Notifications

Your insurance coverage business will certainly pay for your problems, minus your deductible, and afterwards ask the at-fault chauffeur's insurance provider to pay the cash back in a process called subrogation - cheap car.

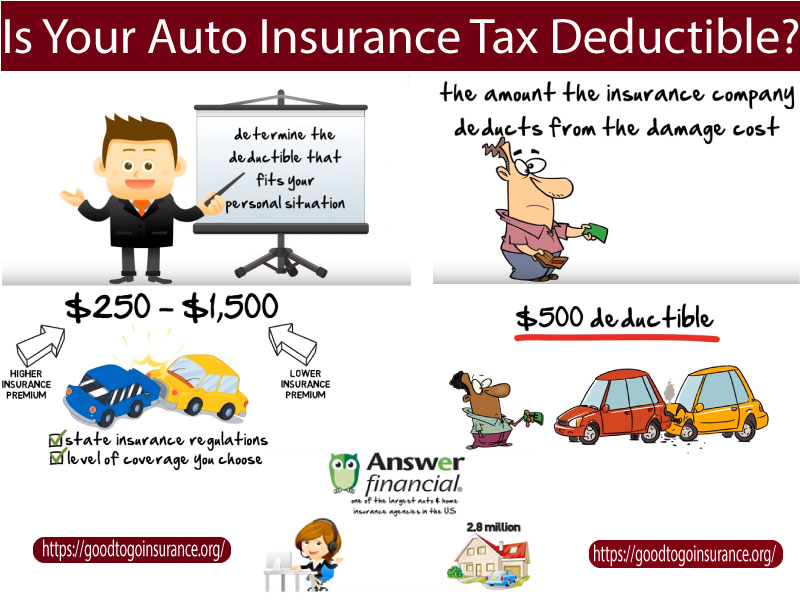

While increasing your deductible will lower your costs, there are various other effects to think about for your auto insurance coverage prices. Allow's take an appearance at all the variables you must take into consideration when picking your automobile insurance policy deductible!

laws insured car insure business insurance

laws insured car insure business insurance

cars insure auto insurance automobile

cars insure auto insurance automobile

If you weren't required to have a deductible, you could practically have as numerous accidents as you desired on the insurance provider's dime. Paying a deductible ensures you likewise have a risk in any kind of claims you make. Deductibles typically just put on harm to your very own home, like in the instances of detailed as well as crash vehicle insurance policy (cheaper cars).

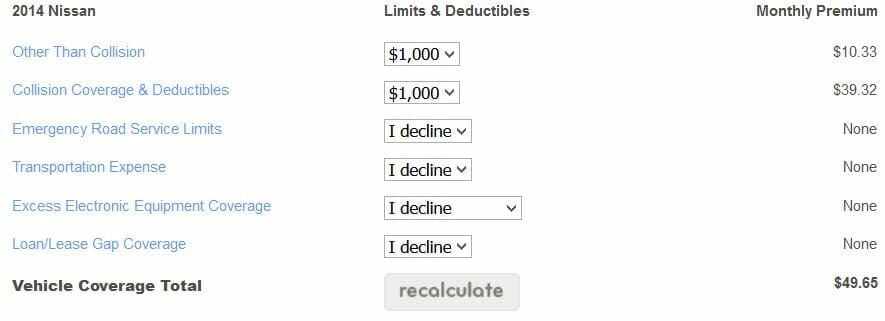

What is the connection between the deductible as well as costs? Usually, a reduced deductible methods higher regular monthly payments. If you have a low insurance deductible, you have much more coverage from your insurance coverage firm and also you have to pay much less expense in the instance of a claim - insurance. A higher insurance deductible suggests a lowered price in your insurance policy premium (cheap insurance).

A reduced deductible of $500 suggests your insurance business is covering you for $4,500. A greater insurance deductible of $1,000 suggests your firm would then be covering you for just $4,000 - cars. Since a lower insurance deductible corresponds to much more coverage, you'll have to pay even more in your monthly costs to cancel this boosted coverage.

cheap insurance car insurance perks insured car

cheap insurance car insurance perks insured car

This depended on the state, however, where Michigan just saved 4% for the insurance deductible raise while Massachusetts saved an average of 17%. Some people make the blunder of selecting the greatest insurance deductible just to save money on their costs. In the instance of an event, though, having a high deductible could have severe monetary repercussions. vehicle insurance.

If you have that money on hand at any kind of point, it might be worth choosing for a greater insurance deductible. Exactly how a lot would certainly you save on a reduced costs if you had a higher insurance deductible? Would certainly you save cash that would certainly equate to that insurance deductible in the case of an incident?

Now you have actually a raised insurance deductible by $500, yet you are saving $80 per year. If you don't obtain right into a crash in those 6 years, the raised deductible was worth it. vehicle insurance.

If you have a good driving document, a greater insurance deductible might work in your favor. insurance companies. You'll conserve money on the costs, which you might use towards your deductible when Home page it comes to a claim. A driver who hasn't had a mishap in 20 years might not be terrified by the above instance of the 6-year time period to make up the difference.

Inevitably, a higher insurance deductible is a greater threat. The lower your deductible, the extra protection as well as safety and security you have. In this case, a high insurance deductible might make sense because you would have higher financial savings on your premiums. affordable auto insurance.

Individuals that are leasing or financing their car have a tendency to choose a lower deductible. If you don't get in a great deal of accidents, you can take the danger with a higher deductible. To maintain it easy, you might desire to hold the exact same insurance deductible for all kinds of coverage as well as automobiles.

There are various other methods to decrease your costs, like going shopping around and also bundling your automobile and also house insurance policy. Click below to learn more about the 16 ways to lower your automobile insurance policy costs. If you couldn't manage to make your deductible tomorrow, you require a reduced insurance deductible. If you're an excellent chauffeur with a high resistance for danger, you can raise your deductible. low-cost auto insurance.

And if you do not have to submit a case for 2, 3, or 4 years you can conserve a substantial amount of cash over time. (FYI: the typical vehicle owner drives for 8 - insure.

Exist other methods to conserve cash on insurance? Yes! We have actually listed a few of one of the most typical insurance policy discounts right here. Other choices include added precaution or house updates like an alarm system, an emergency generator, a brand-new roofing, brand-new electrical or plumbing systems. As constantly, we such as to remind people that insurance is a really customized topic.

car insurance cheapest auto insurance cheaper cheapest car

car insurance cheapest auto insurance cheaper cheapest car

Allow's claim you just entered a wreck and also your cars and truck requires $4,000 in repairs, however your insurance coverage will only cover $3,000. If you're puzzled, understanding your automobile insurance coverage deductible may be the response - suvs. In this write-up, we'll explain what an automobile insurance coverage deductible really is, when you need to pay it, and whether you must pick a high or reduced one (auto).

You do not really pay a deductible to the insurance coverage company you pay it to the repair shop when they fix your auto. If you have a $500 deductible, you must pay that amount prior to the insurance coverage firm pays the continuing to be $1,500.

Insurance firms will certainly not be responsible for expenses that do not exceed your deductible. Your automobile insurance deductible doesn't function like your health and wellness insurance deductible. With health and wellness insurance policy, you have an insurance deductible that obtains reset every year. As you make use of wellness solutions, the cash you invest out of your own pocket will certainly accumulate.

When the brand-new year rolls around, everything beginnings over (insured car). With cars and truck insurance policy, you pay your insurance deductible every time you file a claim. Let's state you got involved in a mishap and also submitted an accident case. On your method to the service center, a freak hailstorm storm adds even more damages to your car.