Notifications

Similarly, if you have a history of having automobile insurance plan without filing claims, you'll get less costly prices than a person that has submitted insurance claims in the past (insurance).: Cars and trucks that are driven much less frequently are less most likely to be associated with an accident or other destructive event. Cars with lower annual mileage may get a little reduced rates.

insured car vehicle insurance car insurance credit score

insured car vehicle insurance car insurance credit score

To find the ideal car insurance coverage for you, you should contrast shop online or talk with an insurance policy representative or broker. You can, yet make sure to track the coverages picked by you and also supplied by insurance firms to make a reasonable contrast. You can that can aid you locate the ideal combination of rate and also fit.

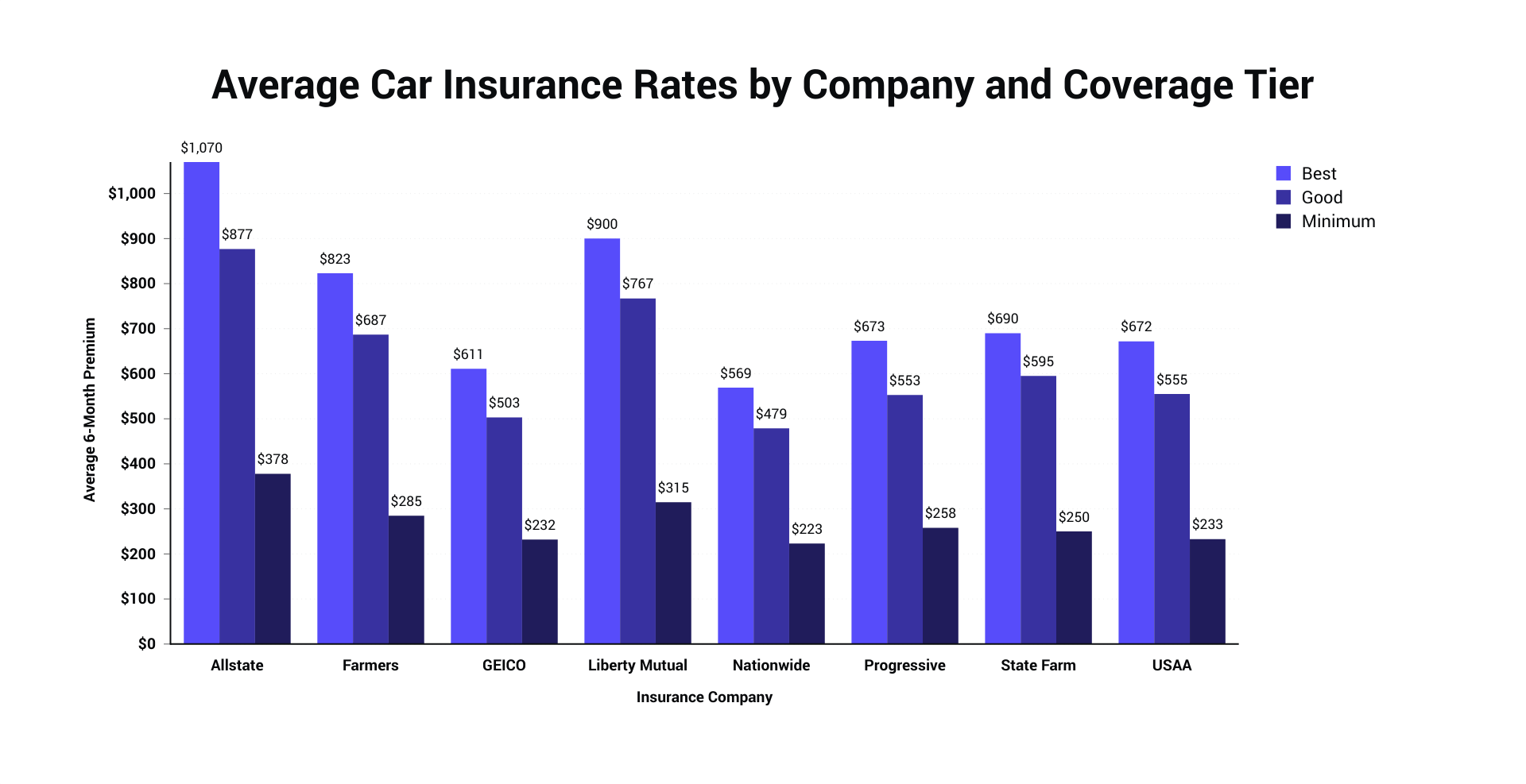

Independent representatives benefit numerous insurance provider and also can contrast amongst them, while restricted representatives work for only one insurance provider. Provided the different rating methodologies as well as variables made use of by insurance firms, no solitary insurer will be best for every person. To better comprehend your regular auto insurance policy expense, invest time contrasting quotes across firms with your picked approach.

Prices were computed by reviewing our 2021 base account with the ages Click for info 18-60 (base: 40 years) applied. automobile. Prices for 18-year-old are based on a driver of this age that is an occupant (not a home owner) and also on their own plan.

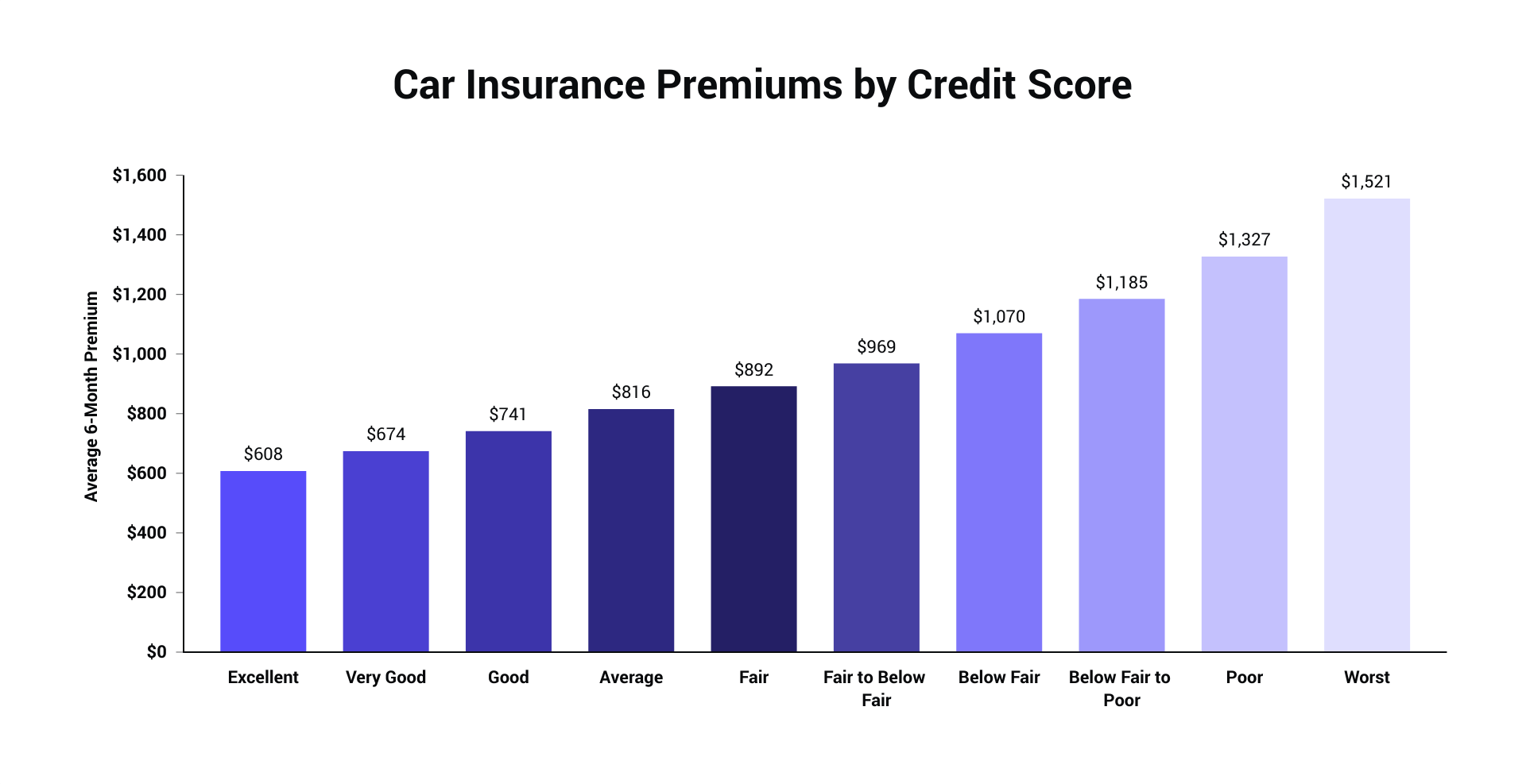

Washington State presently allows credit history as a rating element, but a ban on its usage is currently on hold in the courts (vehicle insurance).

4 things to think about when picking the amount of insurance coverage for your demands: The worth of your properties What you drive Exactly how much you drive Who's in the cars and truck with you In most states, you're required to bring a minimum amount of responsibility insurance coverage and additionally give evidence of insurance coverage before you can register your vehicle or restore your chauffeur's certificate.

If that is the situation, the legally accountable chauffeur will need to pay the additional expenses out of pocket. Take into consideration the following when selecting Car insurance protection:.

That's just how simple it is. With My, Plan, you can see your policy online and also make adjustments or renewals. Use our award-winning The General instinctive mobile app to do these same tasks or submit a case. Do I obtain a discount if I pay my policy completely? In many states, consumers paying in complete obtain discount rates.

The expense of vehicle insurance policy can be complicated, so for lots of vehicle drivers, it's an alleviation to be able to pay in month-to-month installments for the year. Most insurance coverage business give you the option of paying for the entire plan each year or spreading out the payments over each month, yet which is the finest option?

This is exceptionally practical to individuals that have revenue that fluctuates throughout the year or is seasonal, get an annual perk, or obtain a tax refund. car. It can likewise be helpful for people that have difficulty staying on top of monthly repayments. Paying the insurance policy premium annually can conserve you cash if you typically sustain late charges.

car insurance insure low cost auto auto

car insurance insure low cost auto auto

A lot of firms charge an installation cost for this convenience because it takes even more job on the firm's component to procedure 12 repayments instead of simply one. Despite having a monthly fee, paying in monthly installments is a far better choice for some individuals. It allows you to spread out the cost of the premium out gradually as most individuals budget their cash on a regular monthly basis.

low-cost auto insurance cheapest auto insurance cars cheaper

low-cost auto insurance cheapest auto insurance cars cheaper

If you anticipate a major modification in your plan before the year is up, like getting rid of a teen chauffeur from your plan, you'll desire the ability to take them off the policy and also see instant savings. Monthly repayments might additionally be a good selection for somebody who may have the cash to pay an annual premium however wishes to spend the extra cash or utilize it for one more big cost (car insured).

Another determinant is the amount of savings you'll reap if you do make a lump sum settlement. It might not be worth it if you save $30 a year in fees.

Some firms additionally provide you a discount if you established up automated repayments with them. Not just can this option obtain you a discount, yet you'll never ever need to stress regarding paying that expense every month. Commonly the price cut you receive for digital or automated repayments offsets any type of installment costs you may pay every month, so if you're vacillating in between yearly or monthly repayments, figure out if any of these discount rates is readily available (cheapest auto insurance).

Ultimately, you wish to find a repayment method for your automobile insurance coverage that creates an equilibrium in between meeting personal choices and also conserving you the most cash while offering you the auto insurance policy protection you need.

The typical expense of automobile insurance coverage in the United States is $2,388 per year or $199 monthly, according to information from virtually 100,000 insurance holders from Savvy (prices). The state you reside in, the level of insurance coverage you would love to have, as well as your sex, age, credit rating, and also driving background will certainly all variable into your costs.

Vehicle insurance plan have great deals of moving parts, and also your premium, or the price you'll spend for protection, is simply among them. Insurance coverage is controlled at the state level, as well as laws on required protection and prices are different in every state - low cost. Insurance provider consider several factors, consisting of the state and also area where you live, as well as your gender, age, driving history, and also the level of protection you would certainly like to have.

cheaper car insurance perks cheaper car insurance cheap car

cheaper car insurance perks cheaper car insurance cheap car

Right here are the biggest factors that will influence the rate you'll pay for insurance coverage, and also what to consider when looking at your cars and truck insurance coverage options. There have been some huge changes to automobile insurance costs during the coronavirus pandemic.

Service Insider placed with each other a list of ordinary automobile insurance rates for every state. These prices were established as an average of prices reported by Nerdwallet, The Zebra, Worth, Penguin, Bankrate, and the National Association of Insurance Policy Commissioners. Below's a variety car insurance coverage prices by state. Resource: Information from Nerdwallet, Worth, Penguin, Bankrate, The Zebra, as well as the National Organization of Insurance Coverage Commissioners.

And Also from Service Insider's information, car insurance firms tend to charge women extra. Business Expert collected quotes from Allstate and State Farm for basic coverage for male and also women drivers with a the same account in Austin, Texas (cheap insurance). When swapping out only the gender, the male profile was priced estimate $1,069 for protection per year, while the female account was priced estimate $1,124 per year for coverage, costing the lady vehicle driver 5% more.

In states where X is a gender choice on vehicle driver's licenses consisting of Oregon, The golden state, Maine, and soon New york city insurance companies are still establishing exactly how to compute expenses. Ordinary auto insurance costs by age, The variety of years you have actually been driving will influence the cost you'll spend for protection. While an 18-year-old's insurance policy standards $2,667.

This data was given to Organization Insider by Savvy. Just how cars and truck insurance policy prices change with the variety of autos you possess, Somehow, it's logical: the much more cars and trucks