Recent Videos

Let's talk!

The Basic Principles Of How Much Does Insurance Go Up After An

-

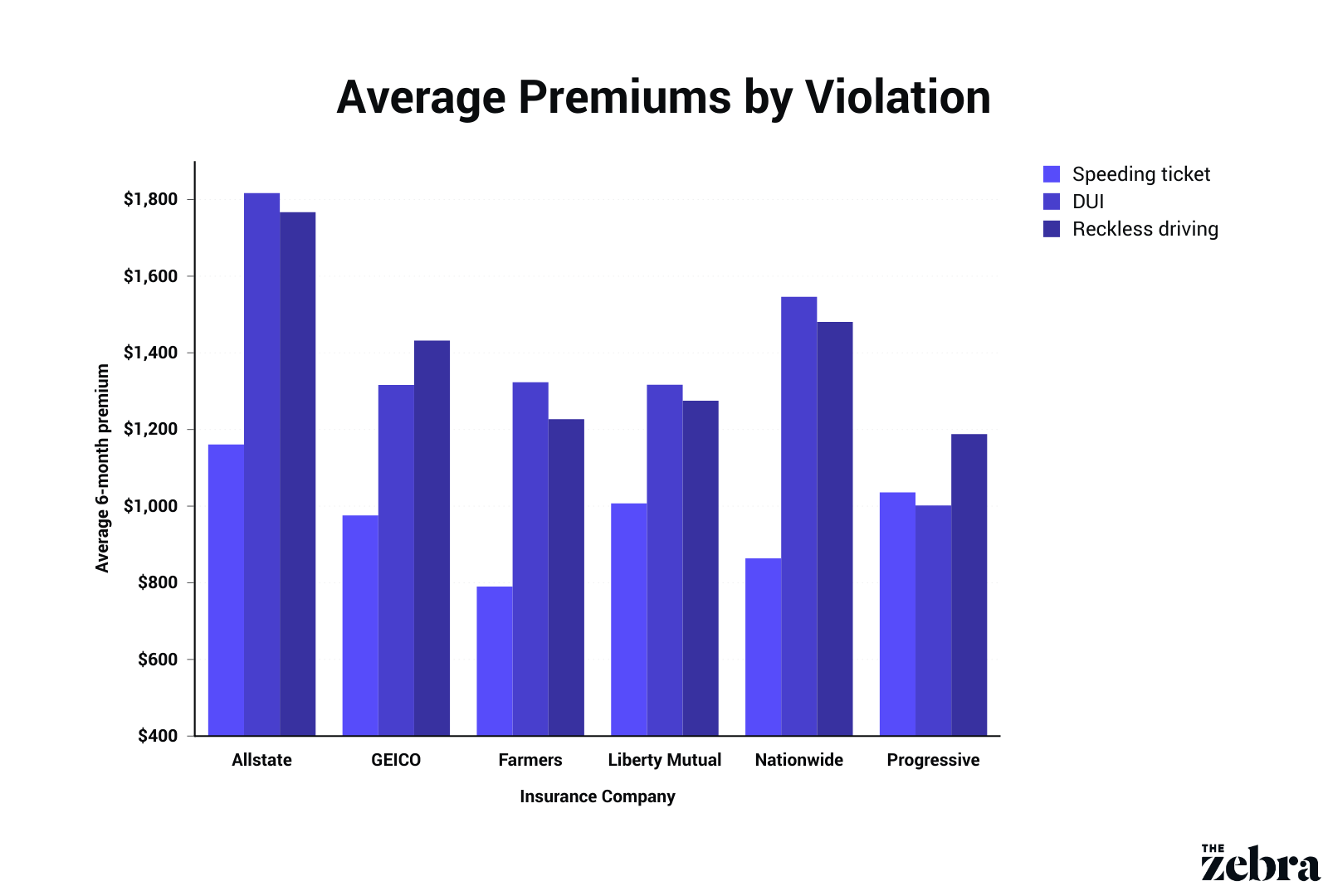

Some kinds of crashes are even worse than othersfor example, a drunk driving event is likely to cause a nonrenewal from essentially every insurance coverage business.

Load complete tabulation, As if recovering from a mishap isn't already undesirable sufficient! If you enter into a mishap and you're at fault, there are still some methods you can use to decrease its influence on your vehicle insurance coverage premium. The most effective strategy is to look around and try to find a far better price.

If you want to find out just how an accident can influence your auto insurance coverage, read on. If you are not discovered at mistake in the crash, your insurance coverage carrier most likely won't boost your car insurance coverage.

If you're located at mistake in a mishap, your insurance is going to have to payout. However, if you're not at fault and also the various other vehicle driver is, their insurance coverage will certainly more than likely cover the problems as well as you can prevent greater rates. Your insurance policy service provider will have an adjuster examine the circumstance to determine that's at fault.

Not known Factual Statements About Will My Car Insurance Go Up After An Accident? - Anidjar ...

But this is not the case. It's not a moral judgment! Raising your rate is totally affordable. Insurer are everything about data. Your original price was calculated based on the quantity of danger you provided when you first got the plan. Since you have actually provided brand-new databy getting involved in an accidentthey demand to recalculate to account for the increased threat you present.

They generally decrease after a few years, as soon as you have actually confirmed that you can preserve a safe driving document. Another means to minimize your premium after an accident is to switch providers. Every firm calculates differently. So while you won't have the ability to hide your driving record, you might have the ability to get a far better price by searching.

cheap auto insurance accident cheap auto insurance cheaper car insurance

cheap auto insurance accident cheap auto insurance cheaper car insuranceSo you have nothing to lose as well as potentially $879 to obtain! Heavyweight companies aren't always the least expensive. If you desire to lower your vehicle insurance coverage premium, let Jerry look around for you and discover the least expensive price. Are accident forgiveness programs worth it? You may be able to bypass a rate hike if you had an accident forgiveness plan.

Simply put, your provider will certainly not raise prices on you the very first time you ruin as well as trigger a crash. Accident mercy programs differ from firm to company. Some provide you crash forgiveness quickly, while others will just use it as soon as you've been an accident-free insurance policy holder for as many as five years.

The Why Did The Cost Of My Car Insurance Go Up At Renewal Time? Statements

Below are some firms that use mishap mercy programs to insurance holders: Exactly how long does a crash stay on your document? A lot of crashes remain on your document for 3-5 years.

The specifics rely on your state and exactly how serious the crash was. For example, in Washington State, a traffic accident will stay on your document for five years. In New York, it's three years. A DUI will certainly remain on a New York driver's record for 15 years. Your driving record can be accessed by insurance provider, the DMV, and also the authorities division.

While you can not conceal your document, you might have the ability to discover a company that can beat your new rate with your old provider. Just how to reduce your car insurance rates after a mishap When you have actually recovered from the mishap, it's time to check out your prices. Initially, look into accident mercy - prices.

USAA, which provides insurance to armed forces participants and their households, states on its Visit this site website: "If we agree that you had no obligation for a mishap, your premium will not be influenced by a crash that is not your fault."States take differing techniques. In the 12 states with no-fault insurance coverage, greater rates are most likely after a collision even if you aren't responsible - vehicle.

The 8-Second Trick For How Long Does An Accident Stay On Your Insurance?

Commonly, the surcharge will certainly lower over time as long as you don't cause anymore accidents (money).

That's not true in all instances, as some business raise prices a little even if you're not at fault. insurance company. After a crash, your state's legislations as well as your insurance provider greatly affect the effect to your prices.

Different firms boast different offerings when it comes to exactly how they treat accidents. Numerous firms supply some level of "", meaning they enable the first crash to be neglected in terms of elevating rates. Typically, mishap forgiveness is either an add-on that costs much more or a perk offered after multiple years commonly five or even more with a clean driving record.

When does an accident quit impacting rates? The longer ago you made a claim on your insurance coverage, the less of an effect it will have on your rates.

When Does Car Insurance Go Down? - The Hartford for Beginners

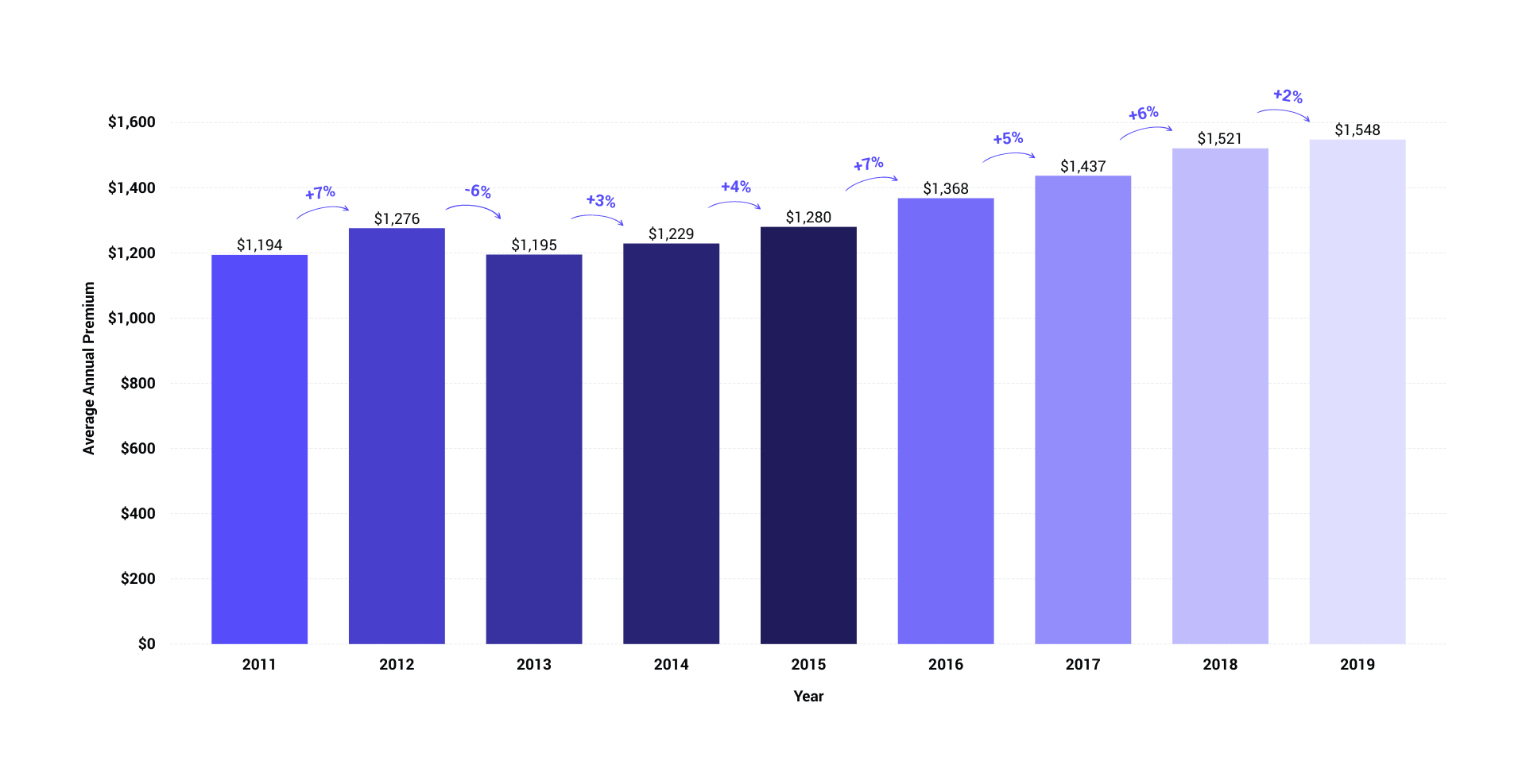

In our research study, we located that if you were accountable for an accident within the last six months as well as made a responsibility case because of this, your prices will raise by around 60% the next time your plan restores. That boost will certainly disappear slowly with time, with rates decreasing to concerning 47% higher than regular after 2 years and only 2.

A lot of insurance coverage business in an accident. If you do not satisfy this limit, after that your insurance provider frequently will not enhance your prices. Showing mistake in a crash can be hard.

Repaid by, or in behalf of, an individual accountable for the mishap. Rear-ended and also not convicted of a relocating website traffic infraction about the mishap. Struck by a hit-and-run vehicle driver, as long as the mishap is reported to the proper authorities within 24 hr. Not convicted of a moving web traffic infraction about the accident, but the various other chauffeur is - insurance company.

If you were entailed in an accident 5 years back, it typically will not be considered when calculating your rates. Yet this time around framework may not relate to some accident-forgiveness programs. Exactly how to minimize auto insurance prices after a mishap If you are at fault in an accident as well as are unable to get accident forgiveness, there are other means to hold down the costs of vehicle insurance costs.

Some Known Questions About How Long Does A Claim Stay On Your Car Insurance - Age Co.

Insurers offer a, consisting of price cuts forever pupils, for having several policies and also for excellent driving tracked by an application. Consult your insurance policy business for your choices. There is risk inherent in this approach because it implies extra out-of-pocket expenses if you are at mistake in another crash.

auto insurance cheapest auto insurance cheapest car insurance

auto insurance cheapest auto insurance cheapest car insuranceNot a suitable choice, obtaining less insurance coverage is a method to minimize your prices. Paying off debts, not missing out on repayments and also dealing with any kind of issues on your credit scores record can all aid reduced prices.

liability cheapest car cheaper car perks

liability cheapest car cheaper car perksJust how much insurance policy rates go up after a claim may vary based on your driving record and the severity of the mishap. The length of time does a mishap influence your insurance? Insurance providers frequently concentrate on the previous 3 years of your driving record when setting prices. cheaper car insurance. A mishap normally impacts rates for a minimum of that long, though some insurance firms consider an at-fault accident for as much as five years or longer in unusual instances.

USAA, which supplies insurance to army participants and also their families, says on its website: "If we agree that you had no duty for an accident, your costs will not be affected by a mishap that is not your fault."States take differing methods. In the 12 states with no-fault insurance coverage, higher prices are more probable after an accident even if you aren't to blame.

How Much Does Car Insurance Go Up After An Accident? Fundamentals Explained

Usually, the additional charge will certainly decrease over time as long as you don't create any kind of more accidents - cars.

That's not real in all cases, as some business raise prices slightly even if you're not at mistake. After a mishap, your state's laws as well as your insurance provider greatly influence the influence to your rates - accident.

Various firms boast various offerings when it pertains to how they treat crashes. Lots of business provide some level of "", indicating they enable the initial accident to be ignored in terms of elevating prices. Normally, mishap mercy is either an add-on that costs a lot more or a perk supplied after numerous years often