Notifications

Your insurance coverage business will certainly spend for your damages, minus your deductible, and after that ask the at-fault vehicle driver's insurance provider to pay the cash back in a process called subrogation - prices.

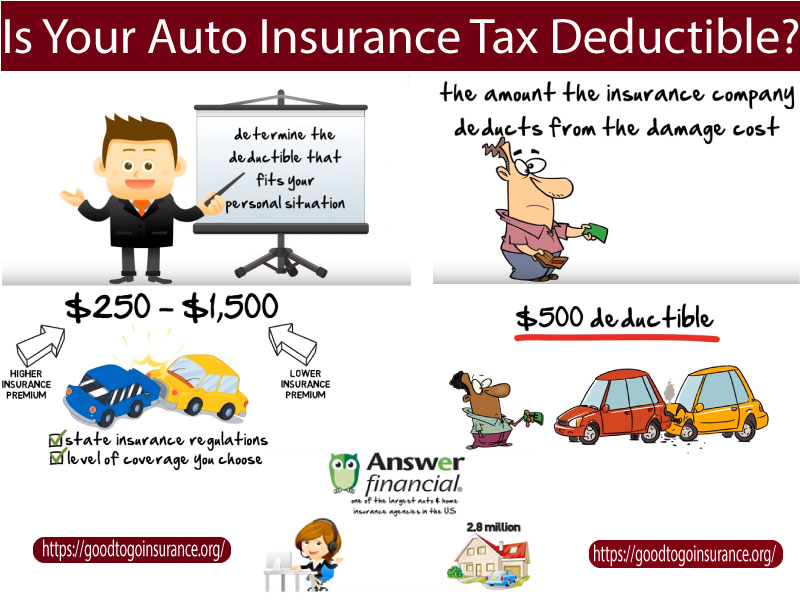

While increasing your deductible will lower your premium, there are other results to think about for your car insurance policy expenses. Let's take a look at all the elements you ought to take into consideration when selecting your auto insurance coverage deductible!

cheaper cars vehicle insurance cheap car low cost

cheaper cars vehicle insurance cheap car low cost

cheap car insurance auto cars cheap auto insurance

cheap car insurance auto cars cheap auto insurance

If you weren't called for to have an insurance deductible, you might technically have as many mishaps as you desired on the insurance provider's penny. Paying a deductible ensures you likewise have a stake in any kind of insurance claims you make. Deductibles typically just relate to damage to your own building, like whens it comes to detailed and accident automobile insurance policy (dui).

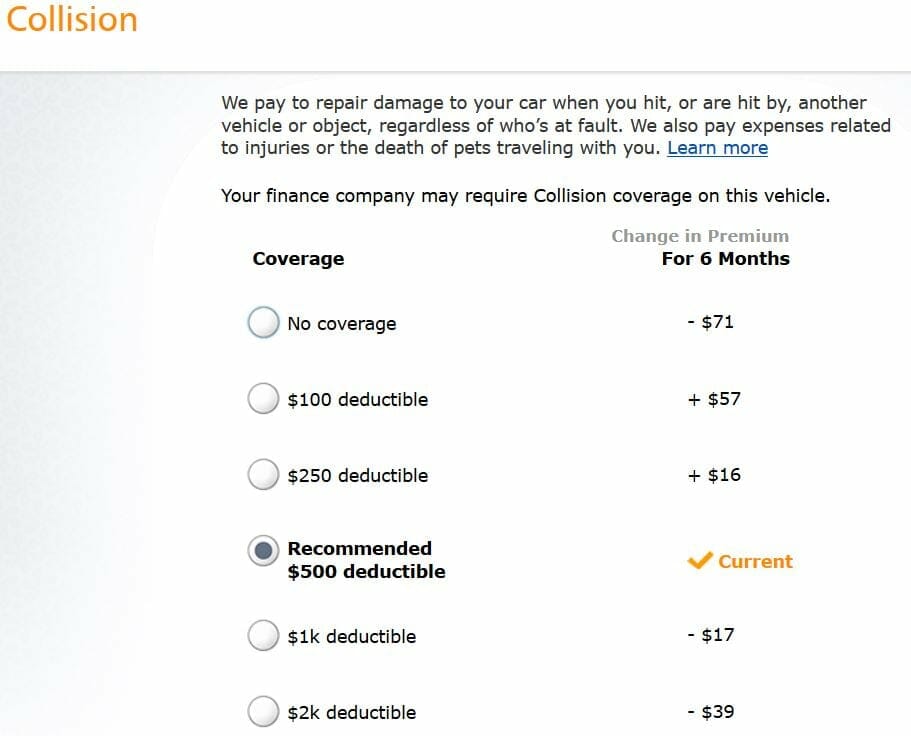

What is the partnership in between the deductible and also premium? Many commonly, a reduced deductible means greater monthly repayments.

A low insurance deductible of $500 suggests your insurance coverage firm is covering you for $4,500. A higher deductible of $1,000 implies your company would after that be covering you for only $4,000 - insured car. Since a lower insurance deductible corresponds to much more protection, you'll need to pay more in your regular monthly costs to balance out this boosted protection.

cheaper car insurance vehicle insurance cars cheaper cars

cheaper car insurance vehicle insurance cars cheaper cars

This depended on the state, however, where Michigan just saved 4% for the deductible raising while Massachusetts conserved a standard of 17%. Yet some people make the mistake of choosing the highest possible deductible simply to conserve money on their premium. When it comes to an incident, though, having a high deductible can have significant economic consequences. cheapest auto insurance.

If you have that money on hand at any kind of point, it may be worth deciding for a greater deductible. How a lot would you save on a reduced costs if you had a greater insurance deductible? Would you save money that would certainly relate to that insurance deductible in the situation of a case?

Currently you have actually a boosted deductible by $500, however you are conserving $80 per year. That indicates you would need just over 6 years in order to comprise the difference. If you do not get right into an accident in those 6 years, the increased insurance deductible deserved it. If not, you need to pay even more out of pocket.

If you have a good driving document, a greater insurance deductible can work in your support. vehicle insurance. You'll save cash on the costs, which you might use towards your insurance deductible when it comes to a case. A driver that hasn't had an accident in 20 years could not be scared by the above example of the 6-year time period to make up the difference.

Ultimately, a higher insurance deductible is a greater threat. The lower your insurance deductible, the much more insurance coverage and also security you have. In this case, a high insurance deductible could make sense due to the fact that you would have greater savings on your costs. business insurance.

Are you renting or financing your cars and truck? Individuals who are leasing or financing their vehicle tend to select a reduced deductible. This provides far better coverage in the instance of an insurance claim. This is essential for individuals that don't own their cars and truck, because they are accountable for returning the auto in functioning condition regardless of whatwith or without the monetary help of insurance coverage.

Crash policies cover those costs if your lorry strikes an auto or various other cars and truck. If you do not obtain in a great deal of crashes, you can take the danger with a higher insurance deductible. However, to maintain it simple, you might intend to hold the very same insurance deductible for all kinds of insurance coverage and also cars.

If you could not manage to make your insurance deductible tomorrow, you need a reduced insurance deductible (dui). If you're a good motorist with a high tolerance for risk, you can increase your deductible.

And also if you do not have to submit a case for two, three, or four years you might save a significant amount of cash over time. (FYI: the ordinary cars and truck owner drives for 8 - trucks.

Are there various other ways to save money on insurance coverage? Various other alternatives consist of added safety and security procedures or residence updates like an alarm system, an emergency situation generator, a brand-new roofing system, new electric or plumbing systems. Home page As always, we such as to advise people that insurance policy is a really individualized subject.

business insurance insured car suvs risks

business insurance insured car suvs risks

Allow's state you just obtained in a wreck and your car requires $4,000 out of commission, however your insurance coverage will just cover $3,000. If you're perplexed, comprehending your automobile insurance deductible could be the answer - car. In this post, we'll clarify what an auto insurance deductible really is, when you need to pay it, and also whether you need to choose a high or low one (business insurance).

You don't in fact pay a deductible to the insurance provider you pay it to the service center when they fix your car. Relying on your state, you could have a deductible for various other kinds of insurance coverage, as well. Let's claim you submit a case that results in a $2,000 expenditure. If you have a $500 deductible, you have to pay that quantity before the insurance provider pays the continuing to be $1,500.

Insurers will certainly not be accountable for expenditures that do not surpass your deductible. Your cars and truck insurance coverage deductible doesn't work like your wellness insurance coverage deductible. With medical insurance, you have a deductible that obtains reset every year. As you make use of health and wellness services, the cash you spend out of your own pocket will certainly build up.

With cars and truck insurance policy, you pay your insurance deductible every time you submit an insurance claim. On your method to the repair work store, a freak hail storm adds more damage to your cars and truck. perks.