Notifications

Likewise, if you have a background of having auto insurance policies without filing claims, you'll obtain less costly prices than someone who has actually filed insurance claims in the past (cheaper cars).: Automobiles that are driven much less often are less most likely to be associated with a crash or various other damaging event. Vehicles with lower yearly mileage may get approved for slightly lower rates.

car insurance companies auto insurance auto insurance

car insurance companies auto insurance auto insurance

To locate the ideal car insurance policy for you, you should comparison shop online or talk with an insurance policy representative or broker. You can, however make sure to monitor the protections selected by you as well as supplied by insurance firms to make a reasonable comparison. You can who can assist you discover the best mix of cost as well as fit.

Independent agents help several insurance coverage companies and also can contrast amongst them, while restricted agents function for just one insurer. Given the different ranking methodologies and also factors used by insurance firms, no single insurer will certainly be best for everyone. To much better recognize your regular cars and truck insurance coverage price, invest time comparing quotes throughout firms with your selected technique.

Prices were calculated by evaluating our 2021 base account with the ages 18-60 (base: 40 years) applied. cheaper auto insurance. Prices for 18-year-old are based on a chauffeur of this age that is an occupant (not a homeowner) as well as on their Click for info very own plan.

insure car insurance car insurance

insure car insurance car insurance

Washington State presently allows credit rating as a rating aspect, but a restriction on its use is presently on hold in the courts (cheap).

4 things to consider when selecting the quantity of protection for your requirements: The value of your possessions What you drive Just how much you drive Who's in the auto with you In most states, you're needed to lug a minimum amount of obligation insurance coverage and additionally supply proof of insurance prior to you can register your car or restore your chauffeur's license.

If that is the case, the lawfully accountable driver will have to pay the extra expenditures expense. Consider the following when picking Automobile insurance coverage:.

That's how simple it is. With My, Plan, you can see your plan online and also make modifications or renewals. Utilize our acclaimed The General instinctive mobile application to perform these same jobs or sue. Do I get a price cut if I pay my policy completely? In a lot of states, consumers paying in full get discounts.

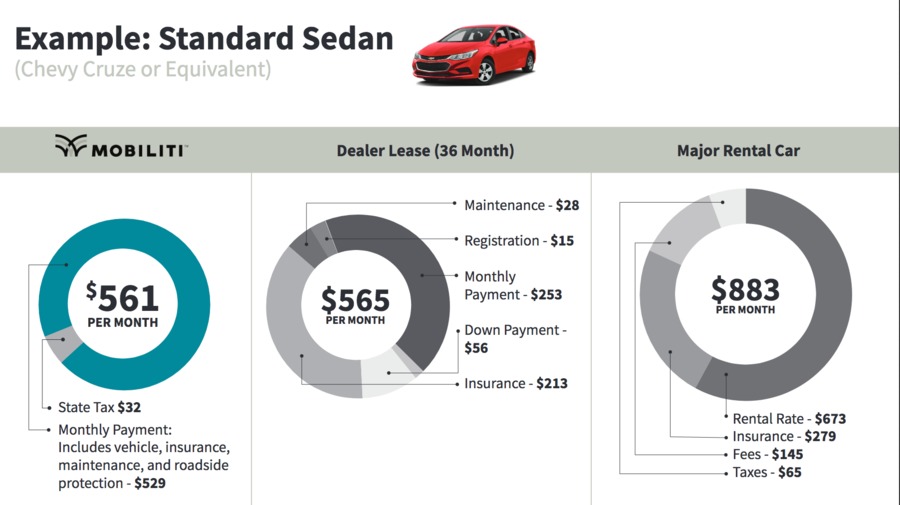

The price of vehicle insurance coverage can be complicated, so for several motorists, it's a relief to be able to pay in regular monthly installations for the year. The majority of insurance policy companies give you the selection of paying for the whole policy each year or spreading out the settlements over each month, however which is the ideal alternative?

This is exceptionally valuable to people that have revenue that rises and fall throughout the year or is seasonal, obtain a yearly benefit, or get a tax refund. credit. It can likewise be practical for people that have problem keeping up with month-to-month repayments. Paying the insurance coverage premium yearly can conserve you cash if you normally incur late costs.

dui auto insurance prices car insured

dui auto insurance prices car insured

Most companies charge an installation charge for this convenience because it takes more job on the firm's part to procedure 12 payments instead of just one. Despite a monthly fee, paying in month-to-month installations is a better choice for some individuals. It permits you to spread out the price of the premium out in time as most individuals spending plan their cash on a month-to-month basis.

trucks credit liability cheaper car insurance

trucks credit liability cheaper car insurance

If you anticipate a significant change in your policy before the year is up, like getting rid of a adolescent chauffeur from your policy, you'll want the capacity to take them off the plan and see prompt savings. Regular monthly payments might also be an excellent option for somebody that may have the cash to pay an annual costs but desires to invest the added cash or utilize it for an additional huge expenditure (cars).

One more component is the quantity of financial savings you'll enjoy if you do make a swelling amount settlement. It might not be worth it if you save $30 a year in fees.

Some companies also provide you a price cut if you set up automatic payments with them. Not just can this alternative obtain you a discount rate, but you'll never have to stress regarding paying that expense every month. Usually the price cut you get for electronic or automatic payments offsets any installation costs you could pay every month, so if you're vacillating between yearly or monthly repayments, figure out if any one of these price cuts is offered (vans).

Ultimately, you desire to locate a settlement method for your auto insurance that produces a balance in between meeting individual preferences as well as saving you one of the most money while giving you the automobile insurance coverage defense you require.

The average cost of vehicle insurance coverage in the USA is $2,388 per year or $199 per month, according to data from almost 100,000 insurance policy holders from Savvy (auto insurance). The state you live in, the degree of insurance coverage you wish to have, and also your sex, age, credit history, as well as driving history will all aspect right into your costs.

Automobile insurance policy plans have whole lots of moving parts, and also your costs, or the price you'll pay for protection, is just among them. Insurance policy is managed at the state degree, and also legislations on needed protection and rates are different in every state - cheapest. Insurer consider various aspects, consisting of the state and also location where you live, as well as your gender, age, driving history, and also the level of insurance coverage you wish to have.

liability cheaper cars vehicle cheaper auto insurance

liability cheaper cars vehicle cheaper auto insurance

Here are the largest factors that will affect the cost you'll spend for coverage, and what to take into consideration when taking a look at your auto insurance coverage options. There have been some big modifications to automobile insurance expenses throughout the coronavirus pandemic. Some automobile insurance firms are offering discounts as Americans drive less, as well as are likewise assisting people affected by the infection delay repayments.

Company Insider put together a list of average auto insurance coverage rates for each state. Below's a range vehicle insurance coverage costs by state (suvs).

As Well As from Business Insider's data, cars and truck insurance provider tend to bill women a lot more. Business Expert accumulated quotes from Allstate and also State Ranch for fundamental protection for male and also women vehicle drivers with a similar account in Austin, Texas (car insured). When exchanging out just the gender, the male profile was priced estimate $1,069 for insurance coverage annually, while the women profile was quoted $1,124 each year for coverage, setting you back the lady vehicle driver 5% even more.

In states where X is a sex option on driver's licenses consisting of Oregon, The golden state, Maine, and soon New york city insurance firms are still identifying how to compute prices. Average cars and truck insurance policy premiums by age, The variety of years you have actually been driving will certainly impact the cost you'll pay for coverage. While an 18-year-old's insurance standards $2,667.

This information was offered to Business Expert by Savvy. How cars and truck insurance coverage rates alter with the variety of cars and trucks you own, Somehow, it's logical: the more autos you carry your policy, the greater your car insurance policy costs. There are additionally some financial savings when several cars are on one plan.

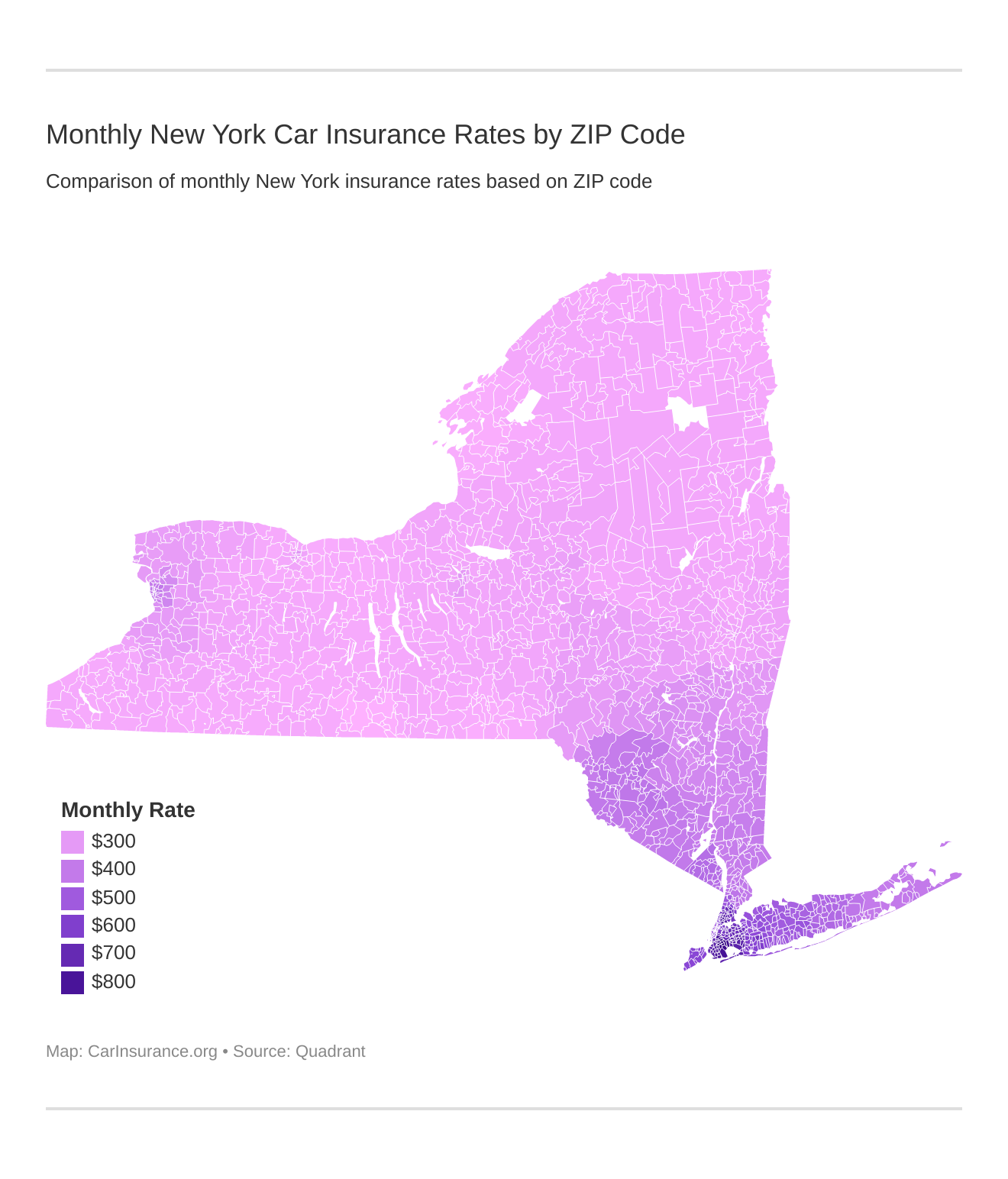

Vehicle insurance policy is more affordable in zip codes that are extra rural, and the same is real at the state degree. Various other factors that can impact the expense of car insurance There are a few other elements that will add to your premium, consisting of: If you don't drive numerous miles per year, you're