Recent Videos

Let's talk!

The Aflac - America's Most Recognized Supplemental Insurance ..

-

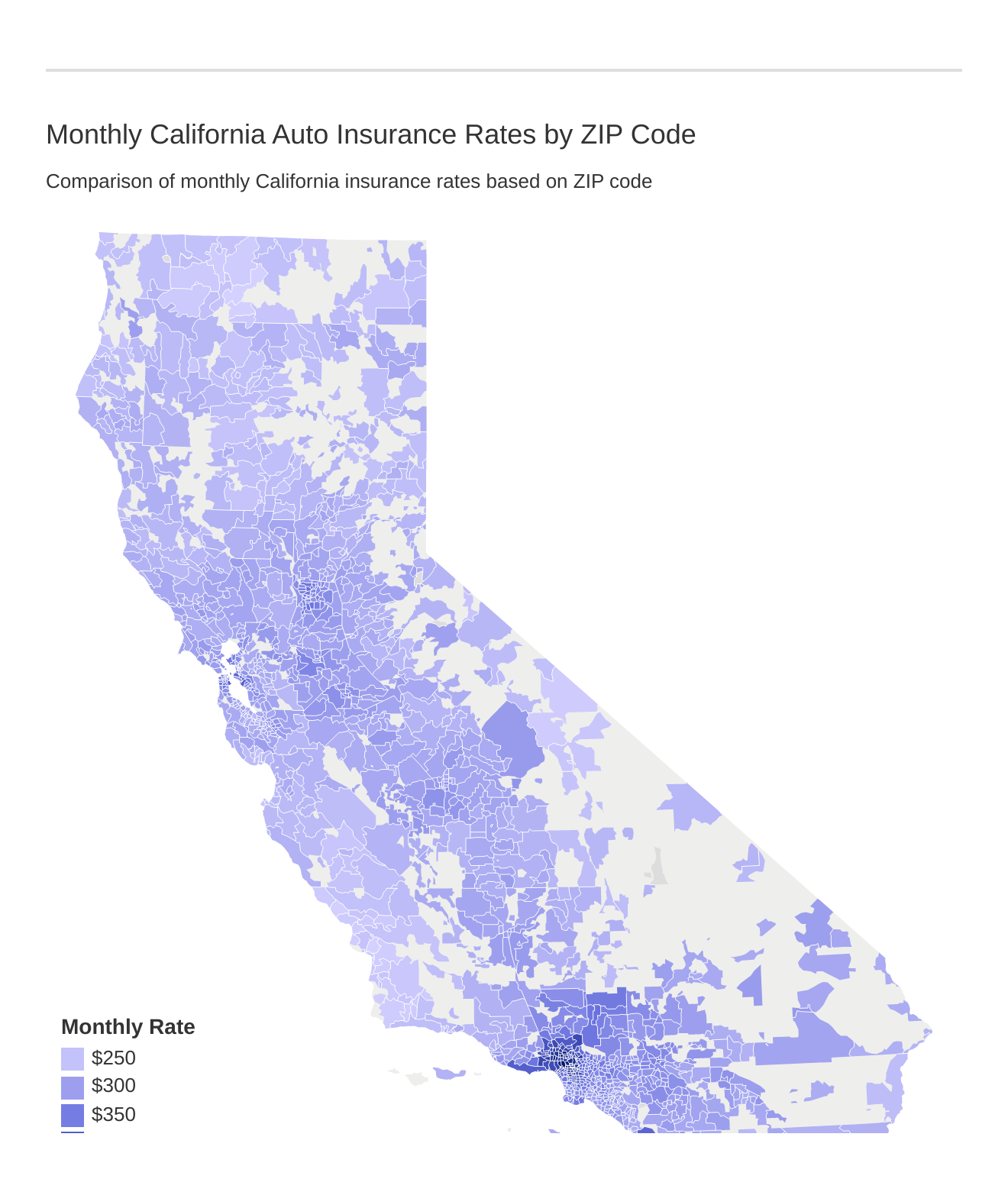

can additionally obtain an idea of what the insurance prices remain in your location. Don't fail to remember to also examine the policies insurance companies use. Low prices are necessary yet might not be worth it if the insurance coverage is terrible. For instance, vacating California might not be a reasonable alternative, however you can maintain a clean driving record to assist your insurance rates. Seeing to it to remain on top of the payments for the insurance policy coverage you presently have is also vital in maintaining your prices low. Recognizing what impacts your The golden state automobile insurance policy prices will certainly help you learn what areas can be adjusted in order to obtain a more enticing quote. If Califorina insurance coverage providers see substantial voids in coverage, they have more factor to increase your rates. Gaps in your insurance policy background might represent you as being monetarily untrustworthy, leading to insurance firms labeling you as a risky driver. California drivers that are not secure financially are believed to make even more insurance cases than other motorists. Not having a vehicle is not a justification to not have protection. Automobile Insurance Policy Insurance Coverage Needs, Each year or before your policy is set to renew , review your car insurance coverage and see to it you still need all the protection you are paying for. Responsibility insurance policy is a must in The golden state, yet other sorts of insurance policy like thorough and also collision coverage may not be very useful as your automobile ages. Price cuts have a tendency to connect to individual variables like being a good driver or homeowner. There are likewise price cuts available for The golden state vehicle drivers that have clean driving documents. As you deal with looking for protection, be conscious of any kind of discount rates companies checklist on their internet sites. You should additionally ask your California insurance representative about them, as numerous companies do not disclose every discount they offer. If you don't have cars and truck insurance policy, your motorist's permit might obtain suspended and also your lorry seized. After suspension, you have to file as well as maintain proof of vehicle insurance policy with the California Department of Motor Autos for three years. Insurance provider will send you a card to show evidence of cars and truck insurance coverage, so make sure to keep it in your lorry to prevent these effects - car. Mercury takes pleasure in an one-of-a-kind position in the industry giving its customers with some of the state's most economical and personalized agent-driven solution. Mercury supplies even more than 1,000 independent representatives in The golden state. Call one for a free price quote as well as begin saving today. California Car Insurance Discounts & Perks Mercury already provides some of the most affordable insurance policy rates offered. Considering that then, it's Visit this website not just come to be the largest economy in America however also the fifth-largest economic situation in the globe, defeating out the UK. It's not a surprise considering that The golden state offers so much, from the glittering seas in San Diego all the means as much as the stunning mountains of Sierra Nevada. Whatever you want, The golden state gives lots of websites as well as tourist attractions to leave you satisfied. About United States Mercury Insurance was established in 1962 by George Joseph. Today, it is a multi-line insurer supplying mostly personal car as well as house owners insurance coverage through a network of independent agents as well as brokers. The company has independent agents that are specially educated to assist our clients every action of the way. Trying to find the most effective auto insurance in The golden state? It probably comes as no surprise that where you live has a bearing on what you pay as well as the ordinary rates for cars and truck insurance coverage. Nevertheless, a new research that takes a look at vehicle insurance policy prices in California suggests area may be an even higher pricing element than many people recognize. Using a hypothetical 45-year-old couple with a tidy driving record and also who own two autos, the study contrasted car insurance coverage premiums by city, area as well as ZIP codeand the results are rather surprising. According to the National Organization of Insurance Coverage Commissioners, the typical automobile insurance premium in California was$ 746 for one car. On The Other Hand, Morro Bay holds the distinction of being California's most affordable city for automobile insurance. trucks. Morro Bay locals pay 30 percent less than the state average (cheap car insurance). Also within specific cities, insurance coverage premiums can differ commonly relying on ZIP code. In Los Angeles, an insurance policy costs for the same pair can differ 33 percent, depending where you live (business insurance). When an insurance company establishes your costs, they additionally take - affordable auto insurance.

populace thickness along with the frequency and also intensity of claims in any kind of given city right into account, states Bob Passmore, director of personal lines policy for the Home Casualty Insurers Association of America (vehicle). The population of Los Angeles is 3. auto. California automobile insurance policy rates are commonly more costly due to a few variables such as high criminal offense city areas as well as several largely booming cities which are aspects that impact a state's typical vehicle insurance policy price (cheaper car). When it concerns insurance costs by county, individuals residing in cities in the central third of the state can anticipate to pay one of the most. On the other hand, the low-lying 3 are usually extra rural, where you can drive and not see one more cars and truck on the road for (affordable car insurance).

insurance companies vehicle insurance cheaper car cheap car insurance

insurance companies vehicle insurance cheaper car cheap car insurance business insurance automobile insurance companies insurance company

business insurance automobile insurance companies insurance company liability insurance company cheaper car auto

liability insurance company cheaper car automiles as well as miles."Possibly the most intriguing searching for of this study is the means insurance policy premiums can swing commonly between postal code within the very same city. Right here are the three most expensive L. cars.A. postal code: 51 percent greater than the state standard. 47 percent greater - vehicle insurance. 47 percent higher. affordable car insurance. As well as here are the 3 most inexpensive L.A. ZIP codes, starting with the most affordable:

7 percent more than the state standard - trucks. 10 percent greater (affordable). 10 percent greater. auto. The swings aren't as substantial in several of California's other big city locations (insurance companies). Anybody relocating to The golden state must recognize the state's legislations relating to roadway regulations as well as automobile insurance policy (vans). Reading the California Chauffeur Handbook is an excellent resource for learning the numerous state - trucks.

vehicle insurance affordable accident insurance affordable

vehicle insurance affordable accident insurance affordablelaws and also needs that may vary from various other states - insurers. Right here are some good ideas to recognize if you are relocating to The golden state. In no-fault states, insurer cover the expense of medical as well as residential property costs of the insured motorist they cover, no matter who caused the accident or crash. In at-fault states like California, the insurance coverage firm covering the driver who is at mistake for the.