Notifications

If you obtain involved in a mishap and also sue, the insurance carrier will certainly subtract the deductible from the protected case - vans. If the damage is major, you will certainly pay the deductible, and the insurer will cover the continuing to be quantity. Nonetheless, if the damage is minor, many chauffeurs choose to pay out of pocket rather of paying a deductible.

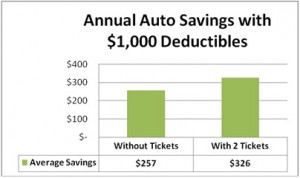

You can really save some cash when selecting a $1000 insurance deductible over a $500 one. Find more information However, this might or could not make much sense depending on private conditions as well as your insurance coverage costs. Additionally, if you live in a no-fault state, your insurance coverage provider will certainly need to cover the cost of clinical bills regardless of who created the crash.

If you are filing a damages case under collision insurance coverage, you will certainly have to pay an insurance deductible. Extensive insurance policy loads in the gaps that the collision insurance coverage leaves behind.

Raising your deductible from $200 to $500 could reduce the thorough and collision costs price by as much as 30%. Meanwhile, if you boost the insurance deductible to $1000, it could decrease the costs to 40% and also more. Since the insurance deductible amount is vice versa symmetrical for the costs you need to pay, the higher your deductible, the reduced your premium prices will certainly be. cheapest.

Some choose to go also more than that to pay reduced premiums. This can make the expenses less foreseeable as you do not understand when you will certainly end up with greater repair work expenses. On the various other hand, others wish to have more economic protection, so they choose a reduced auto insurance policy deductible as well as a greater costs.

While you can save around 10% on your costs by elevating an insurance deductible from $500 to $1000, do not forget to take into consideration the state you reside in. Generally, a quote for a $50 deductible is offered by the auto insurance policy business. This indicates you can establish exactly how things could transform for your plan if you enhanced the deductible to $1000 - cheap insurance.

auto cheapest perks vehicle insurance

auto cheapest perks vehicle insurance

You have to identify the quantity of costs you would certainly need to pay with a higher insurance deductible as well as find out if those savings would be worth it (cheapest auto insurance). Or else, it's much better to pay higher premiums for a reduced economic risk, especially if your car's well worth is low. Points to Think About When Choosing Between Automobile Insurance Deductibles $500 or $1,000 As pointed out above, it's necessary to do your research and contrast the premium amount with one more deductible to locate the right alternative for yourself. perks.

In addition to the $500 and $1000 deductibles, insurance coverage providers offer various other choices that could be better for you - cheap insurance. You could be tempted to opt for the reduced costs, yet you have to consider the expenditures you would need to birth in situation of an accident. You might not have the ability to get the damages covered if you select a $2,500 deductible without having sufficient funds to cover the cost. car insured.

If you own constant insurance coverage as well as have a good driving document, reducing your deductibles could only include around $20 to the month-to-month bill - affordable. If you had an accident as well as filed a collision insurance claim, you have actually conserved $760. Altogether, you require to go a long period of time without an accident insurance claim to make your $1000 deductible beneficial. low cost auto.

The reduced the insurance deductible cost, the greater the quantity of costs you'll have to pay each year. The deductibles begin from $250. It's finest to consult your auto insurance policy service provider to get the best offer, relying on your scenario (credit score). The payback is an additional thing to consider when you are selecting the insurance deductible amount.

If you switch over from $500 to $1000 deductible, you'll save 10% on your costs yearly. risks. With a $500 insurance deductible, your yearly premium would certainly have been $800.

insurance laws risks insurance companies

insurance laws risks insurance companies

If you do not get right into a mishap throughout this period, the increase in the insurance deductible will certainly deserve it. If you do get into an accident, you will pay more out of pocket. It's best to contrast car insurance policy prices and discuss various other variables with your insurance agent to locate the appropriate remedy and also make a notified choice. cheap insurance.

You can conserve around $30 each year when you pay a $1000 insurance deductible in an insurance claim. It's crucial to consider your situation as well as discuss your alternatives with your insurance policy carrier to figure out if the yearly cost savings make sense.

You have a $1000 deductible, which implies you will have to pay $800 yourself. If you had a $100 insurance deductible, you would only have to pay $100 and conserve $700.

At the same time, you might file much more insurance policy declares too. It's actually as much as you to decide as well as consider all pros and also disadvantages. To address the high vs. reduced deductible auto insurance coverage conflict, you need to consider the number of automobile crash claims you have actually made in the past - insurers.

insurance affordable auto cheap insurance low cost auto

insurance affordable auto cheap insurance low cost auto

Make certain to think about the threats entailed (liability). While conserving some money on your costs is terrific, it may cost even more to submit a claim (cheapest car). Take into account all the variables, including your driving document, which specify you live in, as well as the threat of natural catastrophe or crime rate in your location.