Recent Videos

Let's talk!

Little Known Facts About Panel Probes For Answers To Soaring Ho

-

Our referrals for vehicle insurance coverage for brand-new drivers Whether you're a brand-new motorist or have been driving for decades, investigating and also comparing quotes from several companies is a great means to discover the very best rate. Our insurance policy experts have actually found that Geico as well as State Ranch are superb options for vehicle insurance for new drivers.

Here are the factors our scores take into consideration: Price (30% of total rating): Auto insurance coverage rate quotes created by Quadrant Info Provider and also discount rate opportunities were both thought about. Protection (30% of complete score): Business that provide a variety of choices for insurance policy coverage are most likely to fulfill consumer demands. affordable car insurance.

That means figuring out just how much it will cost to add your kid to your cars and truck insurance coverage. Whether this is your initial child or your third, adding a teen vehicle driver to your auto insurance plan can be costly.

insurance companies cheapest car insurance credit affordable

insurance companies cheapest car insurance credit affordableHow Much Does it Cost to Guarantee a Teen Vehicle Driver? A teen motorist doesn't normally have much experience in any of these categories, so you should take into consideration various other things - auto.

If your teenager is going to drive a more recent auto, anticipate to pay a lot much more for vehicle insurance policy than you would on a more affordable, used model. affordable auto insurance. Do I Have to Add My Teen Motorist to My Car Insurance?

laws auto car low cost

laws auto car low cost"You're not called for to add a teen driver to your automobile insurance coverage, but it's more affordable to do so," states Melanie Musson, an automobile insurance policy professional for "From the extremely very first time a pupil vehicle driver supports the wheel, moms and dads should recognize if the kid is covered under their strategy or if they require to be included," claims Musson. vehicle.

Top Guidelines Of Auto Insurance For Teen Drivers - Allstate

Bear in mind that if your teenager's auto remains in their name, they will be unable to be detailed on your policy, and also they'll have to obtain their own. Nevertheless, if a teenager falls under a parent's plan, they can continue to be on that particular policy as long as they reside in the home and also drive among the family members cars and trucks (cheap car).

affordable car insurance cheap car low cost affordable car insurance

affordable car insurance cheap car low cost affordable car insuranceAs with any chauffeur, it is always best to have the minimum state called for insurance policy. cheapest. Driving without any kind of coverage is versus the law as well as can include some significant lawful and also economic implications (low cost auto). Guarantee Under Your Plan, It can make good sense financially to include your teen to your insurance plan.

, adding a 16-year-old women driver includes $1,593 a year to a parent's full insurance coverage policy on standard. It's around $651 a year to include minimal protection for the same teen. The typical bill for including a 16-year-old male expenses $1,934 a year on a moms and dad's complete insurance coverage policy, and also adds about $769 for minimal insurance coverage.

Still, including a teenager to a moms and dad's plan is significantly less costly than having the teen obtain their own policy. Teenager Getting Their Own Plan, The typical prices for full coverage insurance coverage for a 16-year-old driver is $6,930. Listed below you can contrast ordinary annual rates for 16-year-olds, 17-year-olds, as well as 18-year-olds with their own plan.

com Non-owner Car Insurance coverage Non-owner automobile insurance policy Find more info is insurance coverage for motorists that don't possess an automobile yet use rental lorries, ridesharing, and also obtained vehicles to navigate. cheapest auto insurance. While it may be alluring to think about non-owner insurance coverage for your teen, parents must know that insurer won't write a plan for chauffeurs with access to the family members car (insurance companies).

Obtain several quotes and locate the plan that functions best for you. One more often-overlooked method to conserve money on automobile insurance policy for everyone, and not just teen vehicle drivers, is to participate in a secure driving program. affordable car insurance. There are regional driving institutions that provide defensive driving classes, or drivers can speak to the National Safety Council or AAA to find schools in their state.

Not known Factual Statements About How Much Is Car Insurance? - Liberty Mutual

Just how much is automobile insurance for teenagers? When it pertains to auto insurance policy for teenagers, young vehicle drivers pay greater than their older, much more seasoned counterparts-- concerning $169 each month on standard, according to our analysis. It comes down to simple data. Teens 16 to 19 are nearly twice as most likely to experience deadly vehicle crashes, according to the Insurance Institute for Freeway Safety (IIHS). cheapest car insurance.

car insurance cars affordable insured car

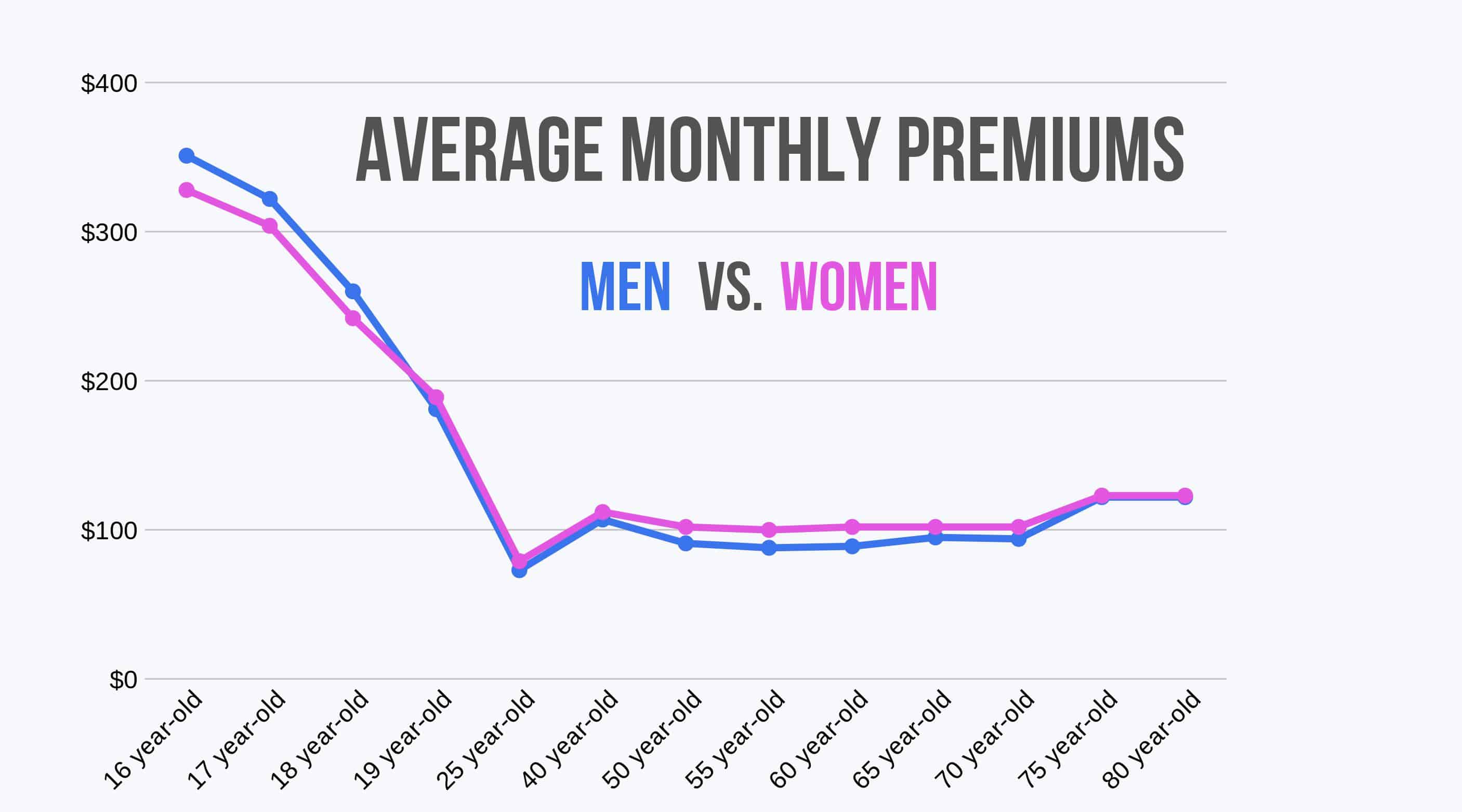

car insurance cars affordable insured carPlus, insurer do not have as much data to take a look at when analyzing how responsible a teen vehicle driver gets on the road. That indicates more threat to insurance firms, which is why auto insurance coverage for teens is much more costly. Teen male vs - cheap. female automobile insurance policy rates, In our evaluation, we found that male teen motorists pay about $20 more monthly than women teen vehicle drivers.

Teen males are more probable to enter wrecks. cheaper auto insurance. They've triggered two-thirds of all crashes amongst teenagers 16 to 19 over the last few years, according to IIHS information (prices). Exactly how to find cheap insurance policy for teens, The best way to locate economical vehicle insurance for teenagers is to compare rates from several business.

While they all take into consideration teenager vehicle drivers riskier to guarantee than older motorists, they don't all upcharge teenagers the very same amount (car insured). The only means to see which uses a young motorist the ideal rate is to compare quotes side by side. In enhancement to searching, try to find teen-specific automobile insurance coverage discount rates, like the ones stated listed below. dui.

Another way to make cars and truck insurance policy for teenagers more inexpensive is to minimize their coverage levels. This is high-risk and also may not also be feasible - cheaper car insurance. As an example, a lender might not allow consumers to eliminate collision as well as detailed insurance coverage if they have a lease or lending on their car (dui).