Notifications

Whether you're a newcomer to the Golden State or you have actually lived here for years, you likely currently recognize the law: Cars and truck insurance coverage is lawfully needed to drive in California (insurance). (That requirement makes a great deal of sense, toocar insurance is useful security for everyone More helpful hints when traveling, because it assists make sure that nobody gets stuck to a big liability expense after an accident.)What you could not know, though, is that if you're a low-mileage driverespecially if you drive less than 10,000 miles per yearyou may be able to save a lot on your cars and truck insurance coverage with Metromile's pay-per-mile auto insurance - laws.

After that, you'll pay a price that can be as reduced as 6 cents per mile you drive. To put it simply, you'll spend for the miles you actually drive. On the months you drive less, your costs will certainly be lowerit all makes good feeling! (Concerned concerning journey? Do not be. Metromile caps your day-to-day mileage at 250 miles.)With Metromile, the much less you drive, the a lot more you can save.

Insurance coverage providers wish to see demonstrated responsible behavior, which is why website traffic crashes and also citations are consider figuring out auto insurance policy prices. Directs on your permit do not stay there permanently, yet how lengthy they stay on your driving document differs depending on the state you live in and also the extent of the offense - cheap auto insurance.

A new sporting activities vehicle will likely be more pricey than, claim, a five-year-old sedan - insurers. If you pick a lower insurance deductible, it will certainly lead to a higher insurance costs which makes picking a greater deductible appear like a pretty great bargain. However, a greater deductible could imply paying even more out of pocket in the occasion of an accident.

suvs cheaper car accident car

suvs cheaper car accident car

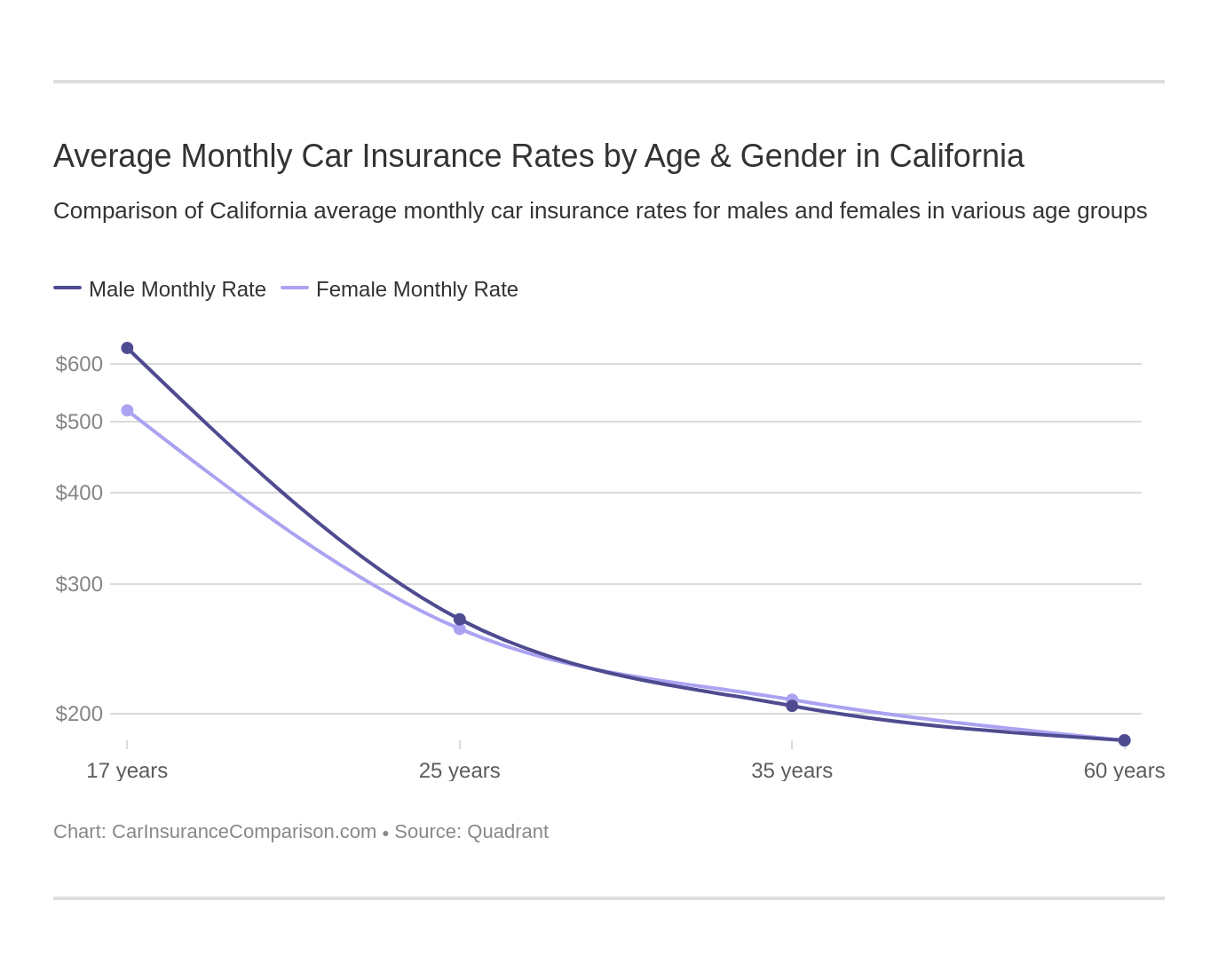

What is the typical vehicle insurance coverage expense? There are a variety of elements that affect just how much vehicle insurance coverage prices, that makes it tough to obtain a precise suggestion of what the average person pays for vehicle insurance coverage. automobile. According to the American Automobile Association (AAA), the typical price to guarantee a sedan in 2016 was $1222 a year, or around $102 each month - liability.

Nationwide not just offers competitive prices, yet additionally a variety of price cuts to assist our participants save also much more. Just how do I obtain vehicle insurance? Obtaining a cars and truck insurance estimate from Nationwide has actually never been simpler. See our vehicle insurance coverage quote area as well as enter your postal code to begin the auto insurance quote procedure - vehicle insurance.

Cars and truck insurance policy is essential to shield you financially when behind the wheel. Whether you simply have fundamental responsibility insurance coverage or you have full car coverage, it is essential to make sure that you're obtaining the very best offer possible. Wondering exactly how to lower cars and truck insurance!. insurers.?.!? Right here are 15 approaches for reducing auto insurance policy costs.

affordable car insurance credit score insured car dui

affordable car insurance credit score insured car dui

cheapest car insurance credit credit cheaper cars

cheapest car insurance credit credit cheaper cars

Lower automobile insurance rates might additionally be offered if you have various other insurance coverage with the very same business. Keeping a risk-free driving record is vital to obtaining lower automobile insurance policy rates. How Much Does Cars And Truck Insurance Coverage Expense? Car insurance policy costs are various for every single motorist, relying on the state they stay in, their option of insurance provider and the kind of protection they have.

The numbers are rather close together, recommending that as you spending plan for a new auto acquisition you may require to consist of $100 or so per month for vehicle insurance coverage. Note While some things that influence vehicle insurance rates-- such as your driving history-- are within your control others, prices may likewise be affected by things like state guidelines as well as state accident rates.

When you understand just how much is cars and truck insurance policy for you, you can place some or every one of these strategies t job - automobile. 1. Make The Most Of Multi-Car Discounts If you get a quote from a vehicle insurer to guarantee a single automobile, you could end up with a higher quote per vehicle than if you made inquiries about insuring several drivers or cars keeping that company - low-cost auto insurance.

affordable vans insure dui

affordable vans insure dui

If your youngster's qualities are a B average or above or if they rank in the leading 20% of the class, you may be able to obtain a excellent pupil price cut on the insurance coverage, which usually lasts until your child transforms 25 - vehicle. These price cuts can range from just 1% to as high as 39%, so make sure to reveal proof to your insurance policy agent that your teenager is an excellent trainee. cheaper cars.

Allstate, for instance, offers a 10% car insurance policy price cut and also a 25% house owners insurance coverage discount when you pack them together, so inspect to see if such price cuts are available as well as relevant. 2. Pay Interest on the Roadway In various other words, be a secure driver. This must do without saying, however in today's age of enhancing in-car distractions, this births discussing as much as feasible.

Travelers provides safe motorist discounts of between 10% and 23%, relying on your driving document. For those unaware, factors are generally examined to a motorist for moving offenses, and also extra factors can result in greater insurance premiums (all else being equivalent). 3. Take a Defensive Driving Course Sometimes insurer will offer a discount for those who finish an approved protective driving training course - laws.

Ensure to ask your agent/insurance firm about this discount rate prior to you authorize up for a class. cheaper car. After all, it is necessary that the initiative being used up and also the expense of the program convert into a huge enough insurance coverage financial savings. It's also essential that the chauffeur register for a recognized training course.

insurance low cost insurance companies insure

insurance low cost insurance companies insure

, take into consideration shopping around and getting quotes from completing business. Every year or two it probably makes sense to acquire quotes from other companies, just in case there is a reduced rate out there. low cost auto.