Notifications

If you have a history of having car insurance coverage policies without submitting cases, you'll obtain more affordable prices than somebody who has filed claims in the past.: Cars that are driven less often are less likely to be entailed in an accident or other destructive event. Autos with reduced yearly gas mileage may receive slightly reduced rates.

vehicle insurance cars credit score cheaper

vehicle insurance cars credit score cheaper

To find the most effective vehicle insurance for you, you should contrast store online or speak to an insurance coverage agent or broker. You can, yet be sure to keep track of the coverages picked by you as well as supplied by insurance firms to make a reasonable contrast. Alternatively, you can who can help you locate the most effective combination of rate and fit (trucks).

Independent representatives function for numerous insurance provider and also can compare among them, while restricted representatives help just one insurance policy company. Provided the different ranking methodologies as well as factors used by insurance providers, no solitary insurance provider will be best for everybody. To much better recognize your typical automobile insurance expense, spend a long time comparing quotes throughout companies with your chosen technique.

Prices were calculated by evaluating our 2021 base profile with the ages 18-60 (base: 40 years) used. cars. Prices for 18-year-old are based on a chauffeur of this age that is an occupant (not a home owner) and also on their own plan.

Washington State currently permits credit rating as a score aspect, but a restriction on its usage is presently on hold in the courts (car insurance).

4 things to take into consideration when selecting the amount of insurance coverage for your demands: The worth of your assets What you drive Just how much you drive Who's in the vehicle with you In a lot of states, you're called for to lug a minimum amount of obligation insurance as well as additionally provide evidence of insurance coverage prior to you can register your lorry or restore your motorist's certificate.

If that is the situation, the legally responsible motorist will certainly have to pay the additional expenditures out of pocket. Think about the adhering to when selecting Automobile insurance policy protection:.

With My, Plan, you can see your policy online as well as make modifications or Click for info revivals. Do I get a discount rate if I pay my plan in complete?

The price of auto insurance coverage can be overwhelming, so for lots of motorists, it's a relief to be able to pay in regular monthly installations for the year. A lot of insurance business give you the selection of paying for the entire plan yearly or spreading out the settlements over each month, yet which is the best choice?

This is extremely practical to people that have revenue that changes throughout the year or is seasonal, obtain a yearly bonus, or get a tax refund. laws. It can likewise be practical for individuals who have difficulty keeping up with month-to-month settlements. Paying the insurance costs once a year can save you cash if you usually incur late fees.

insurance companies laws risks insurance company

insurance companies laws risks insurance company

However, most firms charge an installment charge for this convenience since it takes more deal with the business's component to process 12 payments rather of just one. Despite a monthly fee, paying in month-to-month installments is a much better alternative for some people. It enables you to spread out the cost of the costs out over time as the majority of people budget their money on a month-to-month basis.

affordable car insurance credit score car insurance vehicle insurance

affordable car insurance credit score car insurance vehicle insurance

If you expect a significant adjustment in your plan before the year is up, like eliminating a teen vehicle driver from your plan, you'll want the capability to take them off the plan and also see immediate cost savings. Regular monthly repayments may also be an excellent option for somebody who might have the cash to pay an annual costs yet wishes to invest the added cash or use it for one more huge expenditure (low cost).

Regular monthly: The Price Distinction So which method is best for you? Certainly, it depends mostly on your monetary scenario and also convenience degree. However another determinant is the quantity of savings you'll gain if you do make a swelling sum settlement. It may not be worth it if you conserve $30 a year in charges (cheaper).

Some firms additionally offer you a discount rate if you set up automatic repayments with them. Not only can this choice obtain you a discount rate, but you'll never ever need to bother with paying that bill every month. Often the price cut you receive for electronic or automated payments offsets any installment charges you may pay monthly, so if you're vacillating between annual or month-to-month repayments, learn if any one of these discount rates is available (dui).

Ultimately, you want to find a settlement approach for your automobile insurance that creates a balance between meeting personal preferences as well as conserving you one of the most money while offering you the vehicle insurance protection you require.

The typical cost of automobile insurance in the United States is $2,388 annually or $199 per month, according to information from virtually 100,000 insurance policy holders from Savvy (cheapest auto insurance). The state you stay in, the level of protection you 'd like to have, as well as your sex, age, credit rating, and also driving background will certainly all variable right into your costs.

Insurance policy is regulated at the state level, and also laws on called for protection and also rates are different in every state. Insurance policy firms take right into account many different variables, consisting of the state and also location where you live, as well as your gender, age, driving history, as well as the level of insurance coverage you would certainly such as to have.

Right here are the most significant factors that will certainly affect the cost you'll pay for coverage, and also what to think about when looking at your car insurance coverage alternatives. There have actually been some large modifications to auto insurance coverage expenses throughout the coronavirus pandemic.

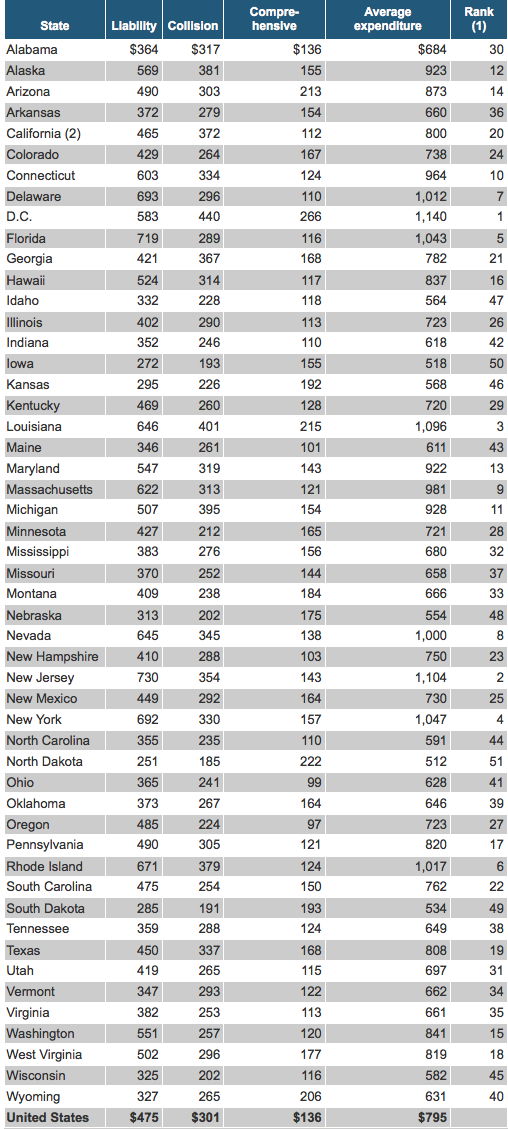

Business Insider assembled a listing of average car insurance prices for each and every state. These rates were identified as approximately prices reported by Nerdwallet, The Zebra, Worth, Penguin, Bankrate, and the National Association of Insurance Policy Commissioners. Below's a range automobile insurance policy costs by state. Source: Information from Nerdwallet, Value, Penguin, Bankrate, The Zebra, and the National Organization of Insurance Policy Commissioners.

As Well As from Company Expert's data, vehicle insurer often tend to bill women extra. Company Expert accumulated quotes from Allstate and also State Ranch for fundamental coverage for male and women motorists with an identical profile in Austin, Texas (credit). When exchanging out only the sex, the male account was priced quote $1,069 for insurance coverage annually, while the women account was quoted $1,124 per year for protection, costing the lady chauffeur 5% more.

In states where X is a sex alternative on motorist's licenses consisting of Oregon, California, Maine, and soon New York insurance firms are still figuring out exactly how to determine expenses. Ordinary cars and truck insurance premiums by age, The variety of years you've been driving will certainly influence the cost you'll pay for protection. While an 18-year-old's insurance coverage averages $2,667.

This information was provided to Company Insider by Savvy. How auto insurance rates alter with the number of vehicles you own, In some methods, it's logical: the more cars you carry your plan, the greater your auto insurance policy costs. But, there are also some savings when multiple cars are on one policy.

Vehicle insurance coverage is less expensive in zip codes that are much more country, and the very same holds true at the state degree. Guarantee. com information reveals that Iowa, Idaho, Wisconsin,