Notifications

California cars and truck insurance coverage prices Typical annual minimum coverage costs Ordinary yearly full insurance coverage costs $733 $2,065 The golden state vehicle insurance policy rates by city, Automobile insurance policy prices in The golden state vary by city - auto. Drivers in densely populated areas have a tendency to have higher rates. Having even more lorries when traveling can imply a greater possibility of a crash.

cheaper car insurance laws laws insurance affordable

cheaper car insurance laws laws insurance affordable

Use this chart as a guide to assist determine your general expenses to make sure that you can decide what insurance coverage rates suit your spending plan. California automobile insurance coverage rates by age, A vehicle driver's age commonly adds to the expense of yearly costs, as it can indicate exactly how statistically risky a driver is - car.

The golden state car insurance coverage prices by credit rating, In lots of states, your credit-based insurance coverage rating will influence just how much you pay for automobile insurance coverage. This is because chauffeurs with reduced credit rating scores statistically have a tendency to file even more insurance claims than vehicle drivers with higher credit history, according to the Insurance Information Institute (Triple-I).

Often asked questions, How much is car insurance in The golden state per month? Full coverage auto insurance coverage sets you back a standard of Additional reading $172 per month and minimum protection costs $49 per month, on standard, in The golden state.

Nonetheless, the Triple-I suggests you consider buying insurance coverage levels above the state minimums for fuller economic security (credit). It is crucial to keep in mind that the state's minimum coverage does not include any kind of protection for your lorry if you are at fault in an accident (affordable auto insurance). If you have a rented or financed auto, you will likely need to lug complete insurance coverage, that includes thorough and collision.

What is the ideal automobile insurance policy company in California? Based on our study, Geico, Progressive, State Ranch and Wawanesa are among the finest automobile insurance firms in California.

cheaper car insurance vehicle insurance insurance cheapest car

cheaper car insurance vehicle insurance insurance cheapest car

Rates were calculated by assessing our base account with the ages 18-60 (base: 40 years) applied. For teens, prices were determined by adding a 16- or 17-year-old teenager to a 40-year-old wedded pair's plan.

business insurance vans low cost auto risks

business insurance vans low cost auto risks

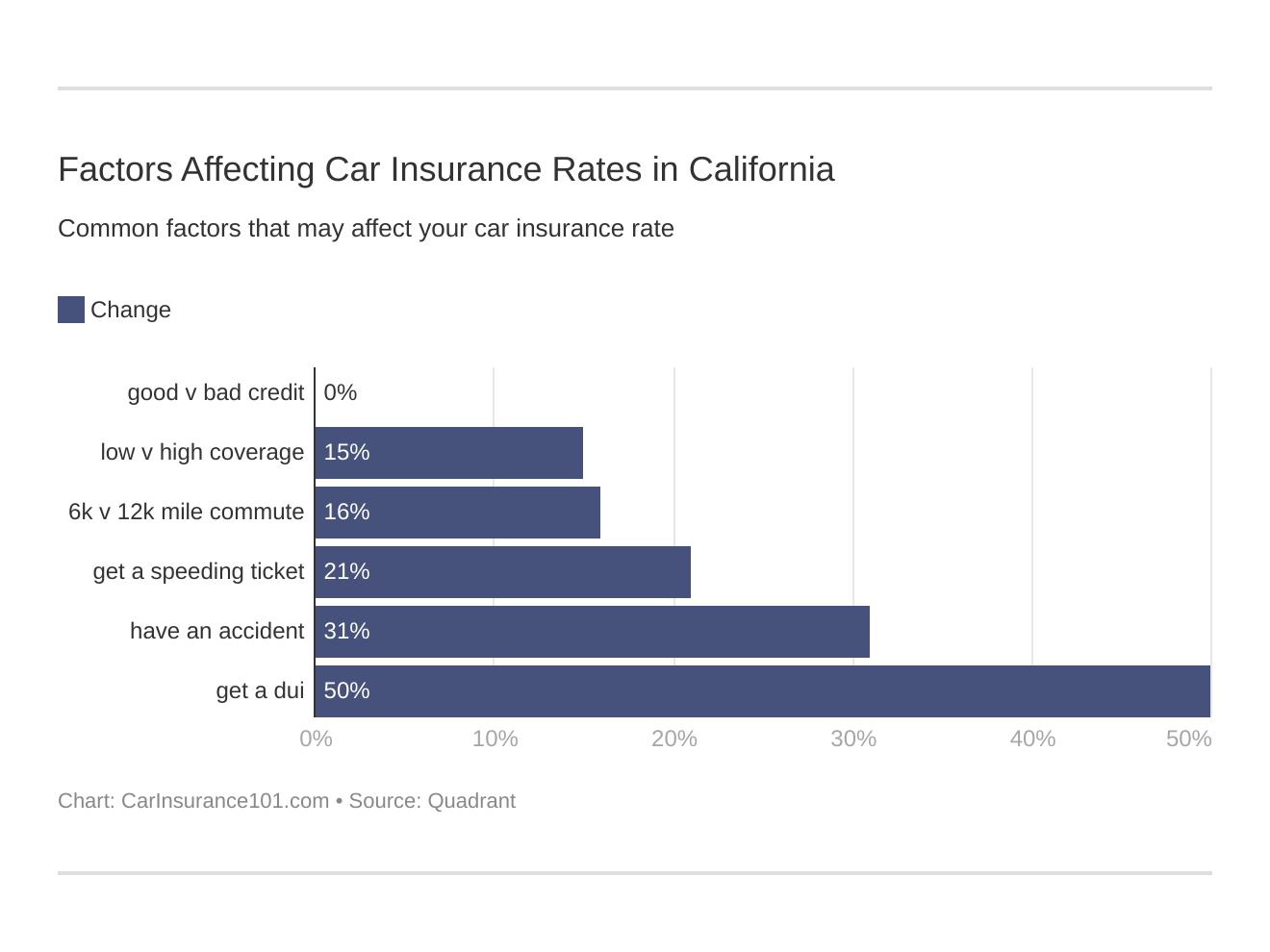

Rates were computed by examining our base account with the complying with incidents applied: clean record (base), at-fault accident, single speeding ticket, solitary DUI conviction as well as lapse in insurance coverage. cheap car.

You might not have complete accessibility to how vehicle insurance providers identify your prices. However, the procedure does not have to be mysterious. We break down the 9 most vital points that impact your cars and truck insurance rates. When considering your vehicle insurance coverage costs, the degree of insurance policy you pick is among the most crucial factors to exactly how much you'll pay.

48 Resource: Savvy Maintain in mind that there are state requirements that may establish the kinds of insurance coverage you're called for to have. Vehicle insurance coverage rates are additionally impacted by your choice to choose a high-deductible policy or a low-deductible policy.

Teenager motorists pay the highest possible vehicle insurance policy rates. The influence of age is substantial, with teenager chauffeurs paying at the very least $400 more typically than other age groups (cheaper cars). The most affordable typical insurance prices are for chauffeurs between 25 and also 34 as well as rates begin to boost again for older drivers over age 50.

While a regular debt rating anticipates the chance that you'll pay your costs promptly, a credit-based insurance rating anticipates the likelihood that you'll submit an insurance case of a higher quantity than what you'll pay in insurance coverage premiums - insure. Some states have relocated to restrict or stop cars and truck insurance companies from making use of credit report to establish insurance coverage prices (cars).

cars automobile affordable car insurance low-cost auto insurance

cars automobile affordable car insurance low-cost auto insurance

In one situation, an 18% boost in retail price resulted in a 6% boost in car insurance coverage costs rates. Insurance can likewise be greater on cars that are most often the target of criminal offense (insurers). Learn how much your cars and truck deserves to find out exactly how your insurance firm elements in the auto you drive.

Then, you can try other techniques such as telematics, which permits an insurer to track your driving habits and if they're excellent, you'll earn a price cut.

insurance company cars cheapest vehicle

insurance company cars cheapest vehicle

Q What is the Elegance Period For The golden state's Automobile Insurance coverage? A In The golden state, If you need new auto insurance coverage after that you will certainly obtain a thirty day moratorium. If you already have among your existing or previous automobiles and also you intend to transfer it then you will certainly obtain 45 days of the elegance duration. insurance affordable.

Q Just How Much Does Car Insurance Policy Expense In Top The Golden State Cities? A California state has reduced insurance coverage rates as compared to other states in the United States. And also every city calculates the cost based on various elements (cheaper auto insurance). As a result; We have analyzed calculated the average auto insurance coverage price in the leading The golden state Cities: $155 per Month $141 each month $133 monthly $85 per Month $120 monthly $114 per Month $151 monthly.

To begin, buy a policy in as little as one minute. Merely check in to your Tesla app., you can purchase a plan in the Tesla application by tapping the account image symbol, located in the top-right edge. Select 'Obtain Tesla Insurance Policy. credit score.', you can acquire a plan in the Tesla application prior to taking delivery and as soon as you have actually an appointed VIN in your Tesla Account.

You will make month-to-month settlements based on your driving behavior rather than standard factors like credit score, age, sex, claim background and also driving documents used by other insurance companies. Your costs is identified based upon what lorry you drive, your provided address, just how much you drive, what protection you pick as well as the automobile's regular monthly Safety Score. perks.