity in your home without having to make regular monthly settlements. As time takes place, your debt will increase and your home's equity will certainly lower. The quantity you receive from a reverse mortgage depends on your age as well as the value of your home. You have to be at least 62 years of ages to receive a reverse home loan.

Insurance policy is commonly anywhere in between 0.5-- 1% of the car loan quantity annually. On a $1 million funding, this alone can conserve you anywhere in between $416.67-- $833.33 each month. So, while you do not require to come up with as much cash upfront, the amount you pay with time will certainly approach a conventional mortgage, or more.

You need to locate a way to come back on course as well as start making your mortgage payments again prior to the moratorium launched by your mortgage insurance coverage is over. Private Home mortgage insurance policy, on standard fundings might be consisted of in your regular monthly payment if you are putting less than 20% down. FHA and USDA call for a regular monthly home mortgage insurance settlement, which will be included in your complete month-to-month settlement. If you are light on capital or have a lower credit rating, an FHA funding may be a great fit for you. FHA finances can likewise profit an individual that has had a recent negative credit occasion such as repossession, personal bankruptcy, or a short sale. If the consumer needs support in qualifying, FHA lendings let family members sign as non-occupant co-borrowers also.