Notifications

At that factor, the automobile can not be driven or parked anywhere in the state up until you have actually ourchased insurance policy for it. When Should I Obtain Cars And Truck Insurance in California? You need insurance policy in order to register the cars and truck with the state of The golden state. The insurance business you select will report the details to the state digitally.

Generally, locals of largely inhabited cities pay higher costs. What Takes place if My Car Is Not Correctly Insured in California? Driving without the minimum required insurance policy is illegal, and also you can get a ticket - perks. If you don't have insurance policy, your enrollment will be put on hold. The state might also take your cars and truck if it isn't properly guaranteed.

risks trucks cheapest car vehicle

risks trucks cheapest car vehicle

insure risks auto cheapest car

insure risks auto cheapest car

Is Obligation Insurance Coverage Required in The Golden State? Obligation insurance policy covers accidents where you are at mistake (car insurance). Does California Accept Digital Insurance Policy Cards?

The prices revealed here are for comparative purposes only and must not be thought about "typical" rates offered by individual insurance providers. Because automobile insurance coverage rates are based upon private aspects, your automobile insurance policy rates will vary from the prices shown below. United State Information 360 Reviews takes an impartial strategy to our referrals. car insured.

low cost vehicle liability vehicle insurance

low cost vehicle liability vehicle insurance

The average automobile insurance policy cost in The golden state can vary from $733 for minimal insurance coverage to $2,065 for full protection (money). Getting an exact answer is hard without addressing a great deal of concerns like where you live, and your auto design, amongst others. money. In spite of all of that, knowing the average cost is at the very least a good starting factor in establishing what you could have to spend.

With that in mind, we'll assess the ordinary expense of automobile insurance coverage in The golden state. cars. We'll dig deeper to discover out how you can optimize your cost savings while getting the insurance coverage you need. The Elements that Influence Typical Cars And Truck Insurance Coverage Costs in The golden state It's most likely not a surprise to locate that not every person pays the very same rates for car insurance coverage in The golden state.

As much as the insurance firms are worried, the ideal are drivers who are anticipated to have the fewest cases. That implies they drive securely as well as sensibly. On the other hand, higher-risk customers are those that could be likely to kip down even more cases and also trigger the insurance firm even more cash. The insurance providers take a look at teams of people to figure threat based upon just how others in the same group normally act.

Young males will commonly be billed much more for their car insurance coverage than those that are older or lady. Age, gender, as well as marital standing are considered below.

And married people are typically safer vehicle drivers than single individuals. Rates mirror all of that. Some vehicles are designed and also constructed with more safety and security functions than others. Some are very expensive to fix, so insurance providers charge a lot more for insurance coverage. That's why it makes good sense to ask your agent concerning premium costs for a particular version prior to you purchase it.

How do you use your car? If you commute daily for fars away, you can possibly expect to pay even more for your policy than if you just placed a couple of thousand miles a year on the odometer (car insured). It could not seem reasonable, however you're likely to pay even more for your protection if you have a bad credit report.

You can likewise choose to take just marginal insurance coverage as mandated by your state. That would be liability insurance coverage, which we'll explain later. insurers. Ordinary Annual Cars And Truck Insurance Policy Price in California As you can see, there are a whole lot of factors that will influence the cost of auto insurance coverage in The golden state for you.

Yet right here's the typical yearly cars and truck insurance coverage prices in The golden state in 2021 for basic guidance. Full protection: $2,065 Very little insurance coverage: $733 What Minimal and also Complete Protection Insurance coverage Method The best explanation of those terms is that complete protection offers the very best monetary security - cheaper car insurance. Minimum coverage gives the least expensive level of automobile insurance policy that each state will certainly allow a driver to have.

This is called responsibility protection. If you were responsible for a mishap that harmed one more vehicle driver and damaged an automobile, your insurance policy would certainly compensate to a particular dollar quantity for the injury as well as damage to the various other auto (insured car). You would certainly not be able to turn in an insurance claim for the damage to your very own automobile - trucks.

Driving a vehicle suggests having vehicle insurance coverage, due to the fact that in California it's a need. The golden state does not play video games when it pertains to driving as well as remaining guaranteed (vehicle insurance). There are loads of vehicle insurance coverage providers offering lots of different choices that meet or surpass the state demands considering that there are countless motorists to guarantee.

Ordinary Price for Minimum Get more information Vehicle Insurance Coverage Requirements in California, The golden state, like nearly all various other states, has actually developed state laws that mandate car owners have to have a certain level of automobile insurance policy protection (risks). If you're driving in The golden state, you are lawfully called for to have insurance policy as well as the plan details should remain in the vehicle with you.

The Zebra crunched the car insurance policy expenses and also determined $573 was the annual standard for responsibility protection just in California. Worth, Penguin has the highest annual average of $617 for minimum insurance coverage. Provided that data, it's secure to claim auto insurance will set you back around $550 a year or more if you choose additional protection. * Fees valid since the writing of this write-up - insurance affordable.

cheaper insurance low cost auto money

cheaper insurance low cost auto money

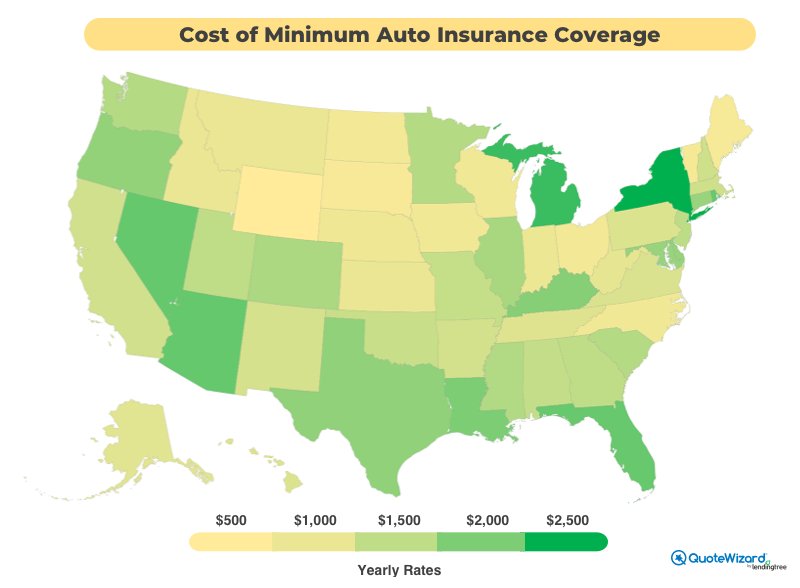

Ordinary California Automobile Insurance Expenses Past the Minimum, If you reside in The golden state you will not be too surprised to discover that the yearly cost of auto insurance policy is 20% greater generally contrasted to other states. But that's considering all 27 million California drivers, numerous of which select to get car insurance coverage past the minimum required amounts.

The Zebra estimates the ordinary annual premium for The golden state vehicle insurance coverage is $1,713 a year. A lot of aspects go right into the expense of a car insurance policy premium.