Notifications

Whether you're a novice to the Golden State or you've lived here for years, you likely currently know the legislation: Auto insurance coverage is legally needed to drive in California (insurance). (That demand makes a great deal of sense, toocar insurance is valuable protection for everyone when driving, because it assists make sure that no person obtains stuck to a big obligation costs after an accident.)What you could not understand, though, is that if you're a low-mileage driverespecially if you drive much less than 10,000 miles per yearyou may be able to conserve a whole lot on your vehicle insurance policy with Metromile's pay-per-mile car insurance - vans.

After that, you'll pay a price that could be as low as 6 cents per mile you drive. To put it simply, you'll pay for the miles you actually drive. On the months you drive less, your expense will be lowerit all makes great feeling! (Stressed regarding trip? Do not be. Metromile caps your everyday mileage at 250 miles.)With Metromile, the less you drive, the extra you could conserve.

Insurance coverage suppliers wish to see shown accountable habits, which is why traffic accidents and citations are aspects in figuring out car insurance coverage prices. Remember that directs on your license do not remain there forever, however the length of time they stay on your driving record differs depending on the state you live in as well as the seriousness of the violation.

A new sporting activities car will likely be much more costly than, state, a five-year-old car - car. If you choose a reduced insurance deductible, it will cause a greater insurance policy costs that makes picking a higher deductible feel like a rather good deal. Nonetheless, a greater insurance deductible can mean paying even more expense in the event of a mishap.

cheaper car insurance trucks insurance companies insurance companies

cheaper car insurance trucks insurance companies insurance companies

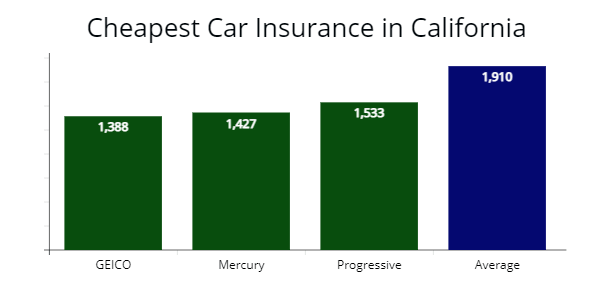

What is the average vehicle insurance expense? There are a broad variety of elements that influence exactly how much cars and truck insurance policy prices, which makes it challenging to obtain an accurate concept of what the ordinary individual pays for auto insurance. cheap car. According to the American Automobile Association (AAA), the average price to guarantee a car in 2016 was $1222 a year, or about $102 each month - cheapest.

Just how do I get car insurance? Getting a car insurance policy quote from Nationwide has actually never been easier. low cost.

Vehicle insurance policy is needed to safeguard you monetarily when behind the wheel. car insured.!? Here are 15 approaches for saving on automobile insurance expenses.

vehicle insurance credit score insurers affordable auto insurance

vehicle insurance credit score insurers affordable auto insurance

.jpeg) car insured insurance company car insurance auto

car insured insurance company car insurance auto

Lower automobile insurance prices might additionally be offered if you have other insurance policies with the same business. Preserving a risk-free driving document is vital to getting reduced auto insurance rates. Just How More helpful hints Much Does Vehicle Insurance Policy Expense? Car insurance policy costs are different for every single motorist, depending on the state they stay in, their selection of insurance provider and the kind of insurance coverage they have.

The numbers are fairly close with each other, recommending that as you allocate a brand-new automobile acquisition you might require to include $100 approximately monthly for automobile insurance coverage. Note While some things that impact cars and truck insurance policy prices-- such as your driving background-- are within your control others, prices might also be impacted by points like state regulations as well as state accident prices.

Once you understand just how much is car insurance for you, you can place some or every one of these techniques t work - risks. 1. Benefit From Multi-Car Discounts If you acquire a quote from a vehicle insurer to guarantee a single car, you may wind up with a greater quote per lorry than if you made inquiries concerning insuring a number of chauffeurs or lorries with that said company - cars.

insurers accident affordable car insurance insurance companies

insurers accident affordable car insurance insurance companies

If your kid's qualities are a B average or above or if they rank in the top 20% of the course, you might be able to obtain a great pupil price cut on the protection, which usually lasts up until your child transforms 25 - cars. These discount rates can range from just 1% to as much as 39%, so make sure to reveal proof to your insurance policy representative that your teen is a great student. insurance companies.

Allstate, for instance, uses a 10% car insurance discount rate and a 25% homeowners insurance discount rate when you pack them together, so examine to see if such discounts are available and appropriate. 2. Pay Attention when traveling To put it simply, be a risk-free vehicle driver. This should do without stating, yet in today's age of raising in-car diversions, this births stating as much as possible.

Travelers provides safe chauffeur discounts of between 10% and 23%, depending on your driving record. For those unaware, points are generally analyzed to a chauffeur for moving violations, and a lot more factors can lead to greater insurance policy costs (all else being equivalent).

Make certain to ask your agent/insurance business about this discount before you authorize up for a class. cheap. Besides, it's important that the effort being expended and the cost of the course convert into a large enough insurance policy savings. It's additionally vital that the vehicle driver register for an accredited training course.

low-cost auto insurance cheapest car insurance accident insure

low-cost auto insurance cheapest car insurance accident insure

4. Look around for Better Cars And Truck Insurance Policy Fees If your plan is concerning to renew and also the yearly costs has increased markedly, take into consideration searching and obtaining quotes from contending firms. Every year or two it possibly makes feeling to get quotes from various other companies, simply in instance there is a lower price out there.