Recent Videos

Let's talk!

The 5-Second Trick For Average Car Insurance Costs In May 2022

-

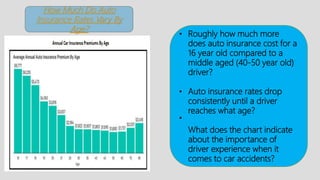

This is called a named exclusion. IN THIS ARTICLEHow much is vehicle insurance for teenagers? Like we have actually stated, teen cars and truck insurance is pricey. The younger the driver, the a lot more expensive the cars and truck insurance coverage. Youthful vehicle drivers are far much more most likely to get involved in auto accidents than older motorists. The risk is greatest here with 16-year-olds, that have a crash price two times as high as 18- and 19-year-olds (business insurance).

vehicle insurance cheapest car insurance car insured car

vehicle insurance cheapest car insurance car insured carA research study by the IIHS located states with more powerful graduated licensing programs had a 30% reduced fatal accident price for 15- to 17-year olds. Adding a teen to your automobile insurance coverage plan, Adding a teenager to your vehicle insurance coverage plan is the most inexpensive means to obtain your teenager guaranteed. It still comes with a significant expense, but you can certainly save if you pick the most effective auto insurance provider for teenagers.

car insurance cars affordable auto insurance insurance company

car insurance cars affordable auto insurance insurance companyWe added a 16-year old teenager to the policy. cheaper. Below's what happened: The ordinary home's auto insurance costs rose 152%. The factor behind the walkings: Teenagers collision at a much higher rate than older chauffeurs. dui.

According to the government Centers for Disease Control as well as Avoidance, the most awful age for mishaps is 16. They have a crash price two times as high as chauffeurs that are 18- and also 19-year-olds. Prices vary by insurance provider, which is the reason we recommend searching for teen vehicle driver insurance coverage - automobile. It's very easy to change automobile insurer. cars.

Simply make certain your teen isn't driving on a complete permit without being formally included to your policy or their very own. If my teenager obtains a ticket, will it raise my rates?.

7 Simple Techniques For Parents Beware: Adding A Teen Driver Can Spike Your Family ...

Can a teen get their own cars and truck insurance plan? State legislations vary when it comes to a teenager's capability to authorize for insurance.

In truth, your teen will likely have a higher premium compared to adding a teenager to a parent or guardian policy. There are cases where it might make sense for a teenager to have their own plan (vehicle insurance). Modern points out two: You have a high-end sporting activities auto. On a solitary strategy, all drivers, including the teen, are guaranteed versus all vehicles.

How to conserve on teen auto insurance policy? Teens pay even more for automobile insurance than grown-up vehicle drivers because insurance policy service providers consider them risky.

Consider versus the fact that young motorists are much more likely to get right into crashes. You can additionally drop detailed and also crash coverage if the car isn't funded and not worth much. credit score.

cheaper car insurance cheap credit cars

cheaper car insurance cheap credit carsAn automobile with a high safety and security ranking will certainly be cheaper to insure. This isn't truly a popular alternative for an excited teenager motorist, however it's worth considering.

Consumer Price Index Summary - 2022 M04 Results - Truths

Nevertheless, you must also recognize the insurer still charge higher prices for the very first couple of years of the certificate. Another means to lessen your insurance policy costs is to make use yourself of the price cuts readily available. Several of them are discussed below, Discount rates for teen motorists, We've recognized the most effective discounts for teen drivers to get inexpensive automobile insurance coverage.

You can take extra motorist education or a defensive driving training course. In some states, discounts can run from 10% to 15% for taking a state-approved motorist renovation class.

cheaper car insurance automobile suvs cheap car insurance

cheaper car insurance automobile suvs cheap car insuranceThe ordinary pupil away at institution discount rate is more than 14%, which is a financial savings of $404. This indicates you don't get right into any type of accidents or infractions.

Numerous vehicle insurance policy firms supply price cuts if you allow a telematics gadget to be placed in your car so they can monitor your driving habits. This can offer up to a 45% discount rate.

There is possible to save (risks). If the student prepares to leave an auto in your home and also the university is greater than 100 miles away, the university student might get approved for a "resident trainee" discount or a student "away" discount, as pointed out above. These discount rates can reach as high as 30%.

An Unbiased View of Car Insurance Information For Teen Drivers - Geico

That might bring about a good student discount. Both price cuts will need you to contact your insurance provider so they can begin to use the discount rates. While you get on the phone with them, don't think twice to ask regarding other potential discounts. Student's authorization insurance, You can obtain insurance with an authorization, but most automobile insurer include the allowed teenager on the parents' plan without any action.