Notifications

5 most affordable vehicle insurance companies Below are our top suggestions for inexpensive vehicle insurance coverage based upon average rate quotes (cheaper cars). The following suppliers stick out from the competitors as the very best low-cost cars and truck insurance coverage providers not only for the discount rates they use however also for their consumer service and strong market credibilities.

In specific, we've found State Farm to be among the most inexpensive choices for trainees. The company uses the biggest student discount rate in the market (approximately 25%). Young chauffeurs can also make the most of State Farm's Steer Clear program to enhance their driving abilities and get more discount rates.

Some states have more affordable vehicle insurance coverage than others. Below are the leading five most pricey states for full coverage vehicle insurance coverage. And here are the five least costly states for full protection cars and truck insurance. Most affordable automobile insurance for chauffeurs with a current accident Not everyone has the perfect driving history and situation to get the most affordable rates.

How to discover the least expensive automobile insurance coverage Car insurance quotes are based on your scenario, your desired protection level and the discount rates a company provides. Some things are set in stone you can't erase an at-fault mishap from your current history. That said, there are a few methods you can enhance your chances of finding low-cost vehicle insurance (cheaper car).

Companies offer several insurance products, such as renters and homeowners, so you can also save by bundling policies. Improve your chauffeur profile You can raise your credit rating to get less expensive insurance coverage in numerous states.

It might take some research, but in the end, you can likely conserve cash on your next automobile insurance coverage (money). Our method Because consumers count on us to offer unbiased and precise information, we produced a thorough ranking system to create our rankings of the best cars and truck insurance coverage business. We collected information on lots of car insurance coverage providers to grade the business on a large variety of ranking elements.

Here are the aspects our scores consider: Cost (20% of total score): Auto insurance rate price quotes produced by Quadrant Information Provider and discount chances were both considered - car insurance. Coverage (20% of overall rating): Companies that use a variety of choices for insurance protection are most likely to satisfy consumer requirements.

All it takes is a few clicks - vehicle.

With some work on your part, you can still discover the least expensive automobile insurance coverage rate possible. 1.

You might also consider getting in touch with an independent representative for assistance in getting the best rate. Independent agents generally offer policies for 5 to 8 insurance coverage business, allowing them to select from amongst several options to identify what is best for you. Suggestions from buddies and family members might also be handy in narrowing down your choices, particularly when it concerns the stability of an insurance agent or company.

Raise Your Deductible If you carry just liability insurance, you won't have a deductible due to the fact that this insurance coverage covers losses you trigger other people to sustain in an accident. (A deductible is the amount of cash you accept pay before your insurer will make any payment toward your own loss.) Nevertheless, C&C protection does have a deductible.

"Consumer Reports recommends canceling your C&C protection if the premiums for it total up to 10 percent or more of your lorry's book value. Continuing to spend for C&C coverage because circumstance might really well trigger you to spend more on the coverage than you would get to fix or change your automobile - insurance affordable.

6. Consider PPM or Telematics Insurance Coverage If you do not drive numerous miles and are a careful motorist, you could conserve some cash with pay-per-mile (PPM) or telematics insurance. PPM programs are provided by Esurance and Metromile (insure). Both business utilize devices in your cars and truck to track the number of miles you drive annually.

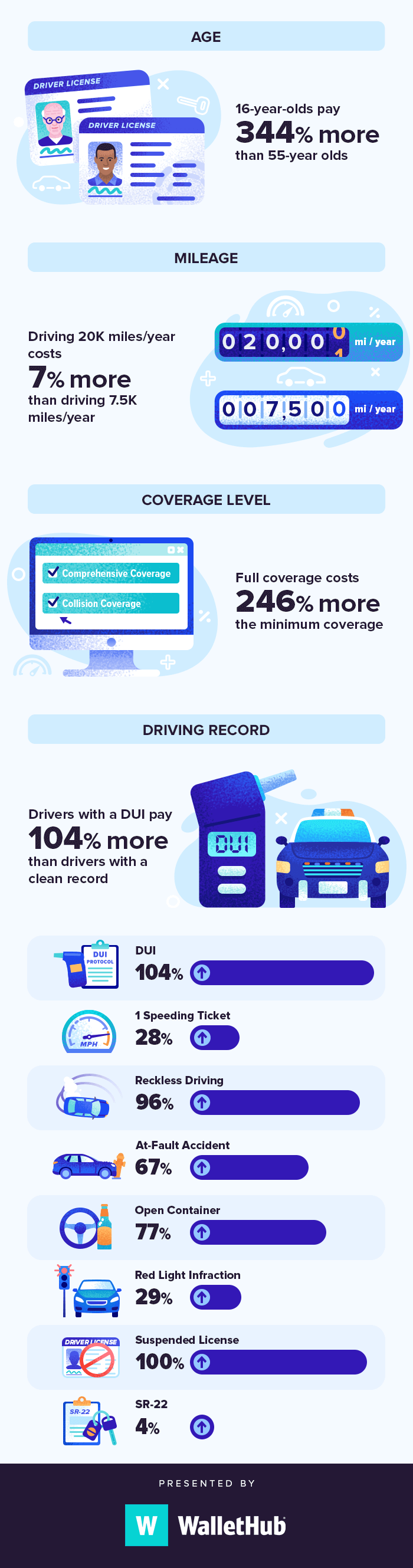

Keep a Tidy Driving Record Safe motorists get a few of the very best rates, so getting the most affordable rate possible can result directly from your own actions. The major car insurance business have different requirements for what precisely makes up a safe driving record but not having actually been ticketed for a moving violation or not causing an accident are standard.

Driving records utilized by insurance companies generally cover the past 7 to ten years. A speeding ticket might remain on your record for only five years, while a DUI will probably be on your record for a full years. 8. Enhance Your Credit history Good credit can also influence your insurance coverage rates, and about 95% of auto insurance coverage companies use your insurance credit rating when setting your premiums in states where it is legal to do.

Nationwide utilizes the following elements of your insurance coverage credit rating when figuring out premiums: Your payment history, including late payments and failure to pay, The length of your credit report, The types of credit in your history 9. Avoid Fees Some insurance coverage business charge you a cost whenever you make a payment or they mail you a costs.

Farmers Insurance charges you up to $2 if you don't receive expenses by means of email. cheaper. And if you don't have your payment immediately deducted from your savings account, this insurer may charge you up to $5. If you are late with a payment, you risk of having your coverage dropped and of getting struck with a cost.

Laws regarding the costs insurers can charge you vary by state. 10. Suspend Your Coverage of an Unused Vehicle If you are not driving among your lorries and plan to keep it in storage for more than a month, you might cancel or briefly suspend insurance coverage for itthough some companies enable you just to do the previous.

And if you're still paying on the car, your lending institution may need you to keep insurance coverage under the regards to your loan contract. A much better idea might be to suspend your liability and accident coverage however maintain your comprehensive coverage in case the cars and truck gets stolen or damaged - accident.

Which business offers the most inexpensive vehicle insurance coverage in Florida? USAA, Geico and State Farm had the least expensive rates for the average Sunlight State driver, amongst providers examined by's experts. But no one's ideal, so do not worry if you do not fit the typical chauffeur demographic. No matter your circumstances, if you're browsing for the least expensive automobile insurance in Florida, here you'll find all the details you need to get the deals you want without compromising coverage.

To provide you a quote of what you can expect, we provide cars and truck insurance coverage estimates for Florida motorists for common circumstances. These consist of vehicle drivers with the following: Mishaps, Speeding tickets, Bad credit, Least expensive insurance for Florida chauffeurs with accidents, State Farm, Geico and Progressive had the least expensive car insurance rates in Florida for motorists with an at-fault accident, amongst those surveyed by Insurance coverage.

Florida ranks 15th amongst the worst states for drivers with bad credit, based on Insurance. The good news is that you can still shave some cash off your coverage expenses if you compare cars and truck insurance coverage companies - auto insurance.

Some optional protections you must include to ensure you have the very best vehicle insurance in Florida include: Bodily Injury Liability (BIL) spends for serious and permanent injury or death to others should you cause a crash. If you have BIL insurance coverage, your insurer will not just spend for injuries as much as the limits of your policy however it also will supply legal representation needs to you get taken legal action against. credit.

Uninsured/underinsured motorist (UM/UIM) protection will offer you with extra coverage if the other celebration does not have cars and truck insurance. It's not mandatory coverage however when you think about that one in 4 drivers do not have car insurance coverage in Florida, it would be a good idea to include it. Purchasing detailed and collision protection is referred to as "complete coverage".

5 ideas on how to minimize your car insurance coverage, Finding cost savings anywhere you can get them can make a big distinction on your car insurance. There are a couple of methods you can cut the expense of your premiums and still have the very best vehicle insurance Florida coverage. The finest cars and truck insurer in