Notifications

If the auto is only worth $1,000 as well as the deductible is $500, it may not make good sense to purchase crash coverage. Crash insurance coverage is not usually required by state regulation. Covers the expense of assorted problems to your automobile not created by a collision, such as fire and theft. Just like Accident coverage, you need to select an insurance deductible. Comprehensive insurance coverage is generally sold together with Collision, and the two are commonly referred to together as Physical Damages coverage - cheap. If the cars and truck is leased or financed, the leasing firm or lending institution might require you to have Physical Damages protection, also though the state law might not need it. Covers the price of medical treatment for you as well as your travelers in case of an accident - credit score. If you choose a$ 2,000 Medical Cost Limit, each passenger will have up to $2,000 protection for clinical claims resulting from a crash in your lorry. If you are associated with an accident and the various other motorist is at mistake but has insufficient or no insurance coverage, this covers the space between your costs and the other chauffeur's protection, up to the limitations of your protection. The limitations required and also optional limitations that may be available are set by state law. This insurance coverage, called for by law in some states, covers your clinical prices as well as those of your guests, no matter who was accountable for the crash. The limits required and also optional limits that might be available are set by state regulation. It is always an excellent suggestion to ask your insurance provider if any discounts might be available to you. The adhering to are several of the discount rates insurers may offer as well as to which you may be qualified: In this post, we'll discover how typical cars and truck insurance prices by age and also state can change. We'll likewise take an appearance at which of the very best car insurance coverage companies provide good discount rates on vehicle insurance policy by age and compare them side-by-side. Whenever you go shopping for automobile insurance, we recommend obtaining quotes from numerous carriers so you can compare coverage and rates.

affordable car insurance money auto insurance low-cost auto insurance

affordable car insurance money auto insurance low-cost auto insurance

Vehicle drivers under 25 have less experience when driving and researches reveal they create much more accidents. 3 So, if you or a person on your plan is under 25 years old, your automobile insurance policy premiums may be higher. Car insurance rates may decrease after a motorist transforms 25, particularly if they haven't had any kind of at-fault crashes.

Normally, if you more than 25 but below follow this link 60 years old, your cars and truck insurance coverage expense per month will certainly be the cheapest (insurance company). If you're not within that age array, you can still find ways to save. We supply lots of unique rates and price cuts with the AARP Automobile Insurance Coverage Program from The Hartford - business insurance.

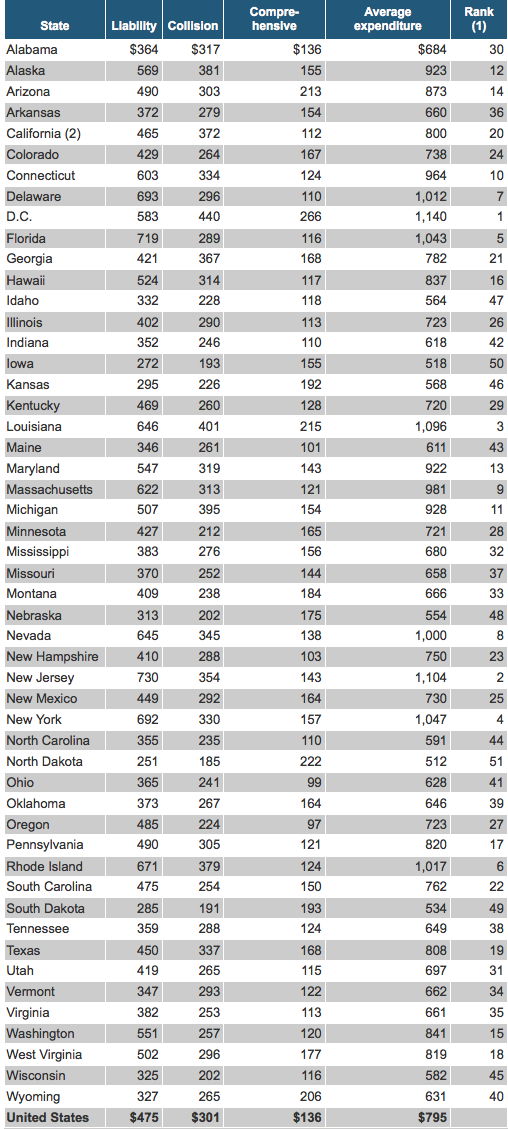

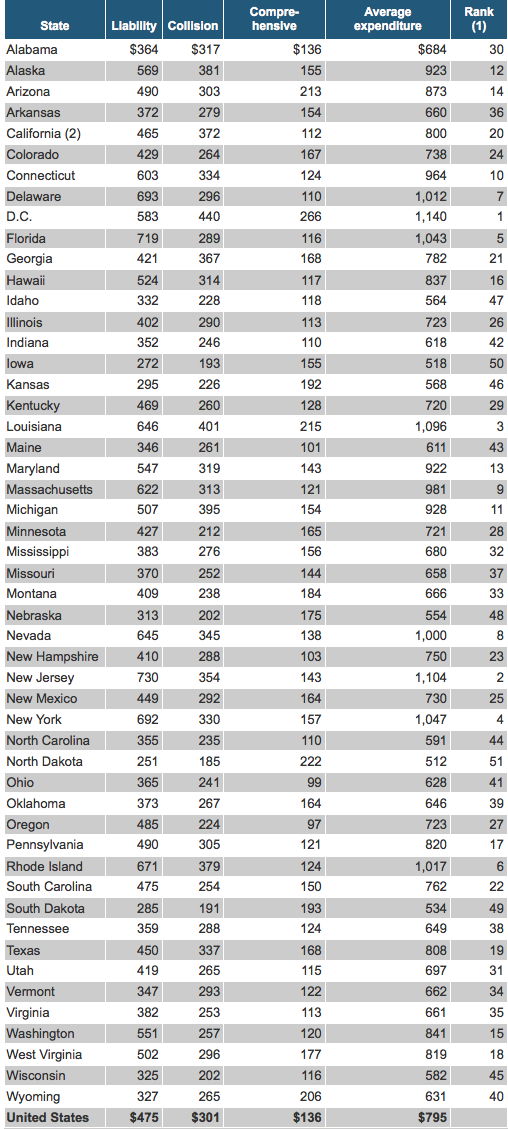

If you have an AARP membership, obtain a cars and truck insurance policy quote today and also save. Just how Much Is the Average Automobile Insurance Coverage per Month in My State?

One state's ordinary auto insurance coverage cost each month may be higher than one more's due to the fact that it needs motorists to have more obligation coverage. liability. On the various other hand, an additional state might average the most inexpensive automobile insurance policy per month since it calls for a reduced minimum protection. Tips to Conserve Cash on Your Month-to-month Auto Insurance Settlement Compare vehicle insurance coverage quotes to ensure you're obtaining the most effective rate. insurance companies.

You might desire to consider adding optional protection so that you're fully covered. You could save up to 5% on your car protection and 20% on your residence plan with The Hartford.

Regularly Asked Inquiries About Auto Insurance Coverage Price Just How Much is Vehicle Insurance for a 25-Year-Old? Depending upon your cars and truck insurer and also the obligation coverage you select, a 25-year-old may pay more or less than their state's average auto insurance expense monthly. When you transform 25, you must call your auto insurance coverage company to see if you can conserve cash on your auto insurance policy rate if you have a great driving background - affordable.

insurance company affordable car insurance car automobile

insurance company affordable car insurance car automobile

You will need to hold at the very least the minimum required insurance coverage in situation of an accident. You may also select extra insurance coverage that will certainly enhance your rate, but likewise enhance your security in case of a mishap - business insurance. Just How Much Is Complete Coverage Insurance Coverage per Month? Full protection vehicle insurance coverage is not the same for each and every of the 50 states.

money car insured low cost auto dui

money car insured low cost auto dui

What Automobiles Have the most affordable Insurance Coverage Rates? When it involves the typical automobile insurance cost monthly for different kinds of vehicles, vans typically have the least costly insurance policy premiums - laws. Sedans typically have the highest possible cars and truck insurance coverage price per month, while sporting activities utility cars and trucks are valued in between - affordable.

credit perks cheapest insurance company

credit perks cheapest insurance company

At What Age Is Vehicle Insurance Coverage the Cheapest? Automobile insurance policy premiums vary based upon lots of factors, consisting of age. Vehicle drivers that are under 25 as well as over 60 years of ages normally pay one of the most for auto insurance coverage (cheaper car). No matter your age, if you want to lower your vehicle insurance coverage rates, you require to find a cars and truck insurance policy firm that can provide you discount rates and advantages.

Filling Something is packing. If you remain in the market for your next policy, anticipate to pay $1,070 per year, according to recent information from the Insurance Policy Details Institute. It's necessary to recognize all the elements that can influence your protection cost given that not every person's cost is the same.Car insurance policy policies have great deals of relocating parts, as well as your premium, or the price you'll spend for coverage, is just one of them.