Notifications

If you have a background of having vehicle insurance plans without submitting insurance claims, you'll obtain more affordable prices than someone who has actually filed cases in the past.: Autos that are driven much less often are much less most likely to be included in a crash or other destructive event. Cars with reduced yearly gas mileage may get somewhat reduced rates.

credit score cheap car insurance cheap car insurance risks

credit score cheap car insurance cheap car insurance risks

To discover the most effective car insurance coverage for you, you need to contrast shop online or talk to an insurance coverage agent or broker. You can, yet make certain to track the insurance coverages picked by you and also used by insurance providers to make a fair comparison. You can that can assist you locate the ideal mix of price and fit.

Independent representatives work for numerous insurance provider and can compare among them, while captive agents function for only one insurer. Provided the different rating techniques as well as elements used by insurers, no single insurer will certainly be best for everybody. To much better comprehend your normal car insurance coverage expense, invest time comparing quotes throughout firms with your chosen technique.

Prices were determined by reviewing our 2021 base profile with the ages 18-60 (base: 40 years) used. insurance. Prices for 18-year-old are based on a driver of this age that is an occupant (not a property owner) and on their own plan.

cheaper car car laws cheap auto insurance

cheaper car car laws cheap auto insurance

Washington State presently permits credit score as a ranking factor, however a ban on its usage is presently on hold in the courts (car insurance).

4 points to consider when choosing the amount of protection for your needs: The value of your possessions What you drive Just how much you drive Who's in the vehicle with you In the majority of states, you're called for to bring a minimum amount of liability insurance policy as well as additionally provide evidence of insurance coverage prior to you can register your automobile or restore your driver's license.

If that is the case, the lawfully liable vehicle driver will need to pay the added expenses expense. Consider the complying with when choosing Auto insurance policy coverage:.

That's just how simple it is. With My, Plan, you can see your policy online as well as make modifications or renewals. Utilize our award-winning The General instinctive mobile application to do these very same tasks or submit an insurance claim. Do I get a discount if I pay my policy in complete? In many states, clients paying completely obtain discount rates.

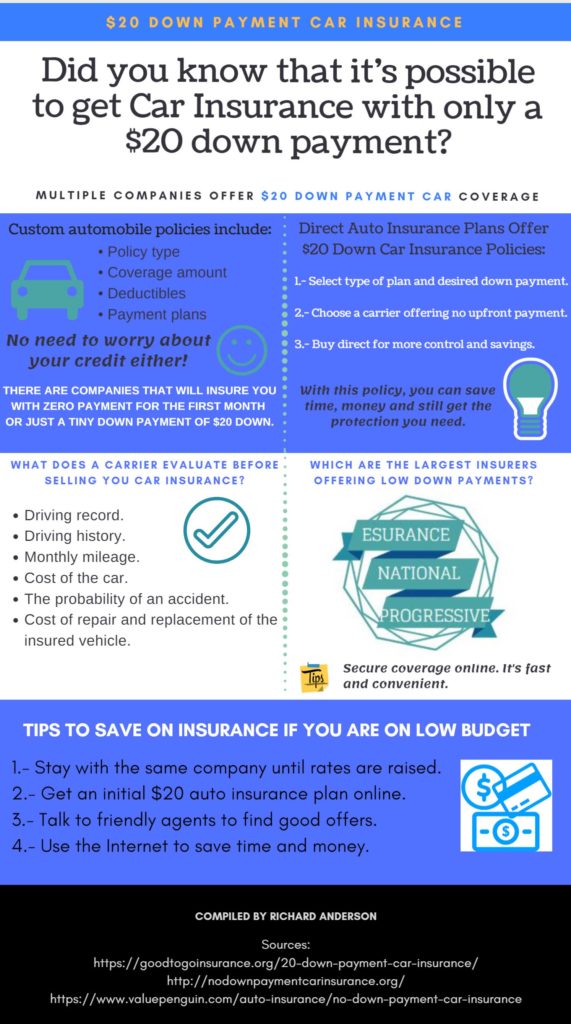

The expense of automobile insurance can be overwhelming, so for lots of drivers, it's an alleviation to be able to pay in monthly installations for the year. While this might appear like the most convenient alternative, it's not constantly one of the most economical over time. insurance company. A lot of insurance coverage business give you the choice of paying for the whole plan annually or expanding the repayments over each month, however which is the most effective alternative? Well, it totally depends on your conditions.

This is incredibly practical to individuals who have revenue that changes throughout the year or is seasonal, get a yearly benefit, or obtain a tax reimbursement. cheapest auto insurance. It can additionally be useful for individuals who have problem staying on par with regular monthly settlements. Paying the insurance premium once a year can conserve you money if you usually incur late costs.

Most business charge an installation fee for this comfort given that it takes more work on the firm's component to process 12 payments rather of simply one. Despite a monthly fee, paying in month-to-month installations is a far better option for some individuals. It enables you to spread the cost of the costs out gradually as a lot of individuals budget plan their money on a month-to-month basis.

prices vehicle insurance insurance company insured car

prices vehicle insurance insurance company insured car

If you anticipate a major modification in your policy before the year is up, like getting rid of a adolescent motorist from your plan, you'll want the capability to take them off the policy and see prompt cost savings. Regular monthly repayments might also be an excellent choice for a person who may have the cash to pay an annual premium however intends to invest the money or utilize it for an additional large expense (auto).

Another factor is the quantity of savings you'll gain if you do make a swelling amount settlement. It might not be worth it if you save $30 a year in fees.

Some firms likewise provide you a discount rate if you established automatic payments with them. Not just can this choice get you a discount rate, yet you'll never need to stress concerning paying that expense monthly. Often the discount rate you receive for electronic or automated payments offsets any type of installation fees you could pay each month, so if you're dithering between annual or regular monthly repayments, learn if any of these discounts is offered (low-cost auto insurance).

Ultimately, you wish to locate a repayment technique for your vehicle insurance that creates a balance in between conference individual preferences and saving you one of the most cash while giving you the car insurance policy defense you need.

The typical expense of cars and truck insurance policy in the United States is $2,388 annually or $199 per month, according to information from virtually 100,000 Click for info insurance policy holders from Savvy (vehicle insurance). The state you live in, the degree of coverage you want to have, and your sex, age, credit report, and driving history will certainly all aspect into your premium.

Auto insurance plan have great deals of moving components, as well as your premium, or the price you'll pay for coverage, is simply among them. Insurance is controlled at the state degree, as well as laws on required coverage as well as rates are different in every state - money. Insurance provider think about several aspects, consisting of the state as well as location where you live, as well as your gender, age, driving background, and also the level of coverage you would love to have.

car insurance cars affordable car insurance insure

car insurance cars affordable car insurance insure

Right here are the greatest aspects that will influence the rate you'll pay for coverage, and also what to consider when looking at your auto insurance alternatives. There have actually been some large changes to auto insurance prices throughout the coronavirus pandemic. Some cars and truck insurers are supplying price cuts as Americans drive much less, and also are additionally aiding people impacted by the infection hold off repayments.

Business Insider placed together a list of typical car insurance coverage costs for every state. These rates were determined as approximately rates reported by Nerdwallet, The Zebra, Value, Penguin, Bankrate, and also the National Organization of Insurance Policy Commissioners. Here's a range vehicle insurance costs by state. Source: Information from Nerdwallet, Worth, Penguin, Bankrate, The Zebra, and the National Organization of Insurance Coverage Commissioners.

As Well As from Business Insider's data, auto insurance business often tend to charge females much more. Service Insider gathered quotes from Allstate and also State Ranch for standard insurance coverage for male and women drivers with a the same account in Austin, Texas (car insurance). When exchanging out just the gender, the male account was estimated $1,069 for coverage annually, while the women profile was estimated $1,124 annually for coverage, costing the lady chauffeur 5% even more.

In states where X is a gender choice on chauffeur's licenses consisting of Oregon, California, Maine, as well as quickly New York insurers are still figuring out exactly how to compute prices. Ordinary car insurance policy premiums by age, The number of years you have actually been driving will impact the price you'll spend for protection. While an 18-year-old's insurance coverage standards $2,667.

This data was provided to Company Expert by Savvy. How vehicle insurance coverage prices transform with the number of vehicles you own, In some ways, it's