Notifications

Your insurance provider will pay for your damages, minus your insurance deductible, and afterwards ask the at-fault driver's insurance company to pay the cash back in a process called subrogation - cheaper auto insurance.

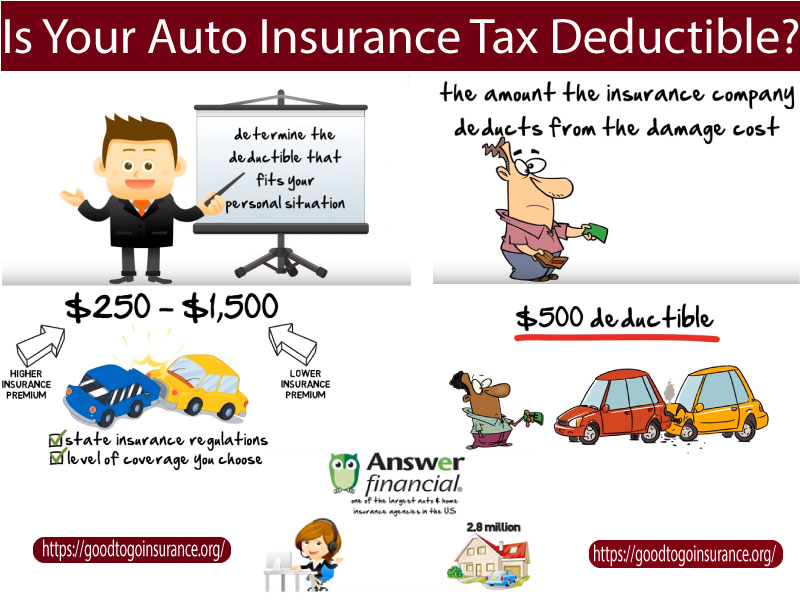

It's the most typical insurance policy concern: Unfortunately, the answer is never reduced and also completely dry. While raising your deductible will certainly lower your premium, there are other results to consider for your vehicle insurance policy prices. Let's take an appearance in any way the variables you should consider when picking your auto insurance policy deductible! What is a deductible? A is the quantity you pay of pocket when you make an insurance claim - business insurance.

auto insurance insurance companies trucks cheaper auto insurance

auto insurance insurance companies trucks cheaper auto insurance

affordable auto insurance insurance companies auto insurance car

affordable auto insurance insurance companies auto insurance car

If you weren't needed to have a deductible, you could technically have as many accidents as you desired on the insurance provider's dime. Paying a deductible ensures you also have a risk in any type of insurance claims you make. Deductibles generally only use to harm to your very own residential property, like in the situations of comprehensive as well as accident auto insurance coverage (cheaper car insurance).

What is the connection between the insurance deductible and also premium? A lot of usually, a lower insurance deductible ways greater month-to-month payments.

A reduced insurance deductible of $500 implies your insurance policy company is covering you for $4,500. A higher deductible of $1,000 means your company would then be covering you for only $4,000 - insured car. Since a lower deductible corresponds to a lot more insurance coverage, you'll have to pay more in your monthly premiums to cancel this boosted coverage.

car cheaper car insurance insure affordable car insurance

car cheaper car insurance insure affordable car insurance

This depended on the state, though, where Michigan only saved 4% for the insurance deductible raise while Massachusetts conserved approximately 17%. Some people make the mistake of selecting the highest deductible just to conserve money on their costs. When it comes to an occurrence, though, having a high insurance deductible could have severe financial consequences. insurance affordable.

If you have that cash on hand at any kind of point, it may be worth deciding for a higher deductible. Just how much would certainly you conserve on a lower costs if you had a higher insurance deductible? Would certainly you conserve money that would certainly equate to that insurance deductible in the instance of an incident?

Currently you have actually a boosted deductible by $500, however you are saving $80 annually. That suggests you would need just over 6 years in order to comprise the difference. If you do not enter into a mishap in those 6 years, the raised insurance deductible deserved it. If not, you have to pay more expense.

If you have a great driving record, a higher insurance deductible might function in your support. cars. You'll save money on the costs, which you might make use of in the direction of your deductible when it comes to an insurance claim. A chauffeur who hasn't had a mishap in 20 years may not be frightened by the above instance of the 6-year time duration to make up the difference.

4. Just how threat averse are you? Ultimately, a higher insurance deductible is a greater threat. The lower your deductible, the a lot more coverage and safety you have. How a lot are you and also your family members prepared to run the risk of? 5. What is the worth of your car? Expensive cars set you back more to insure. In this instance, a high insurance deductible may make good sense due to the fact that you would have greater financial savings on your costs.

Are you leasing or financing your car? Individuals who are leasing or financing their cars and truck tend to select a lower deductible. This supplies far better protection in the situation of a claim. This is required for people that don't have their vehicle, because they are accountable for returning the cars and truck in working condition regardless of whatwith or without the financial help of insurance.

Accident plans cover those costs if your vehicle hits a cars and truck or other cars and truck. If you don't get in a great deal of crashes, you can take the threat with a higher deductible. To maintain it straightforward, you may desire to hold the very same insurance deductible for all types of coverage and also cars and trucks.

If you could not Home page afford to make your deductible tomorrow, you require a lower insurance deductible (affordable). If you're a good driver with a high tolerance for danger, you can increase your deductible.

And if you don't need to sue for two, 3, or 4 years you might save a significant amount of money in time (risks). (FYI: the average automobile owner drives for 8. 3 years without sending a claim. SUV and also pickup vehicle owners have insurance claims about every 6. 5 years).

Are there various other ways to conserve money on insurance policy? Other options include added safety and security actions or home updates like an alarm system, an emergency generator, a new roofing system, brand-new electric or plumbing systems. As constantly, we like to advise individuals that insurance policy is an extremely customized subject.

car insurance cheap insurance auto affordable car insurance

car insurance cheap insurance auto affordable car insurance

Allow's state you simply got in a wreckage and your automobile requires $4,000 in repairs, yet your insurance policy will just cover $3,000. If you're perplexed, recognizing your auto insurance deductible could be the solution - car insurance. In this short article, we'll discuss what an automobile insurance policy deductible actually is, when you need to pay it, as well as whether you must choose a high or low one (insurers).

You don't in fact pay a deductible to the insurance policy firm you pay it to the fixing shop when they fix your car. If you have a $500 insurance deductible, you need to pay that quantity prior to the insurance coverage business pays the continuing to be $1,500.

Insurance firms will not be accountable for costs that do not exceed your deductible. Your automobile insurance deductible doesn't function like your wellness insurance policy deductible. With medical insurance, you have a deductible that obtains reset each year. As you use wellness services, the money you spend out of your very own pocket will certainly include up.

With cars and truck insurance policy, you pay your deductible every time you file a claim. On your way to the fixing store, a freak hail storm adds even more damages to your car. cheaper.