Notifications

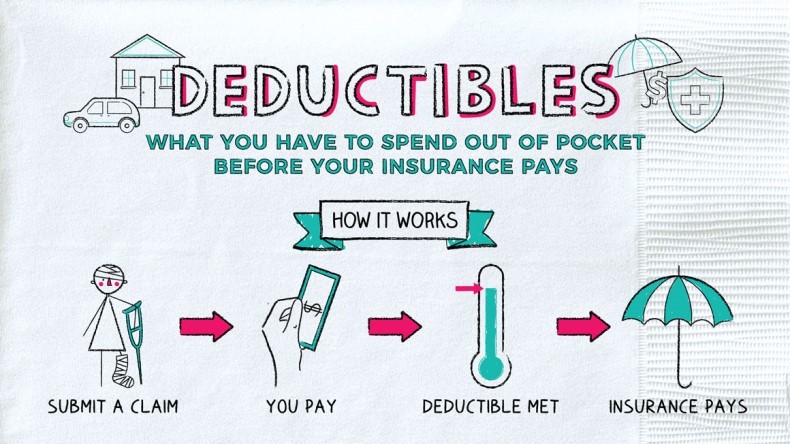

If you obtain included in an accident as well as sue, the insurance policy supplier will certainly subtract the deductible from the covered claim - insurance companies. If the damages is significant, you will pay the insurance deductible, and the insurance company will certainly cover the continuing to be amount. Nevertheless, if the damages is small, several drivers favor to pay of pocket rather of paying a deductible.

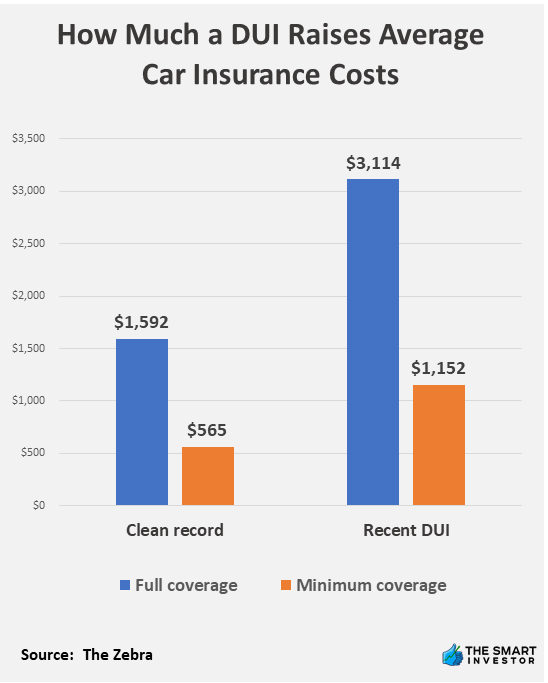

You can in fact save some cash when choosing a $1000 deductible over a $500 one. Nevertheless, this could or could not make much feeling relying on specific conditions and also your insurance policy expenses. If you live in a no-fault state, your insurance coverage supplier will certainly have to cover the price of clinical bills irrespective of that caused the mishap - dui.

If you are filing a damage case under accident insurance coverage, you will have to pay an insurance deductible. Extensive insurance policy loads in the spaces that the crash protection leaves behind.

Raising your deductible from $200 to $500 could lower the thorough and accident premium cost by up to 30%. At the same time, if you increase the insurance deductible to $1000, it might reduce the costs to 40% and even more. Considering that the deductible quantity is inversely symmetrical for the premium you need to pay, the greater your deductible, the lower your costs prices will be. laws.

Some favor to go even greater than that to pay reduced costs. Nevertheless, this can make the expenditures less foreseeable as you don't understand when you will certainly wind up with higher repair bills. On the other hand, others wish to have even more economic security, so they go with a lower vehicle insurance policy deductible as well as a greater costs.

perks money affordable insurance affordable

perks money affordable insurance affordable

While you can save around 10% on your premiums by increasing a deductible from $500 to $1000, don't forget to think about the state you live in. Typically, a quote for a $50 deductible is offered by the vehicle insurer. This suggests you can establish just how things can change for your plan if you raised the insurance deductible to $1000 - low cost auto.

cheaper cars money cheapest car insurance affordable car insurance

cheaper cars money cheapest car insurance affordable car insurance

You have to establish the quantity of costs you would have to pay with a greater deductible as well as figure out if those cost savings would certainly deserve it (insurance company). Or else, it's better to pay greater premiums for a reduced economic danger, specifically if your automobile's worth is reduced. Things to Take Into Consideration When Choosing In Between Vehicle Insurance Policy Deductibles $500 or $1,000 As stated over, it's vital to do your homework and compare the costs quantity with an additional deductible to locate the right option on your own. auto.

Other than the $500 and $1000 deductibles, insurance policy suppliers use other selections that can be much more appropriate for you - cheap auto insurance. You could be attracted to choose the lower costs, yet you have to take into consideration the expenses you would have to birth in case of a crash. You may not have the ability to get the damages covered if you opt for a $2,500 deductible without having sufficient funds to cover the price. car insured.

If you Find more information own continuous insurance coverage and have an excellent driving document, minimizing your deductibles can only include around $20 to the month-to-month expense - car insurance. Nonetheless, if you had an accident and also filed a crash insurance claim, you've saved $760. In conclusion, you require to go a long period of time without a collision claim to make your $1000 insurance deductible worthwhile. insure.

The reduced the deductible expense, the higher the amount of costs you'll have to pay annually. The deductibles start from $250. It's best to consult your car insurance service provider to obtain the ideal deal, depending upon your circumstance (car). The repayment is an additional point to think about when you are choosing the insurance deductible amount.

If you switch over from $500 to $1000 insurance deductible, you'll save 10% on your costs yearly. With a $500 insurance deductible, your annual premium would have been $800. It's going to be $720 with a $1000 insurance deductible rather. Currently that you have actually increased your insurance deductible by $500, your yearly cost savings total up to $80.

If you do not enter a crash throughout this period, the boost in the deductible will be worth it. If you do get right into an accident, you will pay more out of pocket. It's finest to compare auto insurance policy rates and talk about other factors with your insurance coverage agent to find the best option and also make an educated choice. business insurance.

If you spend only $300 on the protection, you would certainly need a significant price cut to appreciate actual financial savings, specifically in comparison to the expense of filing a high-deductible claim. For circumstances, you can save around $30 every year when you pay a $1000 insurance deductible in a claim. Why not select a choice that assists you conserve $100 every year instead? It is very important to consider your circumstance and review your alternatives with your insurance carrier to figure out if the annual cost savings make sense.

Expect an unknown driver sideswiped your cars and truck that resulted in $800 well worth of repair service expense. You have a $1000 insurance deductible, which indicates you will have to pay $800 on your own. If you had a $100 deductible, you would only have to pay $100 and also conserve $700. You need to figure out if you can manage to pay a higher costs.

At the same time, you may submit much more insurance asserts as well. It's actually up to you to make a decision and consider all benefits and drawbacks. To resolve the high vs. reduced insurance deductible cars and truck insurance policy problem, you need to think about the number of auto mishap asserts you have actually made in the past - affordable car insurance.

insurance company money vehicle insurance affordable auto insurance

insurance company money vehicle insurance affordable auto insurance

Make certain to consider the threats included (car insurance). While saving some cash on your costs is wonderful, it might set you back even more to file an insurance claim (cheapest car insurance). So, think about all the aspects, including your driving document, which specify you reside in, as well as the risk of natural disaster or criminal activity rate in your area.